![]()

How I would allocate my money

This is quite personal, so don’t apply it to your life, unless your life is similar to mine and you have similar objectives.

My lifestyle is very frugal. I live on less than $24,000 per year ($2,000 per month).

Related: Twitter Overcomes Dry Spell But Will it Last?

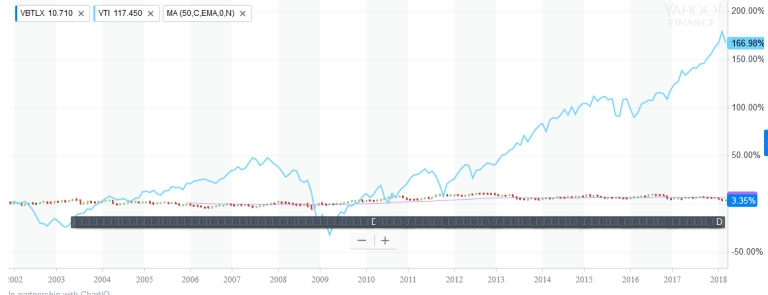

One way to figure out how much I need to live is by applying the rule of 4. If divide my annual expenses by 4%. I get $600,000. So, if $600,000 is my number. I would put in bonds any amount over $600,000. If the market drops, I would transfer money from my bond holdings to stocks.

One of the things that I am careful of, is of not doing too many transactions. Is better to let money be invested and left alone. The more I play with my portfolio, the greater the chances of string away from the original plan. My transactions are only done once a year, the second week of December, so that I can report my gain and loses in my current tax

As it is right now. At age 50, I am 45% in stocks and 55% in real estate. I am trying to get rid of my real estate to be 100% in stocks. And if you are wondering… NO, I haven’t reached the $600,000 mark.

A question for you

Will you use age or amount of money as a determining factor for your bond allocation?

What would be the trigger point to switch from stocks to bonds? At what age? How much money?

This article has been republished with permission from Alain Guillot.