Thanks to a combination of high mortgage rates and decreased affordability, the Southern California housing market has taken a hit with the number of home sales, new and existing, dropping to a level not seen in over a decade.

Based on data from real estate analytics company CoreLogic, the number of new and existing homes sold during the month of September fell by 18% compared to the same time a year ago. Not since September 2007, when the after-effects of the financial crisis were bubbling over, has home sales fallen by this much.

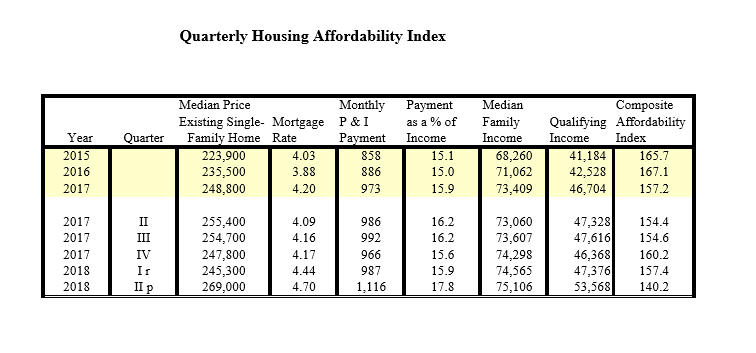

Data from the National Association of Realtors show that the Quarterly Housing Affordability Index has been dropping thanks to a rise in median home prices.

Affordability is even more out of reach with respect to the Southern California housing market with the California Association of Realtors saying that the median home price topped $600,000 during the summer–its first time ever.

“You can blame the Bay Area and other red hot high-cost areas for the increase,” said Capital Public Radio News contributor Drew Sandsor in an article. “There are now five counties out of the nine-county Bay Area where the median price is above a million dollars. And that could go higher looking at demand, which has led to many bidding contests”

Related: Richmond Fed President Says Rates Must Keep Rising

Rates Up, Affordability Down

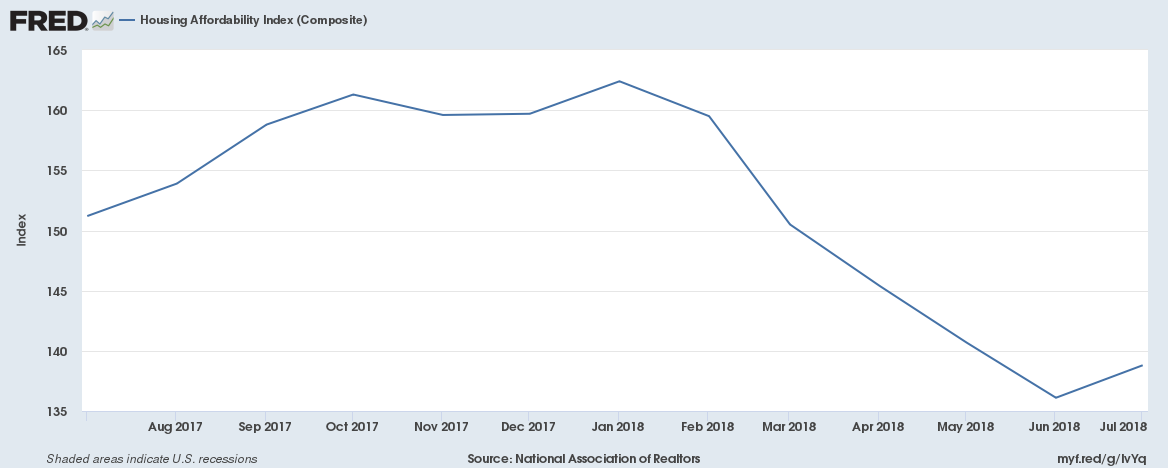

Since hitting a peak in January, the housing affordability index has been on a downward trajectory, which could go even lower as the Federal Reserve continues its rate-hiking path, which is expected to run through the end of the year and possibly most of 2019. Just last month, the Fed increased the federal funds rate for a third time this year by 25 basis points, bringing it to 2.25.

The rate hikes have been paired with a marked increase in real estate prices, which have dampened real estate activity. According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), this combination of high prices and interest rates helped to bring down housing affordability thus far this year.

![]()

“The double whammy of higher prices and rising mortgage rates has priced out some would-be buyers and prompted others to take a wait-and-see stance,” said Andrew LePage, a CoreLogic analyst in the release. “There was one caveat to last month’s sharp annual sales decline – this September had one less business day for recording transactions. Adjusting for that, the year-over-year decline would be about 13 percent, still the largest in four years.”

After the financial crisis and subprime mortgage collapse, home prices took an unceremonious fall as millions of homes faced foreclosure and were sold at heavily-discounted prices. Home prices hit a floor around 2012 and began to recover at accelerated levels, pricing out many prospective homebuyers.

“Price growth is moderating amid slower sales and more listings in many markets,” LePage said. “This is welcome news for potential homebuyers, but many still face a daunting hurdle – the monthly mortgage payment, which has been pushed up sharply by rising mortgage rates.”

For more real estate trends, visit ETFTrends.com