By RiverFront Investment Management

The NFL season is now underway, and after the first month of games, some teams have thrown in the towel and are playing for next year’s top draft pick. Others are ‘pretenders’ who win more often than they lose but will falter when times become difficult. Finally, the ‘contenders’ are executing their game plan flawlessly and preparing themselves each week with the goal of winning the Super Bowl. Currently, we view the US stock market as a ‘contender,’ as the weight of evidence from our three tactical rules has improved each quarter. Entering the fourth quarter, we believe the ‘three rules’ (as defined below) are further aided by a macroeconomic backdrop that consists of monetary easing, signs of trade resolution/ceasefire, and a strong US labor market.

DON’T FIGHT THE FED: We believe investors should not go against the policy guidance of central bankers in the US or abroad.

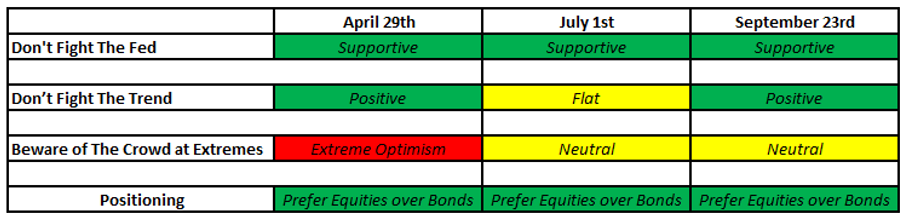

Opinions are not intended as recommendations and are subject to change. Terms used in this chart are RiverFront interpretations. Definitions for terms used above are included in the disclosures.

The current policy stance in the US is ‘supportive’, in our view as the Fed has reduced interest rates by 25 basis points at each of its last two meetings. The rate cuts now have the fed funds target at between 1.75% and 2.00%. By lowering interest rates, the Fed has enticed homeowners to refinance their homes, which potentially increases disposable income as monthly mortgage payments decrease. Lower interest rates are also beneficial to corporations that have debt because it allows them to pay down debt faster, increase dividends, or reinvest. The impact of this low rate environment is apparent in the Chicago Fed’s National Financial Conditions Index, which now shows financial conditions close to the loosest they have been since 1971; indicating a willingness for financial institutions to lend to borrowers. Overseas, the European Central Bank (ECB) has restarted quantitative easing in Europe by printing €20 billion per month to stimulate their slowing economy (See our Weekly View from 9/16/19). The Bank of Japan (BOJ) has also committed to additional easing, which is expected to come in October. We believe global central banks are currently supportive and on the investor’s side.

DON’T FIGHT THE TREND: We believe investors should determine the direction and strength of the trend and adjust their investment decisions accordingly.

Currently the US primary trend, which we define as the S&P 500’s 200-day moving average (the average closing price of the S&P500 over the last 200 trading days), is rising at an annualized 11.3% rate. This is a significant improvement from the flat trend that we observed during our July 1st update. The strengthening trend is notable given the nagging backdrop of a trade war that has already resulted in several tariff increases. Currently, some signs of a cease-fire in US/China trade tensions have pushed the S&P 500 near an all-time high level. If trade negotiations deteriorate, we think the trend will likely weaken, but the strength of the trend makes it unlikely, in our view, that the S&P 500 would fall much below the current 200-day moving average of 2826 (as of 9/23).

The international primary trend, which we define as MSCI All Country World ex-US index’s (ACWX) 200-day moving average, is also strengthening. The international trend is rising at a lower 4.6% annualized rate but has less support than the S&P 500 and will turn down quickly if the improvement does not continue, in our view. Importantly, the international trend is more vulnerable to trade discussions and Brexit, in our view, which could go either way over the next three months.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available at the end of this publication.

BEWARE OF THE CROWD AT EXTREMES: Analyze sentiment by determining if it sustainable at current levels. If sentiment is identified to be unsustainable, then as investors we believe we must be willing to lean in the other direction and be prepared to act aggressively once the condition changes.

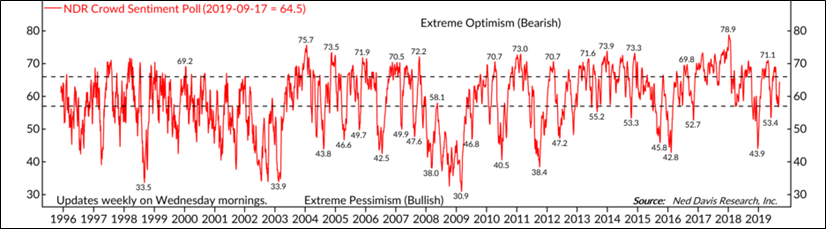

Ned Davis Research’s (NDR) Weekly Crowd Sentiment Poll (see chart below) currently sits right in the middle of neutral after reaching ‘extreme optimism’ in July and then falling slightly into ‘extreme pessimism’ in August. Sentiment is supported by a strong labor market, as unemployment sits at a low 3.7% and higher labor turnover (people quitting their jobs) indicates that employees are comfortable quitting their jobs before having found an alternative or have found new employment. Ultimately, when the labor market is strong there is a cascading affect through the rest of the economy, in our view. Given the strong labor backdrop, markets have been able to better weather negative headlines. For example, the S&P 500’s trading range has been contained to 2850 – 3027. We believe that sentiment going forward will continue to be driven by monetary policy decisions, global trade, and geopolitics.

Past performance is no guarantee of future results. © 2019 Ned Davis Research Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data disclaimers refer to www.ndr.com/vendorinfo/.

THE FINAL VERDICT:

We believe the Fed and central banks around the world are signaling that they will do whatever is needed to continue the expansion. Central bankers’ willingness to aid the expansion creates a supportive backdrop for equity performance around the world. In the US, we view rising price trends and sentiment that is not overly optimistic as additional positives in the near-term. If our three tactical rules remain at current levels, we believe that the risk positioning in our portfolios is appropriate. If the trend improves, and the Fed and sentiment remain unchanged, we will look to add additional equity exposure to the portfolios.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

It is not possible to invest directly in an index.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries.

The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and “shadow” banking systems. Because U.S. economic and financial conditions tend to be highly correlated, we also present an alternative index, the adjusted NFCI (ANFCI). This index isolates a component of financial conditions uncorrelated with economic conditions to provide an update on financial conditions relative to current economic conditions.

Definitions: Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 960434