Covered call ETFs and strategies remain in focus. The JPMorgan Equity Premium Income ETF (JEPI) gathered $13 billion in 2023, despite rising just 10% in value. The ability to generate enhanced income through an easy-to-access, actively managed options-based, equity strategy appealed to many advisors. It also led to more product development.

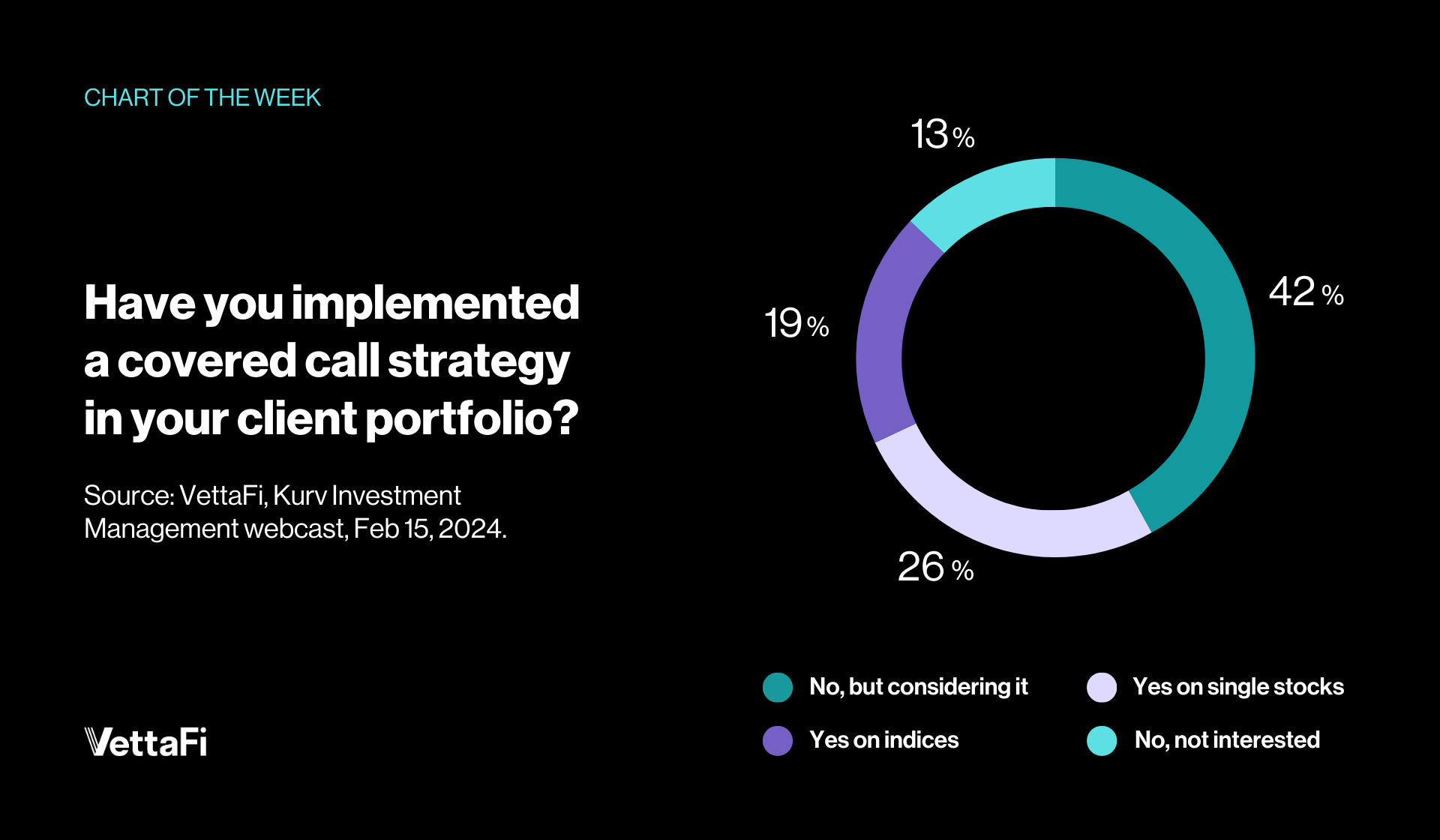

Last week, VettaFi hosted a webcast with Kurv Investment Management on covered calls. We asked advisors a simple question. “Have you implemented a covered call strategy in your client portfolio?” Just over one-fourth of respondents (26%) had done so on individual stocks, while just under one-fifth (19%) had on indices. What was most encouraging was that 42% had not implemented covered calls but were considering it. Many advisors are still in the education stage with newer options-based ETF investments and regularly come to VettaFi to hear from industry experts.

Popular Covered Call Strategies

JEPI is the largest actively managed equity ETF with $32 billion in assets. The ETF recently owned 134 stocks Some are dividend payers like Intuit, Microsoft and Progressive. However, the fund also owned non-dividend paying companies like Amazon.com and Vertex Pharmaceuticals. JEPI sells one-month out of the money call options on the S&P 500 index to generate additional income and reduce volatility. As of mid-February, JEPQ had a 12-month yield of 8.2%

While JEPI was the most popular covered call ETF in 2023, its sibling has gained investor favor in 2024. The JPMorgan Nasdaq Equity Premium Income (JEPQ) gathered $1.3 billion year-to-date as of February 16, approximately double what JEPI pulled in. JEPQ owns 96 stocks including Alphabet, NVIDIA, and Telsa and sells out of the money call options on the Nasdaq 100 index. As of mid-February, JEPQ had a 12-month yield of 10.4%.

There are other asset managers offering covered call ETFs using options on broad market benchmarks. The Goldman Sachs Nasdaq-100 Core Premium Income ETF (GPIQ) and the Parametric Equity Premium Income ETF (PAPI) are two of the newer ones that launched in 2023. Meanwhile the Global X S&P 500 Covered Call ETF (XYLD) has a more than 10-year record.

ETFs with Call Options Tied to Individual Stocks

The Amplify CWP Enhanced Dividend Income ETF (DIVO) is different from some of its ETF peers. The $3 billion fund holds only 33 dividend paying stocks in a diversified portfolio, including Procter & Gamble and Walmart. Then it selectively, tactically sells call options on individual stocks. As of the end of January, DIVO had a distribution rate of 4.8%.

Single security covered call ETFs include the YieldMax TSLA Option Income Strategy ETF (TSLY) or the Kurv Yield Premium Strategy Amazon ETF (AMZP). YieldMax began offering ETFs in late 2022 while Kurv rolled out if initial suite in late 2023.

These ETFs offer high distribution rates and offer exposure to a company’s share price. However, they do not own shares of the underlying companies (Tesla or Amazon.com) directly. Rather, the ETFs use put and call options for synthetic replication. Single security-based strategies typically are more volatile than ETFs that own several dozen stocks or more.

Overall, we expect options-based strategies to continue to gain traction in 2024 as education continues. The products take more complicated high-income generating investment approaches and make them accessible through one ticker.

For more news, information, and analysis, visit VettaFi | ETF Trends.