By Roman Chuyan, CFA

Economic Trouble

US economic performance falters in Q3

- Inflation remained elevated last month and shows no signs of slowing

- Consumer confidence plunged in the past two months

- Consumer spending stalled in recent months after surging in Q1 on monetary stimulus

I’ve focused on rising US inflation in my recent commentaries, why it’s a serious problem, even though the Fed has ignored it. Today, I highlight the latest economic numbers that show mixed performance in Q3 after a surge earlier in the year that was fueled by monetary stimulus. Inflation remains near its highest in 30 years, and consumer confidence unexpectedly plunged in the past two months.

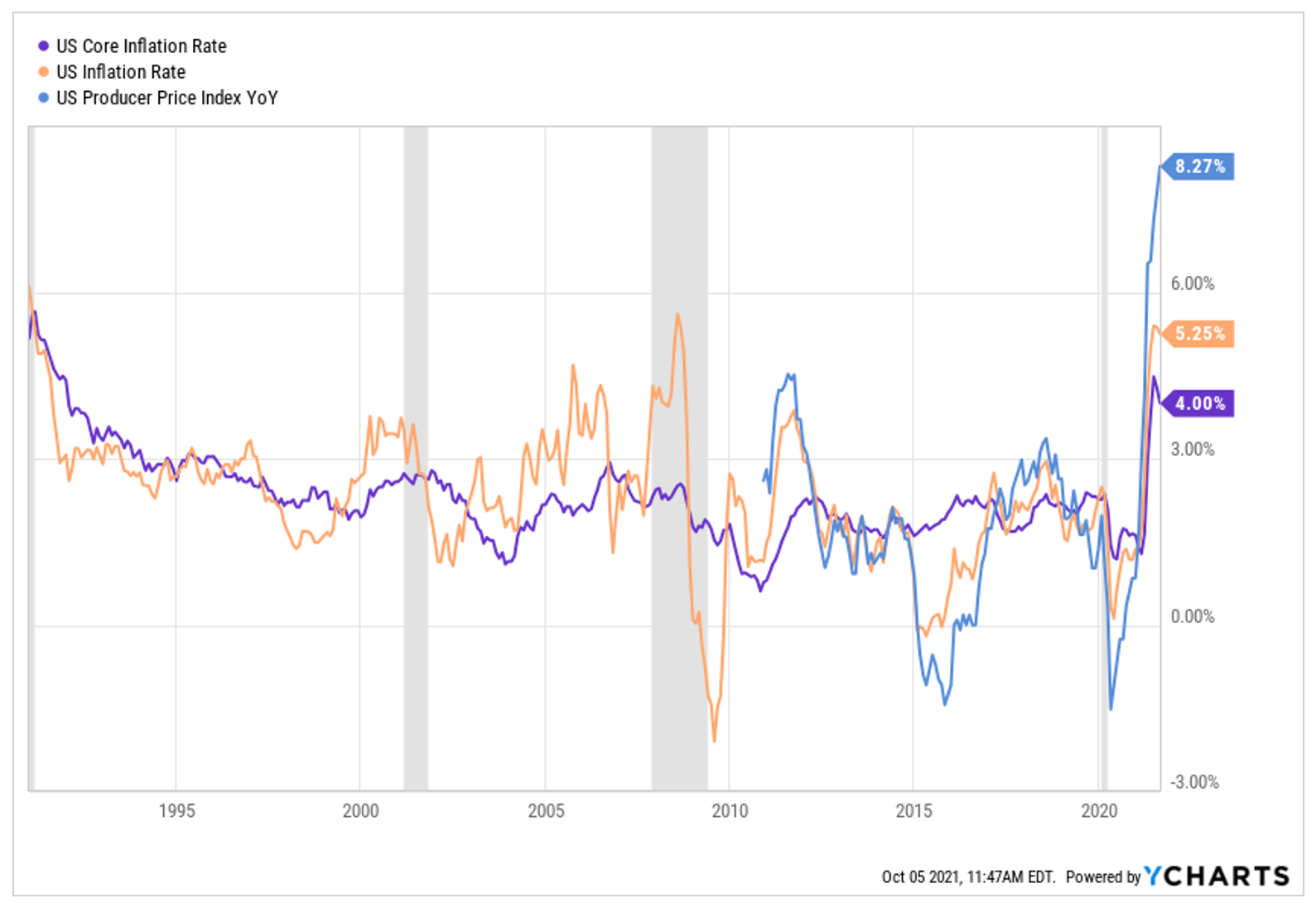

Inflation remained largely unchanged in August after its recent surge. Total CPI inflation (the orange line on the chart above) dipped slightly to 5.3%, and core inflation to 4%. But producer price inflation (the blue line) surged above 8%.

