By RiverFront Investment Management

Growth has slowed around the world and long-term interest rates have responded. In fact, the 30-year US Treasury rate recently broke below 2%, which resulted in a new historical low. Furthermore, German 10-year bunds are now yielding -0.65% as their economy teeters on recession and there are 13 countries in Europe with negative yielding 10-year debt.

The US bond market believes the Federal Reserve has been slow to react, as a result 10-year Treasury yields have fallen to the same level as 2-year Treasury yields. Last week, 10-year interest rates briefly fell below 2-year rates causing what the market refers to as an ‘inverted yield curve.’

What is a yield curve? The yield curve graphically illustrates the relationship between shorter and longer-term interest rates. Most of the time, this curve is upward sloping, with short-term interest rates typically lower than long-term interest rates. This is because investors typically demand a premium for having their rates fixed for longer periods of time.

Why is it important? When bond investors feel like the Federal reserve has raised interest rates too high, or that a recession is imminent, long-term rates can fall below short-term ones, “inverting” the shape of the curve.

When the 3-month/10-year curve inverted back in March, many investors took comfort that the 2/10 curve was still positive. Since that is no longer the case, we thought it’d be helpful to reevaluate our March stance regarding the flattening yield curve, especially in light of increased trade tensions and our belief that the Fed is on the case and is expected to cut rates further in 2019.

WE BELIEVE THE BOND MARKET REFLECTS A SLOWING GLOBAL ECONOMY, NOT A US RECESSION: Although it’s always dangerous to assume “it’s different this time,” we don’t believe investors should consider this new inversion as a signal for an imminent recession. As we wrote back in March, there are a few reasons for this conclusion:

- Global central banks have been exceptionally supportive: For the last decade, central banks have suppressed interest rates through various quantitative easing (QE) programs. This has occurred not only in the US, but also in Europe and Japan, where the economies have faced greater deflationary pressures and slower growth prospects. QE programs have dramatically increased the quantity of short-term securities available, while significantly decreasing the availability of longer-maturity bonds. The net result, in our view, is that the yield curve has been distorted by QE and that the efficacy of inversion as a recession signal has been diluted.

- The inversion might be short-lived: Just because the yield curve went from marginally positive to marginally negative, does not mean investors have to change their outlook on all other economic data and information surrounding global markets. Furthermore, the curve can quickly un-invert by countermeasures from the Federal Reserve. Specifically, the Fed can reduce the Fed Funds Rate which would influence the short end of the yield curve. Such a move would likely steepen the curve, reassuring investors that the Fed would support markets if they thought the expansion was at serious risk. Expectations for Fed accommodation continue to increase, such that the market is now pricing in the probability of 2-3 more rate cuts by the end of the year. Thus, we believe the yield curve can remain flatter than usual for an extended period.

- Yield curve has gone mainstream: Given the historical success of the yield curve as a recession signal, it has become more popular and is very closely monitored. Consistent with the old adage, ‘a watched pot never boils,’ we believe it is unlikely that this recession signal will remain the sure-fire indicator that it was in the past. Former Fed Chair Janet Yellen noted this new dynamic when she said that the increased attention on the yield curve has made it “less good” as a recession indicator. Even if we were to believe that the inverted yield curve signal was still valid, historically it has not provided an indication on the timing of the next recession. For example, the curve inverted almost two years prior to the last recession.

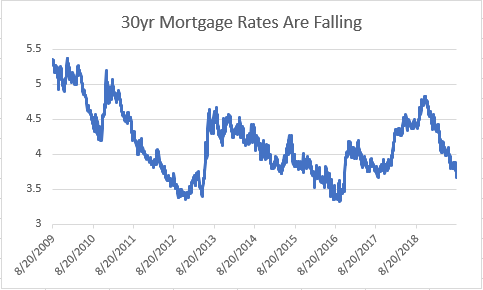

- Interest rates are historically low: Absolute interest rates are extremely low. This is important because low interest rates allow companies and consumer to keep the cost of debt relatively low and lowers the probability of a debt cycle abruptly ending. As interest rates go lower, indebted companies and individuals can refinance and reduce their monthly servicing costs. This is apparent today as US refinance applications are running at 3-year highs as homeowners rush to refinance their homes in the wake of 30-year mortgage rates falling to their levels lowest since November 2016 (3.6%). For this reason, we do not foresee a credit induced crisis, like that which occurred in 2008.

Disclosures: Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

RISK MANAGEMENT: It is always dangerous to assume that “it’s different this time,” and we don’t take lightly the risk that investors will panic as a result of this recession signal. We think the greatest risk of the yield curve inversion is related to investor psychology, which is already fragile due to China trade tensions, the uncertainty around Brexit, and the global economic slowdown. If so, we need to recognize that the yield curve signal might become a self-fulfilling prophecy and influence consumer and business spending behavior enough to usher in the next recession. Therefore, we will continue to listen to the message of the bond market and monitor the way in which it impacts economic growth.

Bottom Line: While we continue to expect heightened volatility for the rest of this summer, we do not believe the US will enter recession ahead of the 2020 presidential elections. As a result, we are not ready to shift our strategy of preferring equities over bonds.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 931779