By Roman Chuyan, CFA

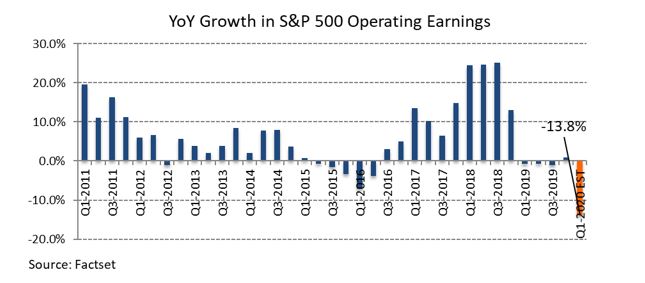

- Operating earnings for the first quarter dropped by 14%

- This is the biggest decline in the S&P 500 earnings since 2009

- The price-to-earnings ratio for the S&P 500 is up to 20.2, well above average and its 2019 level

Earnings reporting for the first quarter of 2020 is nearly completed, with 90% of the companies included in the S&P 500 index reporting their results. In this article, I provide an overview of how earnings are trending so far. The numbers below are mostly actual results, with estimates for 10% of companies that still haven’t reported. I also have articles coming up on economic update and our outlook for the S&P 500 – to stay tuned, bookmark, and revisit our ETF Strategist page.

Operating earnings for the first quarter dropped by 13.8%, the largest decline since Q3-2009. A below-average 65% of S&P 500 companies beat already-lowered analyst expectations. The travel halt and the widespread coronavirus-related lockdowns in March are the primary reason for the decline. Other factors include the crash in oil and other commodity prices that hit the Energy and Materials sectors hard. The drop comes after four consecutive quarter of flat-to-negative growth (see chart above). The trailing 12-month operating price-to-earnings ratio for the S&P 500 is back at 20.2, well above average and above its 2019 level.

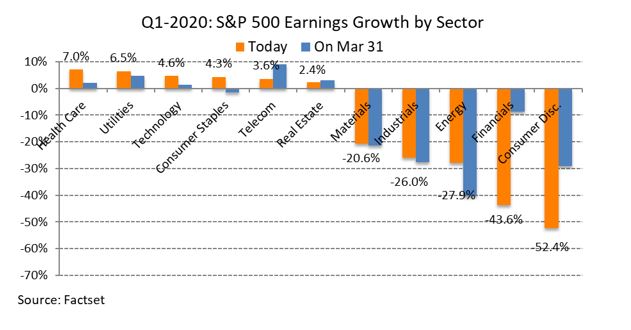

There’s a sharp divide between “bad” and “okay” sectors this quarter. Five “bad” sectors exhibited double-digit percentage declines in earnings from the same quarter last year. The Consumer Discretionary sector is the worst performer with a -52% plunge in earnings, followed by Financials (-44%), which lagged analyst consensus as of March 31st by the most, 35%.

Six “okay” sectors exhibited single-digit growth in earnings. The defensive Health Care (+7%) and Utilities (+6.5%) sectors lead growth this quarter. The traditionally growth-oriented Tech sector came in at a low-but-positive 4.6% growth. The Energy sector beat consensus estimates by the largest margin, +12.4%, by reporting a smaller-than-expected 28% drop in earnings.

Where do earnings go from here? Looking at the recent sharp market rebound, some strategists expect a quick rebound in earnings. I think this is misguided. We entered a severe recession in Q1 (-4.8% annualized GDP), and Q2 looks to be much worse – most economic numbers are the worst on record. Earnings typically continue to decline past the end of a recession and often go negative. For example, they dropped by 16% YoY Q3-2009, even though the recession ended in Q1-2009.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document, article or newsletter and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.