Alternative income ETF strategies are hot, and many asset managers are bringing their expertise to meet advisors. JPMorgan has pulled in $18 billion of new money this year for two of its covered call ETFs. Meanwhile Amplify, Global X, and NEOS have seen demand for their own offerings. In recent weeks, we have new covered call products run by Goldman Sachs and Morgan Stanley’s Parametric. We even just got a filing for a potential Bitcoin Covered Call ETF from Roundhill.

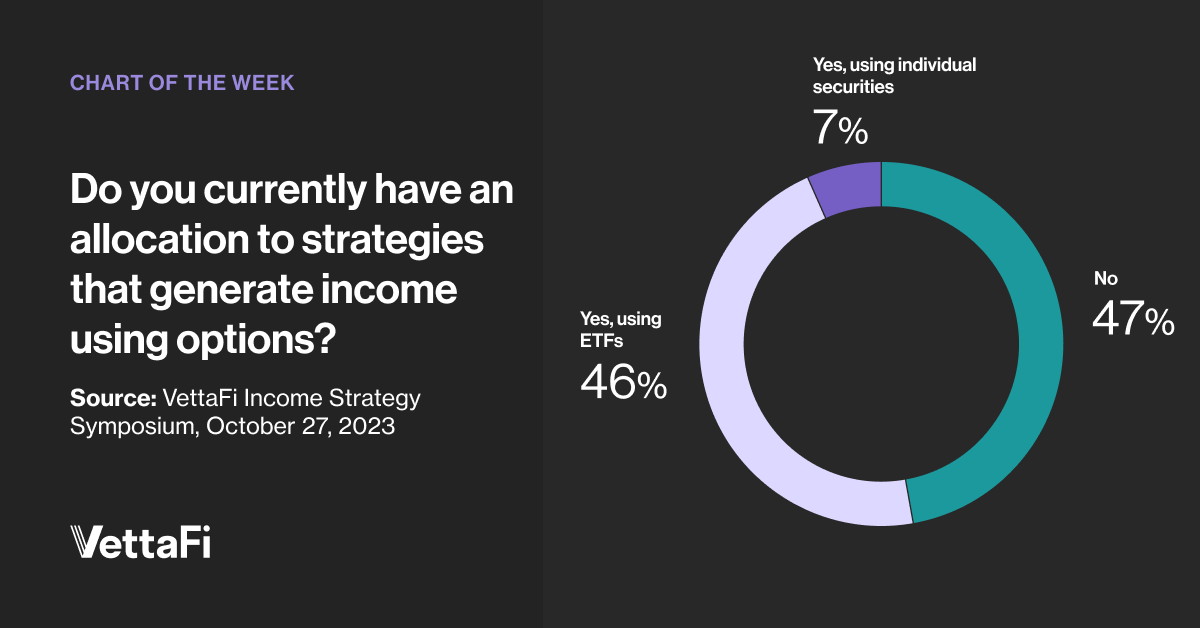

Given the growing supply of products, VettaFi asked a simple question to attendees during the Income Strategy Symposium in October. “Do you currently have an allocation to strategies that generate income using options?” While 47% of respondents said no, this was closely followed by the 46% that said yes using ETFs. Approximately 7% said yes, using individual securities.

We were pleasantly surprised how many advisors and investors were using options-based income strategies. Yet there’s room for further growth. The investment approach provides equity market exposure with benefits normally associated with bonds: consistent income and some reduced volatility.

JPMorgan’s Active ETF Has Been Leading the Charge but Has Peers

The asset base for the JPMorgan Equity Premium Income ETF (JEPI) swelled to $29 billion despite the fund rising approximately 2% in value in the first ten months of 2023. JEPI has added $13 billion of new money this year. The fund’s rolling 12-month yield of nearly 10% and its loss of only 3.5% in 2022 has added to its appeal.

Meanwhile the Global X S&P 500 Covered Call ETF (XYLD) has $2.8 billion in assets and rose 5.4% in value this year. XYLD offered a 12-month yield of 12%. XYLD tracks a buywrite index rather than incorporating active management in its use of options.

Talking Alternative Income at VettaFi Symposium

The poll question was asked by VettaFi as representatives from Amplify and NEOS were educating advisors about some of their ETFs. The Amplify CWP Enhanced Dividend Income ETF (DIVO) actively selects dividend-paying stocks like Procter & Gamble and UnitedHealth Group. Management then boosts the fund’s yield to 5% using covered calls.

The NEOS S&P 500 High Income ETF (SPYI) provides exposure to the S&P 500 and employs a covered call, S&P 500 index options strategy to generate monthly tax efficient income. The fund currently generates a 12% annualized yield. SPYI’s use of options is the result of active management.

At the VettaFi Income Strategy Symposium, we also discussed some covered call ETFs that launched in October. The Goldman Sachs S&P 500 Core Premium Income ETF (GPIX) seeks to maintain style, capitalization, and industry characteristics like its benchmark, the S&P 500 Index, while providing monthly income distributions at a relatively stable rate. Management sells call options at a varying percentage of the market value of the equities.

We also talked about the Parametric Equity Income ETF (PAPI). PAPI combines a diversified, dividend-focused equity portfolio with selling call options on the SPDR S&P 500 ETF (SPY).

Not All Covered Call ETFs are the Same

Some of the above ETFs have sibling covered call products providing equity exposure to stocks in the Nasdaq-100 Index or international equities. There are differences between covered call ETFs in what they own, what they cost and how they have performed in the recent past. We encourage you to catch a replay of the Income Strategy Symposium to learn more as well as visiting the fund company’s site for more details.

For more news, information, and analysis, visit VettaFi | ETF Trends.