One of the primary reasons advisors recommend clients hold a mix of equity and fixed income assets in portfolios is diversification. A potential benefit of that increased diversification is reduced correlations, meaning bonds and equities do not often move in the same direction.

When equity-based exchange traded funds, such as the Invesco QQQ Trust (NASDAQ: QQQ), SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA) and SPDR S&P 500 ETF (NYSEArca: SPY) decline, fixed income funds should provide some buffer against those pullbacks. However, that thesis has recently been damaged.

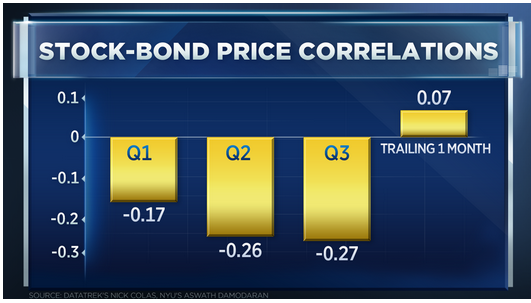

“According to DataTrek co-founder Nick Colas, a key relationship between stocks and bonds has broken down, and it could greatly hurt nest eggs,” reports CNBC. “His latest research shows that the two assets became positively correlated in September, a trend that’s rarely been seen over the past two decades.”

![]()

Not The First Time

There have been times when stocks and bonds have displayed surprisingly tight correlations.

“While investors have become accustomed to stocks and bonds mostly moving in the opposite direction, in the 1980s and 1990s stocks and bonds tended to move together. Between 1980 and 2000 stock-bond correlations were positive, averaging about 0.4 (based on a rolling 60-month calculation). But as some investors will remember, that was a very different time,” according to BlackRock.