By Riverfront Investment Group

2019 is ending in a few weeks and the economic and stock market expansion that started in the previous decade is poised to continue into 2020. Our tactical rules support this view and are keeping us invested in equities. Until recently, all three rules of Don’t Fight the Fed, Don’t Fight the Trend, and Beware of the Crowd at Extremes were favorable for having positive equity returns over the next three to six months as the Fed was on hold, the trend was rising, and crowd sentiment was neutral. However, the enthusiasm around a potential Phase -1 trade deal between the US and China led crowd sentiment into extreme optimism territory.

By no means does elevated sentiment indicate investors should take their chips off the table, it simply suggests a degree of prudence is in order, in our opinion. At RiverFront, we have elected to implement trailing stops to defend against pullbacks especially in our shorter-horizon portfolios, while staying invested in the event domestic equity markets continue to reach new highs. Overall, our tactical rules are still sending a bullish signal to stay invested.

DON’T FIGHT THE FED: Investors should not go against the policy guidance of central bankers in the US or abroad.

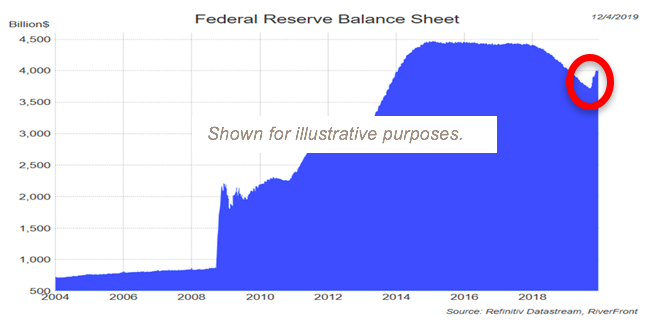

The Federal Reserve cut interest rates three times in 2019; reducing the fed funds target range to 1.50 – 1.75%. These interest rate cuts were viewed as insurance cuts, to support the economic expansion which began June 2009. Currently, the Fed is viewed as being on hold as it pertains to future rate cuts, but the low rate environment is still making a positive impact on the economy. Financial conditions continue to be close to the most accommodative for investors in history, indicating a willingness of financial institutions to lend to borrowers. Additionally, as can be seen in the chart, the Fed has begun expanding its balance sheet (red circle) for the first time since 2014 through purchases of T-Bills, repos, and reverse repos. We believe, the Fed’s balance sheet operations are supportive for investors and risk assets; providing liquidity to financial markets.

Internationally, the European Central Bank (ECB) continues to print €20 billion per month to stimulate their slowing economy and the Bank of Japan (BOJ) continues to expand its balance sheet. Overall, we believe that global central banks are supportive and on the investor’s side.

DON’T FIGHT THE TREND: Investors should determine the direction and strength of the trend and adjust their investment decisions accordingly.

Currently the US primary trend, which we define as the S&P 500’s 200-day moving average, is rising at an annualized 19.2% rate (red-line, right chart). This is significantly faster than the 11.3% annualized rate that we observed during our September 23rd Weekly View update. However, we do not see the current trend growth as sustainable given that it is driven almost solely by the anticipation of a US/China trade agreement. If current levels on the S&P 500 hold steady, the trend will fall to a more sustainable 10% annualized rate over the next month. If trade negotiations deteriorate the trend will likely weaken, but the strength of the trend makes it likely that the S&P 500 would stay above the current 200-day moving average of 2935 given the supportive US economic backdrop; in our view.

The international primary trend, which we define as MSCI All Country World ex-US index’s (ACWX) 200-day moving average, is also strengthening. The international trend is rising at a lower 8.5% annualized rate (red-line, left chart) but has less support than the S&P 500 given that international markets have yet to reach their 2018 highs. We continue to believe that the international trend is more vulnerable to trade disappointments, in our view, as President Trump vacillates between getting a deal done now or renegotiating a deal after the 2020 election.

BEWARE OF THE CROWD AT EXTREMES: Analyze sentiment by determining if it is sustainable at current levels. If sentiment is identified to be unsustainable, then as investors we must be willing to lean in the other direction and be prepared to act aggressively once the condition changes.

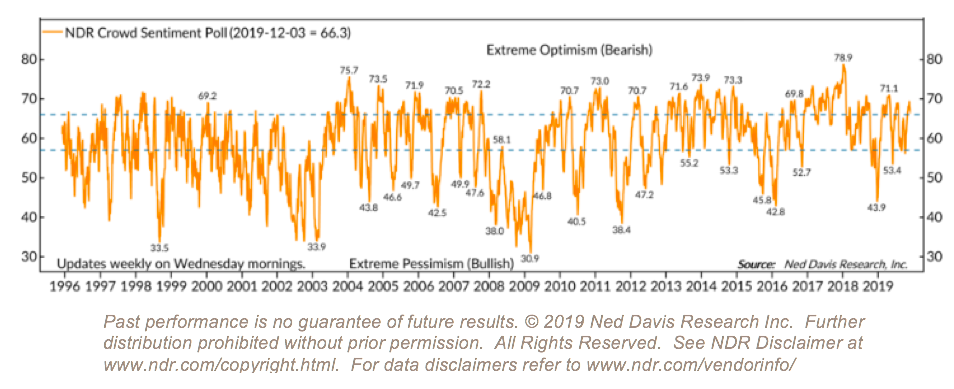

Ned Davis Research’s (NDR) Weekly Crowd Sentiment Poll (see chart below) has recently moved into the extreme optimism zone and financial markets have pulled back as uncertainty of the phase-1 trade deal has risen recently. Sentiment had been supported by a continued strong labor market as unemployment sits at a low 3.5%, a better than expected 3rd quarter earnings season, and improving trade negotiations. However, the recent tone change on trade could dampen expectations and bring sentiment back to neutral levels that are more supportive for equities. At current levels, sentiment suggests equity markets may need a minor pullback to reset expectations before markets can attempt to make new highs.

THE FINAL VERDICT:

We believe the Fed and central banks around the world are signaling that they will do whatever is needed to continue the economic expansion. Central bankers’ willingness to aid the expansion creates a supportive backdrop for equity performance around the world. However, with sentiment at extremely optimistic levels we anticipate investors will be more twitchy in reaction to headlines. Therefore, while the Fed and the trend are on investor’s side, sentiment may dampen the supportive backdrop over the next three months. Given that two out of three of our tactical rules remain positive for investors and risk assets, we continue to have more equity exposure relative to fixed income in the portfolios but have stop losses in place in our shorter-horizon portfolios to counteract the reaction of the crowd that has now become too optimistic.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

It is not possible to invest directly in an index.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries.

The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and “shadow” banking systems. Because U.S. economic and financial conditions tend to be highly correlated, we also present an alternative index, the adjusted NFCI (ANFCI). This index isolates a component of financial conditions uncorrelated with economic conditions to provide an update on financial conditions relative to current economic conditions.

Definitions: Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 1031625