The “low-base effect” is long gone, and if it mattered then inflation would have backed down – but it didn’t. Despite this, the Fed officials maintained their “transitory” rhetoric well into Q3. As I detailed in my recent commentaries, inflation is not transitory and will likely re-accelerate beginning this month and into the end of the year, due to another “base effect” last year. Also, the rise in commodity prices that initially accelerated inflation, shows no signs of moderating – natural gas, for example, skyrocketed ahead of the heating season:

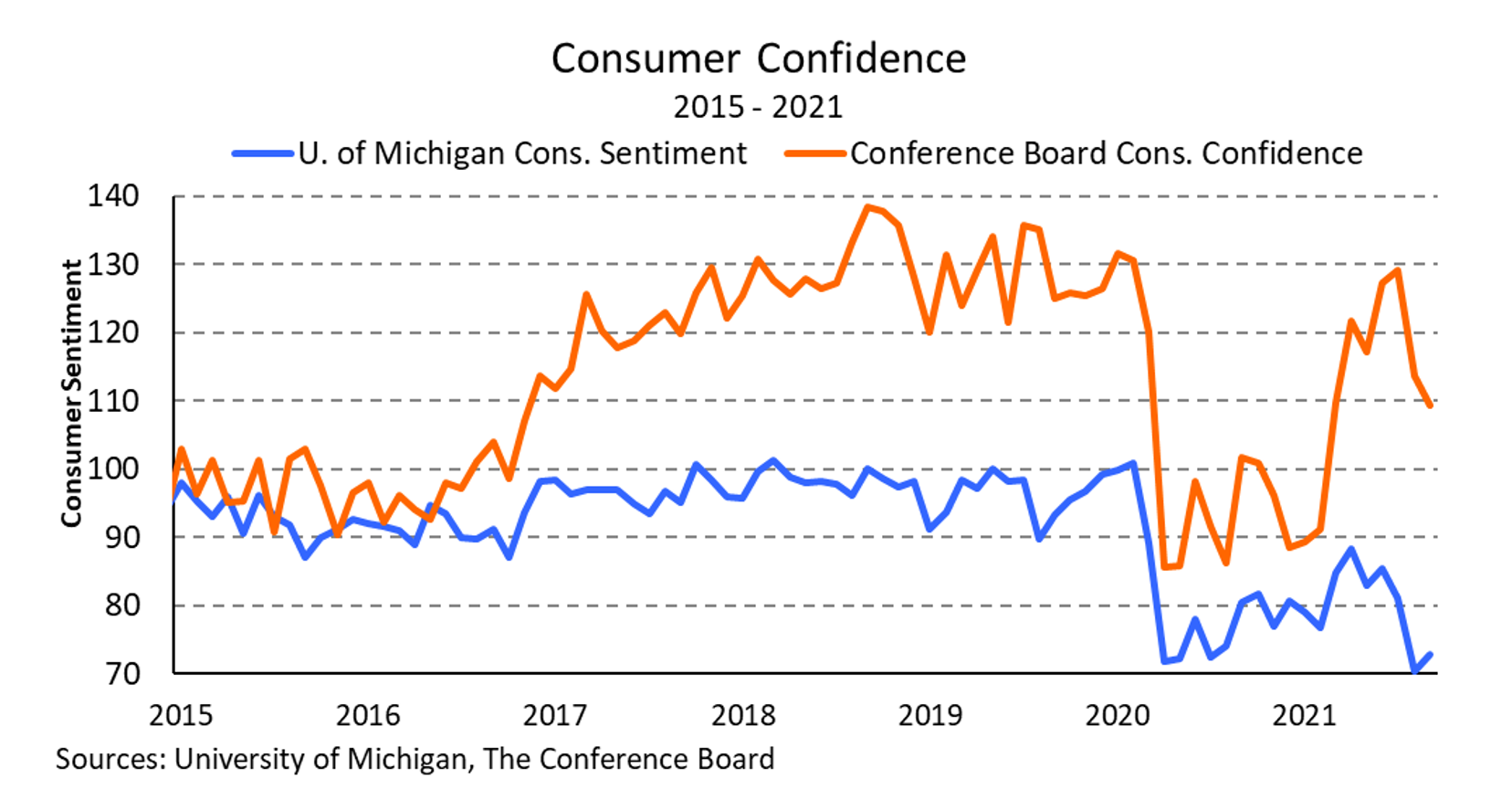

Consumer confidence – a leading indicator of future spending – dropped in Q3. The University of Michigan’s sentiment measure dropped to its lowest since 2011 in August and rebounded only slightly in September (the blue line on the chart below). Declines in confidence were widespread across demographics and across all regions. Moreover, the declines covered all aspects of the economy, from personal finances to prospects for the economy, including inflation and unemployment. Consumers believe the economy’s performance will be diminished over the next several months, due partly to dashed hopes that the pandemic would soon end. The Conference Board’s confidence measure, which doesn’t ask about inflation, dropped sharply, but remains around its historical average.

