By Rob Glownia, CFA, CFP, Riverfront Investment Group

In our 2018 Outlook, Tug of War, we wrote that the fixed income market would face several obstacles in 2018. For example, investors would have to weigh the risks of the Federal Reserve raising interest rates, the US budget deficit, and the potential for a trade war, just to name a few. With yields near multi-decade lows and the headwinds mentioned above, our strategy has been as follows:

- Continue to favor equities relative to fixed income in our balanced portfolios.

- Within our bond allocation, remain underweight high quality fixed income assets such

as US government debt, which we believe to be overvalued. - Continue to prefer corporate bonds, with the expectation that higher yields would offer

greater inflation protection and a potential cushion to absorb higher rates.

As expected, we have seen a move higher for interest rates in 2018. Specifically, the 2-year US Treasury has risen by 67 bps or basis points (bps = 1/100th of 1%) since the start of the year and the 10-year US Treasury has moved up by 69 basis points to about 3.09%. Since credit products are typically based on a spread over US Treasury rates, this has had a negative impact on almost all areas of the fixed income market.

Even though we anticipated the move higher in interest rates, we’ve been surprised at how much the investment grade corporate bond market has underperformed year to date.

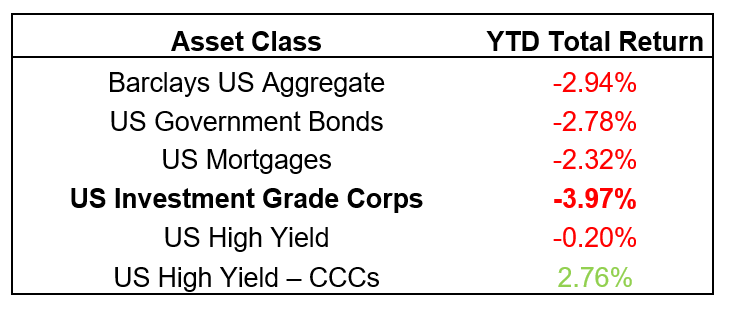

Below is a table showing the returns for various fixed income sectors. As you can see, corporate bonds (US Investment Grade Corps) have been material underperformers thus far in 2018:

![]()

Source: Bloomberg. Past Performance is no indication of future results. Shown for illustrative purposes only, not indicative of RiverFront portfolio performance.

INVESTMENT GRADE CORPORATE BONDS UNDERPERFORMING FOR SEVERAL REASONS:

We believe there are a few reasons for the selloff in investment-grade corporate bonds:

Longer Duration: With interest rates being so low for the last few years, companies have restructured their balance sheets and have refinanced their debt. As part of this process, corporations have extended the maturities on their loans to take full advantage of the low cost of capital.

As such, the investment-grade segment of the market now has an effective duration of about 7 years, which is about a year longer than the bond market’s most quoted benchmark, the Bloomberg Barclays US Aggregate (duration represents a bond’s price sensitivity to changes in interest rates). For this reason, the investment grade corporate bond market has been more adversely affected than other sectors of the bond market as rates have moved higher.

Foreign Selling Pressure: As the old adage says, “money goes where it is treated best.” For a long time, that place was in the US where, despite our low interest rate environment, the income opportunity was still better than fixed income products overseas. In fact, many overseas markets have recently experienced negative interest rates! However, as US interest rates have risen, so has the cost of currency hedging for non-US investors. As a result, it has become more expensive for foreigners to own US bonds unless they’re willing to accept the currency risk associated with the US dollar exposure. For this reason, we believe foreigners who do not want US dollar exposure have been selling bonds, putting pressure on the asset class.

Weakening Credit Metrics: The size of the corporate bond market has grown substantially since 2005. With that growth, there has also been a considerable change in the composition of the sector. For example, the portion of lower quality BBB rated bonds has increased, while the quantity of A, AA, and AAA bonds has decreased. The net result is that the investment grade corporate bond market has morphed into something riskier, and investors are rationally demanding a higher level of compensation for the greater risk of default.

POSITIONING OUR PORTFOLIOS:

Despite the reasons for the selloff discussed above, we believe there are a few fundamental reasons to remain constructive on the sector.

