By Doug Sandler, Chris Konstantinos & Rod Smyth, RiverFront Investment Group

Sometimes, despite the most favorable predictions, an unexpected storm can quickly appear with little warning. Global capital markets experienced just such a storm in 2018 when the calm seas of a synchronized global recovery were replaced by the choppy waters of trade wars and rate hikes. Unexpected storms are a common occurrence in the capital markets and how one responds to them can tell you a lot about a portfolio management team and their process. This edition of the Weekly View covers the actions we have taken in RiverFront’s Advantage portfolios over the past twelve months.

In our Outlook 2018 ‘Tug of War’ we recognized these crosswinds but expected global growth to win-out, and thus positioned our portfolios accordingly. However, the investment environment can change quickly, and plans need to be altered for the unexpected. The first signs of an approaching storm came in March of 2018 when President Trump put the world on ‘high alert’ about his desire to overhaul the US’ current trade policies. More storm clouds appeared after the Italian election, after each Fed rate hike and with every piece of data reflecting slower economic growth. Despite our long-term positive outlook, the approaching storm could not be ignored and acted as the catalyst to amend our plans and adjust our portfolios.

Throughout 2018 our portfolio management team has been navigating through the storm while keeping watch for the calmer waters we expect ahead. Keeping with the nautical metaphor, the adjustments we have made over the past twelve-months fall into three broad categories: Trimming the Sails, Adding Ballast and Securing the Cargo.

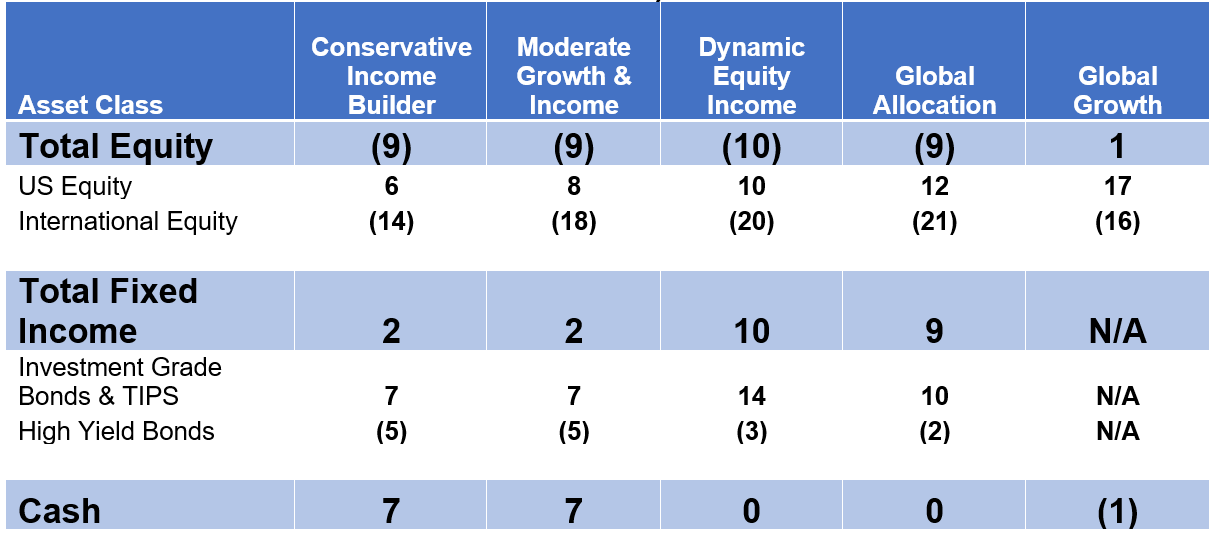

Trimming the Sails: The two biggest risks to mariners trying to navigate through a storm are the risk of capsizing and the risk of being blown significantly off course. The simplest way to reduce the risk of either is to trim the sails and the degree of trimming will depend on the expected length and intensity of the storm. Our portfolio managers have been ‘trimming the sails’ by reducing the level of our equity exposure in the Advantage portfolios throughout 2018. Today, our equity/bond allocations are roughly in alignment with our benchmarks, which equates to about 8-10 percentage points less equity exposure than one year ago (see Table 1 on next page). We have deliberately chosen not to underweight stocks given current reasonable valuations and our favorable outlook on global economic and earnings growth.

Adding Ballast: When waters are choppy, a boat needs enough ballast to offset the force of the waves, which allow it to stay ‘on course’. From a portfolio management context, ‘ballast’ are the things in a portfolio that can act as a counterbalance to choppiness in the equity markets. Currently, we believe cash and investment grade bonds are the most effective ballast for our portfolios. Over the last year, our balanced Advantage portfolios have increased their ballast (cash, TIPs and investment grade bonds) by 10-14 percentage points. Our fixed income team also believes that it is a relatively opportune time to add ballast to the portfolios given that US interest rates are near their 12-month highs and longer-term Treasuries are now offering yields not seen since 2011.

Securing the Cargo: The most secure part of a ship is near its center. We believe the ‘center’ of a portfolio is often best represented by the portfolio’s benchmark. Some portfolio managers “secure their cargo” by reducing the number of non-benchmark positions in a portfolio because they can be more volatile and impact the portfolio’s overall “seaworthiness”. A portfolio’s most volatile positions can be those that are less diversified and thus carry the greatest idiosyncratic (specific) risk, like individual stocks or specific country ETFs. For this reason, we have eliminated some of these types of positions in the portfolios we manage. Importantly, while our portfolios no longer own individual stocks, the portfolio management team continues to consider individual stocks for future inclusion in the portfolios.

We believe the next most volatile category of securities in a portfolio are often those that provide diversified exposure to a historically volatile asset class or sector. Some examples of volatile asset classes include international equities (developed and emerging), MLPs, small-caps, and high-yield bonds while more volatile sectors include technology, industrials, materials and energy. Throughout the year our portfolio managers have been ‘securing the cargo’ by removing 14-21 percentage points of international exposure and 2-5 percentage points of high yield from the portfolios. These positions were replaced with US equity and several broadly diversified international Exchange Traded Funds (ETFs).

We believe that the result of these adjustments, as summarized in the table below, has created a more “seaworthy vessel” for current market conditions.

Source: RiverFront Investment Group. Past performance is no guarantee of future results. The asset class weightings shown in the table above are for the RiverFront Advantage Separately Management Accounts (Portfolio) and are subject to change. They are not calculated or derived from any Unified Managed Account (UMA) or Model Delivery Platform (MDP). While our SMAs and models for UMAs and MDPs will have similar investment weightings, there may be differences between the models; as such, there will be differences in the current portfolio weights/statistics in actual client accounts. These asset class weightings are also not representative of the RiverFront RiverShares portfolios. International stocks includes Developed and Emerging Equities. Total Fixed Income incorporates Investment Grade Bonds, High Yield Bonds, Treasury Inflation Protected Securities (TIPS) and Bank Loans.

In 2018, international stocks have been most affected by the issues discussed above and are now in clear downtrends, in our view. Therefore, a reduction in international stocks has been the emphasis of our risk management and tactical decision making throughout the year. We still believe that international stocks offer more attractive long-term relative value than the US, and thus are looking for the right re-entry point.

Important Disclosure Information

Diversification does not ensure a profit or protect against a loss.