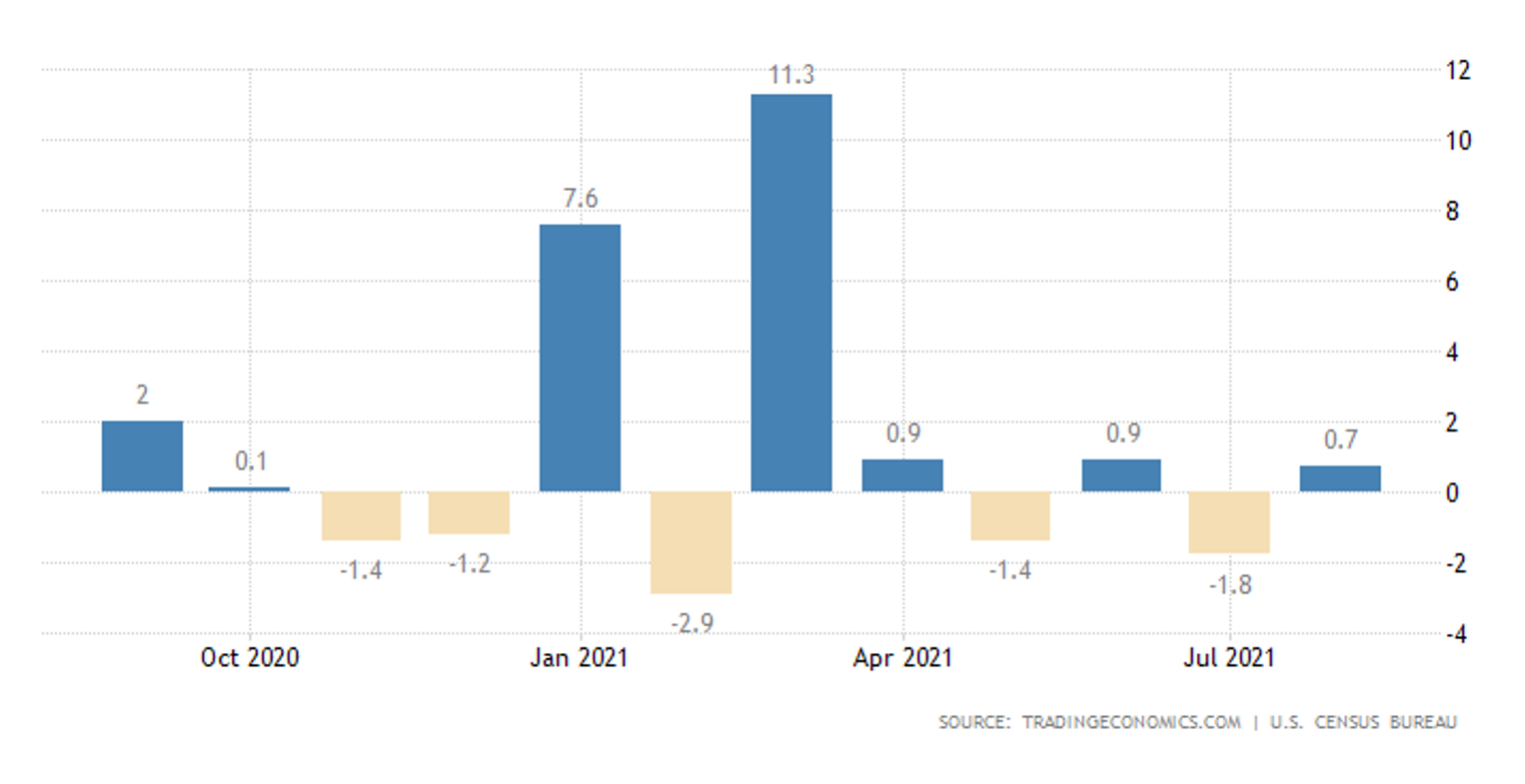

Finally, consumer spending itself, which fuels 70% of our economy, stalled in recent months after surging in Q1 as people cashed the federal stimulus checks. The trend flattened immediately as the stimulus reached a steady state in April. In the latest figures, retail sales fell by 1.8% in July and grew by 0.7% in August. Also keep in mind that spending is measured in nominal terms, including rising prices. With inflation around 5% annually, spending must increase that much just to keep real consumption steady.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, SMArtX, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Source for the S&P 500 actual returns: S&P Dow Jones.

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.