By Roman Chuyan, CFA, Model Capital Management

- Our fundamentals-based equity model continues with its negative outlook for the S&P 500.

- Economic factors remain negative, and market rebound has moved index valuation close to neutral.

- Economists are competing for the gloomiest projection, with some expecting a -25% GDP in Q2.

- I give a possible scenario of when we might get back into the stock market.

Author’s note: this report was sent to clients on April 1, 2020.

For fixed income focus, see our latest article Bear-Market Bond Adjustment.

Please bookmark our ETF Strategist page for the latest articles!

The exponential spread of the coronavirus has taken a heavy toll in both human life and economic activity. As testing becomes more available, known infections have risen sharply and the US jumped to first place globally in total infections. New York City emerged as the new epicenter of the disease, and multiple states have closed non-essential businesses. In addition to the halt in all travel, entertainment, and public events, the entire manufacturing and retail industries were shuttered in several states, forcing employers to furlough millions of employees.

After protecting our clients against this downturn, we continue to be defensive in our tactical strategies. The stock rebounded from their lows increased their valuation. Combined with negative economic factors, this keeps our equity model negative. Our Credit model turned positive after bond prices fell in March (see our latest article Bear-Market Bond Adjustment), and we bought investment-grade loans (such as FLRN) and bonds (LQD), while keeping the overall portfolio duration short.

Market Trends

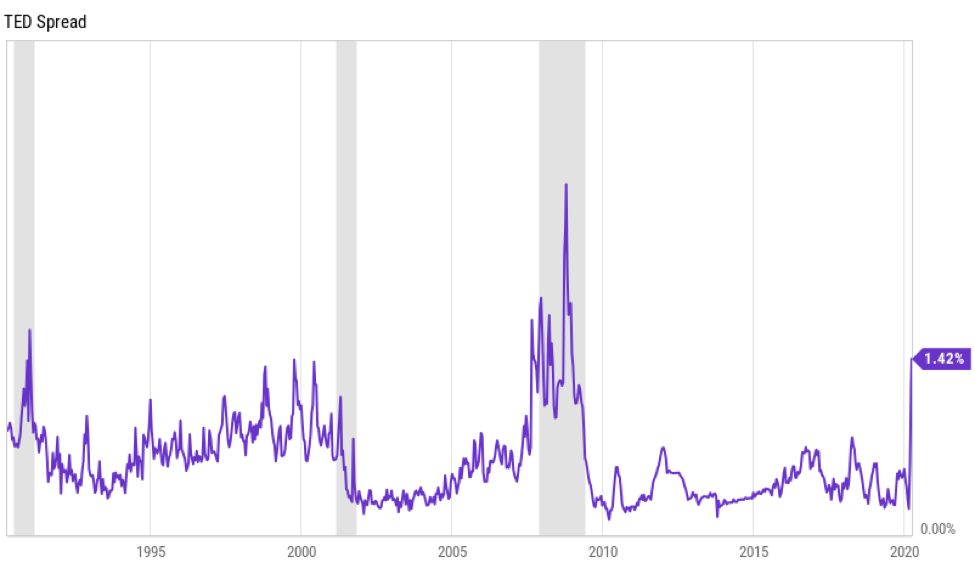

Years of over-investment in risk assets – stocks, bonds, asset-backed, high-yield – had to be unwound as the downturn began. Many investors trying to sell at the same time made the selloff especially steep earlier this month, resembling closely the steep selloff in October of 2008. The 2008 episode wasn’t the end of that bear market, and this might not be the end of current one. Bear markets are characterized by:

- They coincide with economic recessions, and the two reinforce each other. A severe recession is underway this year (see Economic Focus).

- Bear markets last for awhile. The 2007-09 bear market persisted for 18 months, and the 2001-02 bear market lasted for about two years.

- They result in destruction of wealth. The S&P 500 dropped by at least 47% from its peak in the past two bear markets.

Source: Ycharts

Economic Focus

Just two weeks ago, I think most of us expected a mild-to-moderate economic downturn because of virus-containment measures. In my previous report, I wrote that major banks would project a recession. It turned out to be a contest for the gloomiest projection. Many economists now expect around a 10% annualized contraction in Q1 and 25% in Q2. Goldman Sachs is winning the contest, announcing today that it expects the US economy to shrink by an annualized 34% in Q2 and unemployment to soar to 15%. If anything close to that occurs, it would be the largest economic downturn since 1946 when GDP fell by 11.6% as the manufacturing of war materiel ended. The deepest recent quarterly downturns occurred in 2008 (-8.4% annualized), and before that in 1958 (-10%).

Economic numbers for March are only beginning to come in, with initial jobless claims soaring to 3.3 million, then to 6.6 million – two consecutive weeks of largest weekly job losses on record. We’re in uncharted territory.

Initial Jobless Claims

Source: Ycharts

Some media reports are beginning to point to “warning signs” that appeared before the pandemic began of a fragile economy, high stock valuation, and excessive borrowing. Of course, these signs were obvious to anyone who cared to look. We wrote about them for most of last year and were defensive based on our models, which protected our clients against this downturn. But the economists at major banks and securities firms were too busy cheerleading the rising market. There should be no surprise, however – economists follow markets.

Fundamental Themes

To inform our investment thesis, we continue to think about upcoming themes:

Economic projections: Economists are now competing for the gloomiest projection, with many expecting around a 10% annualized GDP contraction in Q1 and 25% in Q2. The March data has only begun to come in. While consumer confidence measures dropped only moderately, the timing of these surveys covered only part of the period of quarantines and layoffs. The 3.3 and 6.6 million jobless claims numbers were simply astounding.

Earnings: Public companies will begin reporting their Q1 earnings in about two weeks – and the results will likely be terrible across many sectors. This might initiate another wave of market selling.

Institutions: While hedge funds employ all sorts of strategies, they tend to be long stocks during a bull market. Liquidating leveraged long positions likely accelerated the market plunge in mid-March. The subsequent market rebound gave funds and their banks an opportunity to complete liquidations in an orderly manner, but left them averse to risk-taking for a while. The next wave of selling is likely to come from pensions and retail investors.

Coronavirus: The epidemic continues to drive market moves. While China has been reporting few new cases, there’s doubt about its numbers. Infections and deaths continue to grow exponentially outside of China and South Korea. The president’s task force extended the social distancing guidelines to April 30th from early April – an unwelcome delay to investors who were hoping for a quick economic re-opening. An eventual “flattening” of the infections curve will be perceived as positive by investors. At least two potential cures are in clinical trials – an approval would be a positive as well.

Some clients asked us: when will you get back into the market? Aside from the fact that we always follow our fundamentals-based process, let me give a possible scenario. Another leg down in stock prices, perhaps 20% or more, would make them very cheap. At the same time, a flattening in the infections curve and/or FDA approval of a cure would allow the government to plan for reopening the economy. If economic factors, such as consumer confidence, don’t deteriorate much further, along with very cheap valuation, this might turn our equity model’s forecast positive.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Source for the S&P 500 actual returns: S&P Dow Jones.

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.