It is important to note here, that recovery time depends on the intensity of the drawdown and the nature of the market after the drawdown ends and recovery begins, so recovery times are not always in direct correlation to the drawdown intensity.

The -13% drawdown of the 2015–2016 correction took about two months to recover while the -19% correction in 1998 took only about three months. The -11% drop in 2000, though, took almost five months to recover.

Despite the discrepancy between corrections’ drawdowns and recovery times over the last 20 years, they all took less than half a year to recover. The recovery for the bear markets, however, required years of recovery time.

Duration

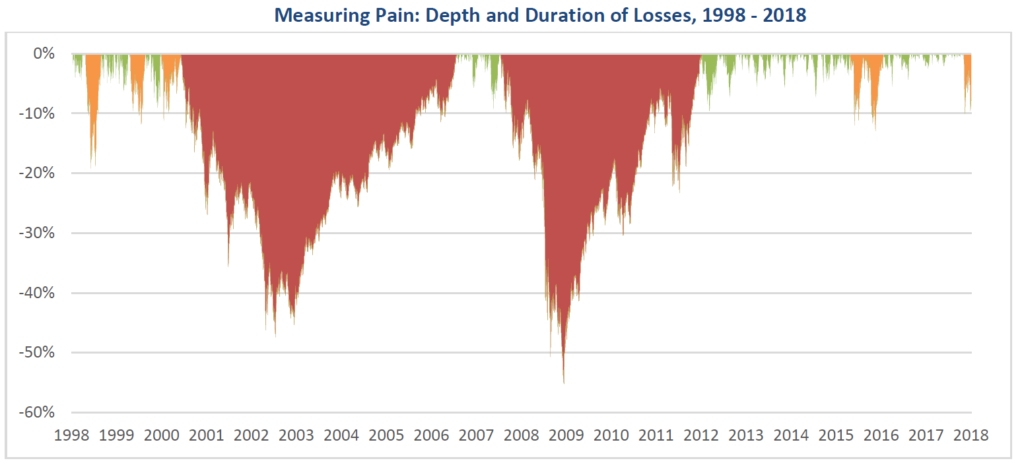

The duration of a drawdown includes both the total length of time the market took to fall from a peak to the trough and the length of time to recover the losses back to the pre-drawdown level.

The graph below shows the depth and duration of losses of the corrections and bear markets.

![]()

Source: Yahoo Finance, S&P 500 Total Return Index

The bear market during the Dot-com Bust of 2000–2002 may have created a smaller drawdown than the bear market during the Financial Crisis of 2008-09, but its duration was much longer. Tables A and B above show average duration of corrections can be less than a year while bear markets can go beyond four years.

If on average it takes less than a year for investors to move on from a correction, are corrections worth all the fuss?

In contrast, a bear market generally takes years before recovery is realized—and sometimes longer for the investor to mentally and emotionally recover. That sort of recovery time can seriously wreck a long-term investment plan or delay goals like retirement start dates or college education funding.

Corrections: Practice Runs for Risk Management

Corrections may happen more often, but on average, they tend to be less intense and shorter in duration. Generally, they do not derail investors from their financial goals.

Bear markets, on the other hand, are much more disruptive for people hoping to achieve their goals, resulting in major losses that take years to recover from. For those near or in the retirement phase, these losses can be particularly detrimental.

Corrections are often a wake-up call for investors to consider managing risk. But if investors and their portfolios are unable to withstand a 10% correction, are they prepared for the possibility of an actual bear market? With the recent panic surrounding the February 2018 correction, it seems many may not be adequately prepared.

Don’t Panic—Prepare

The current market and volatility regime we’re in now suggests more uncomfortable downward moves may be ahead, which may make it harder for investors to hold on to a “buy-and-hold” strategy.

It’s our philosophy to hedge market risk directly in order to limit losses during bear markets and help investors remain invested and on track with their investment goals. We understand you can’t invest in risk assets and simultaneously protect against both smaller, short-term losses (corrections) and larger, longer-term losses (bear markets) and given the difference in the nature and impacts of corrections versus bear markets, we’ve chosen to seek protection from the latter. We believe in managing against potentially life-altering losses to portfolios rather than seeking protection from what are often bumps on the investment journey.

David Lovell is Director of Marketing at Swan Global Investments, a participant in the ETF strategist Channel.