As the Dow Jones Industrial Average (DJIA) fell over 700 points during Monday’s trading session, the U.S. dollar served as a safe haven play. This put gold down, but not out.

Gold was one of the few bright spots in the market last year. This was notable, especially during the heavy sell-offs in early 2020. Fast forward to today, and different market forces are shaping the way investors view gold, including inflation.

“Gold futures marked a second-straight decline on Monday, amid some strength in the U.S. dollar and a sharp, global selloff in equities, partly prompted by renewed concerns about the spread of the COVID-19 delta variant,” a MarketWatch report said.

“The precious metal ‘has recently been over-promoted as an inflation hedge,’ said Adrian Ash, director of research at BullionVault,” the article added. “That’s created ‘disappointment and then pre-emptive selling among investors who fell for the idea that central banks are about to start tightening.'”

Furthermore, gold isn’t a surefire way to mute losses in equities. That was readily apparent during Monday’s trading session.

“Gold rarely jumps just because the stock market falls,” said Ash. Instead, it is often “hit by profit-taking when equities sink because it helps raise cash for hedge funds and other speculators to meet margin calls on their losing bets.”

Nonetheless, a buy-the-dip opportunity could exist for gold once Covid fears ease.

“For now, we do see more strength for the dollar index. This is pushing the gold price lower,” wrote Naeem Aslam, chief market analyst at AvaTrade.

Using Miners as an Alternate Play

Miners can serve as an alternate play, especially during volatile markets. Gold prices can fluctuate wildly, but miners can help dampen the volatility as opposed to playing gold prices directly.

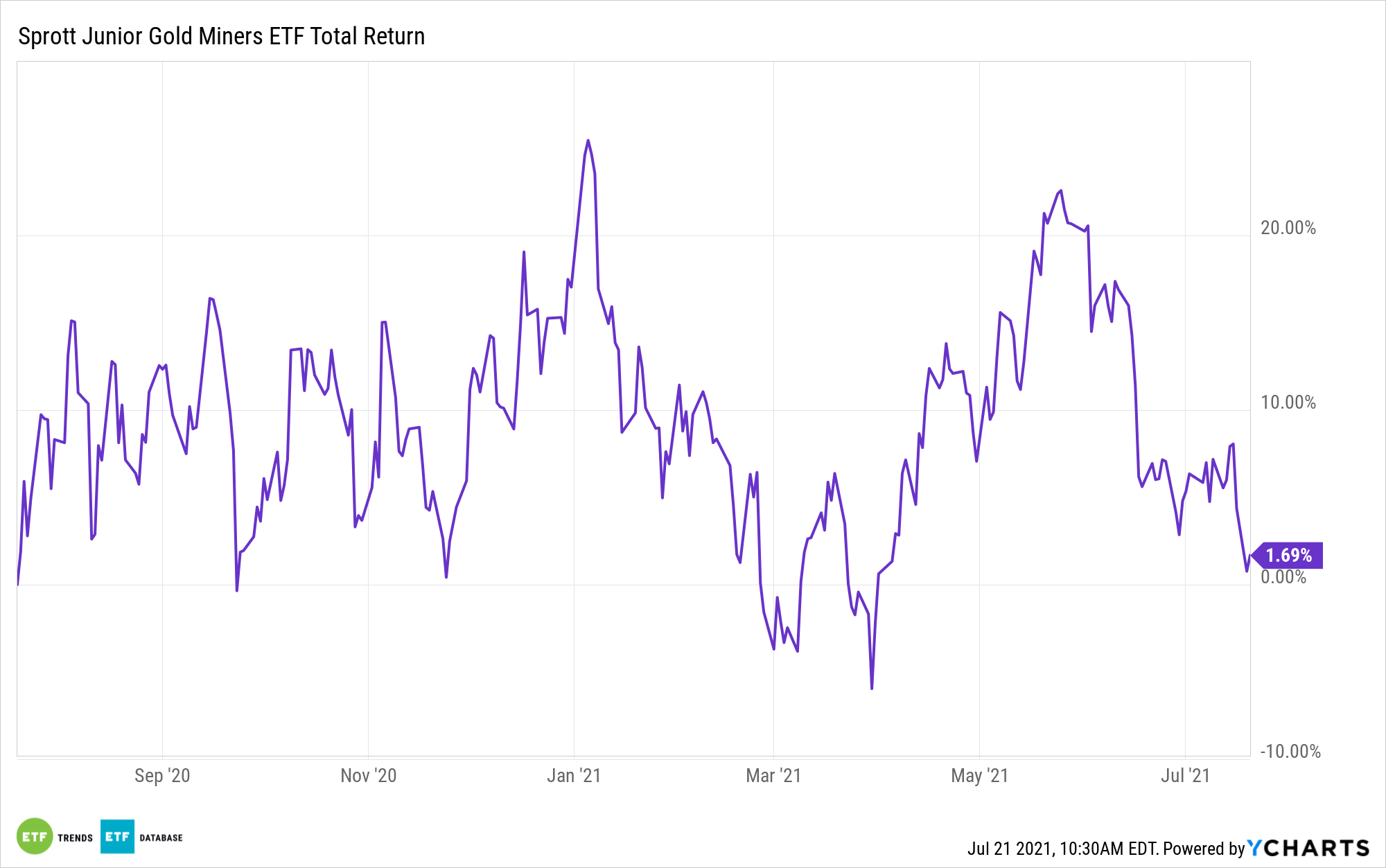

One way to access the miners space is via exchange traded funds (ETFs) like the Sprott Junior Gold Miners ETF (SGDJ). SGDJ seeks investment results that correspond to the performance of its underlying index, the Solactive Junior Gold Miners Custom Factor Index.

The index aims to track the performance of “junior” gold companies primarily located in the U.S., Canada, and Australia whose common stock, American Depositary Receipts (ADRs), or Global Depositary Receipts (GDRs) are traded on a regulated stock exchange in the form of shares tradeable for foreign investors without any restrictions.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.