Yield Advantage: History suggests that yield wins over time in the fixed income market. This is especially true in the investment-grade space, where defaults are nearly non-existent. Specifically, investment grade corporate bond defaults have been less than 1% going back to 1987 according to Moody’s. We believe that the additional 120 basis points in coupon income coupled with a relatively high confidence of getting your principal back (albeit with some volatility along the way) is a winning strategy.

Corporate Earnings Continue to be Strong: As of last week, more than 80% of the S&P 500 companies have reported and the Q1 earnings season has been solid. According to JP Morgan[1], 75% of companies are beating their earnings estimates, with an average positive earnings surprise of 9%. In addition to strong earnings, corporate balance sheets appear to be in good shape, with many companies having refinanced their debt at historically low interest rates.

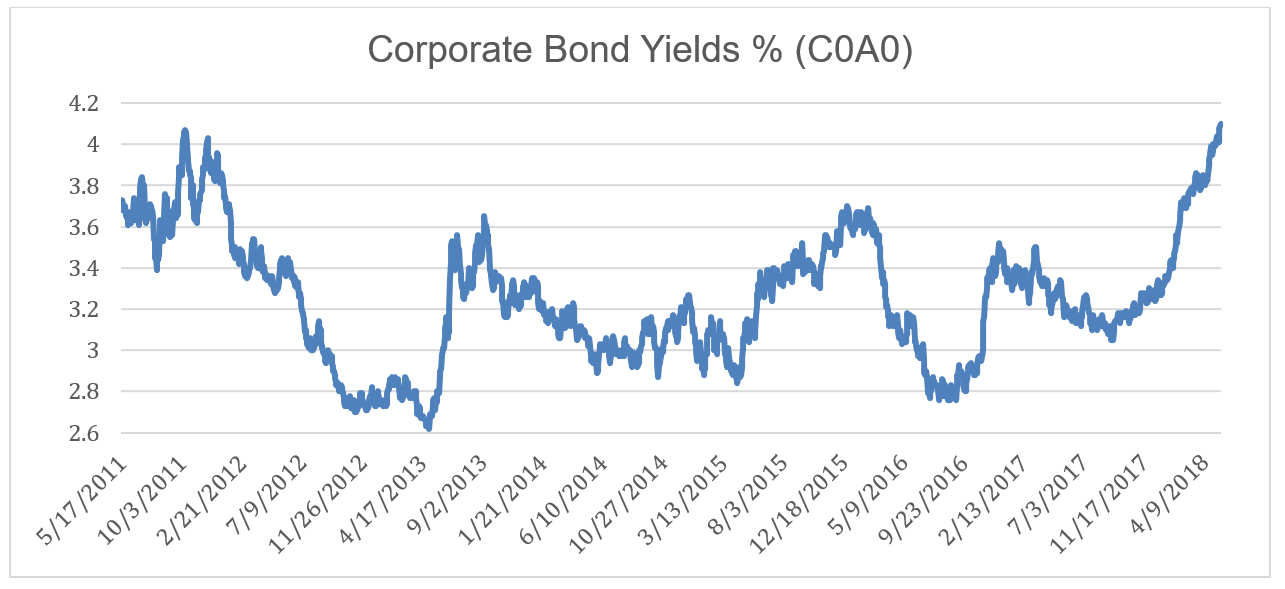

For these reasons, we have maintained our overweight to investment grade corporate bonds, despite the underperformance YTD. The sector is now yielding more than 4%, which is the highest since 2011:

Source: Bloomberg, ICE BAML. Shown for illustrative purposes only. Past performance is no guarantee of future results. You cannot invest directly in an index.

While we’re still overweight credit, we’ve recently reduced some of our longer-dated corporate bond exposure. With longer maturities, the volatility in a bond’s credit spread (which is the premium that investors demand to compensate for default risk) is much higher. Therefore, we have substituted some US Treasury exposure on the long end of the yield curve, which we believe will help dampen volatility over the near term.

Bottom Line: Over the long term, we are strong believers in yield advantage. We are comfortable taking some shorter-term principal volatility to generate additional income, since we currently do not to expect defaults for investment grade companies.