By Riverfront Investment Group

Recent fiscal stimulus measures to combat the impact of COVID-19 have re-ignited investors’ concerns about too much government spending. While the federal debt has been on investors’ minds since the National Debt Clock was erected near Times Square in 1989, critics have been more vocal as our nation’s debt burden has surpassed our country’s annual Gross Domestic Product (GDP). To address this concern, we are writing about the same topic we discussed in February 2019.

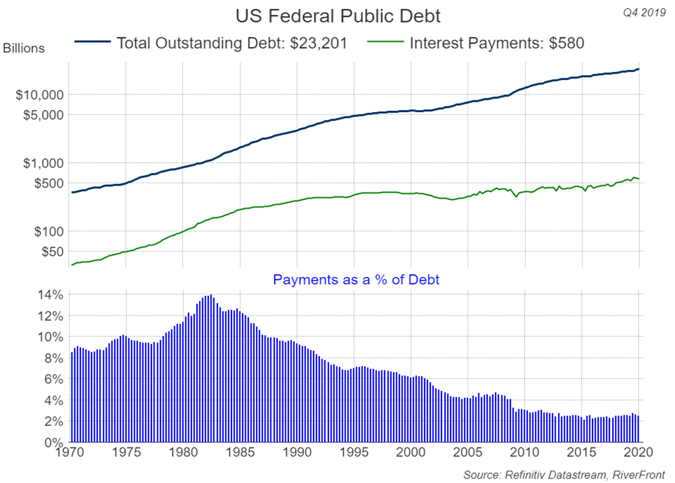

Federal debt was over $23 trillion at the end of 2019 (top-line, chart below) and estimated to have grown to nearly $25 trillion YTD.

Disclosures: Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

However, due to low interest rates, the payment percentage (see chart above) has also declined making the larger debt-burden more manageable, in our view.

As scary as the increase in federal debt appears, we are less concerned for two reasons. First, in our opinion, there are several mitigating factors that make the debt-load less precarious than what is reported in the headlines. Second, we believe the ‘warning lights’ that would typically flash before a debt crisis remain unlit.

MITIGATING FACTORS TO THE ESTIMATED $25 TRILLION IN DEBT

- Payment-Burden Less Onerous: While Federal debt has grown consistently over the last 50 years, the payments as a percentage of debt have remained low given the record low interest-rate environment. So long as interest rates stay low, the growing Federal debt should remain manageable, in our view.

- Intergovernmental Debts: According to Treasury Direct through April 2020 roughly $5.9 trillion of the $25 trillion debt is intergovernmental debt. Intergovernmental debt is the debt that the government owes to itself. For this reason, some economists believe that ‘Federal Debt Held by the Public,’ which excludes intergovernmental debt, is the more important measure of the Federal government’s indebtedness. By this measure, the federal debt is about $19.1 trillion, which is about 90% of 2019 GDP. While $19.1 trillion is a big number, it is 24% smaller than $25 trillion and below the psychological threshold of exceeding 100% of GDP.

- Sterling Collateral: Although it would be highly unlikely, if the US was obligated to post collateral for its loans, we believe there are plenty of assets it could pledge. A few of the ‘priceless’ assets it controls include prime land (national parks) and buildings, a portfolio of patents, usage rights to digital spectrum, and natural resource rights for energy and minerals.

- Printing Press: Lastly and most importantly, the federal government has the ability to print its own currency, like it is doing now. In theory, no country with its debts denominated in its own currency should fail to make good on its debt obligations.

WARNING LIGHTS NOT FLASHING

The federal debt is a hotly debated topic and there are many additional concerns we have chosen not to address in this short publication. There are also a number of philosophical debates about intergovernmental debt and printing money that we don’t discuss in this piece, not because of the validity of these arguments but due to their timing. Ultimately, the only way we will truly know if our federal debt is a problem is if the market tells us it’s a problem; thus far these ‘warning lights’ are not flashing, in our view. When the following three warning lights begin to flash, we believe it will be time to worry about the federal debt:

- US Dollar Plunges: Countries that have debt problems will also generally experience currency weakness. Foreign investors place less value on a currency that they believe is not supported by cash flow, assets, or will be diluted by printed money. In the era of ‘fiat’ currencies (ones not backed by physical assets like gold), this concept of ‘money printing’ can feel reckless to some. However, deep financial and political issues in Europe and China suggest to us that the US dollar will remain the world’s preferred transaction currency for the foreseeable future. Today, not only is the dollar not weakening, it is near multi-year highs relative to a trade-weighted basket of other currencies.

When to Worry: Currency values move in cycles and the dollar is likely near the tail-end of a cyclical period of strength, in our opinion. Therefore, we would not be concerned about minor weaknesses in the dollar, in fact a little dollar weakness would be welcomed by US exporters and global investors. However, we would be concerned if the dollar began falling by more than 10% per year for several years.

- Inflation Spikes: Hyperinflation is another characteristic of economies experiencing a debt crisis. Stories of citizens using currency as wallpaper (Weimar Republic of Germany) or needing wheelbarrows of cash (Zimbabwe and Argentina) to purchase basic household items are common in such economies. Currently, inflation in the US has been declining as a result of COVID-19 and sits under 0.5% as of the end of April.

When to Worry: We believe significant levels of annual inflation of 10% or more would cause the ‘warning light’ to flash.

- Long-Term Interest Rates Jump: Investors that are worried about reckless spending or large debt burdens will demand higher interest rates on borrowed money to compensate them for the risk of not getting paid back. The interest rate on the 30-year US Treasury Bond is currently under 1.5% and is only about 70bps (bps = 1/100th of 1%) higher than the rate on the 10-year note.

When to Worry: The 30-year bond would need to rise significantly above current levels before we would start to get concerned.

IMPLICATIONS FOR THE ECONOMY AND MARKETS

The level and growth of the federal debt has irked investors for years. It has been a common refrain of market pessimists, and the passage of the $2.2 trillion stimulus bill and the additional stimulus programs that are being discussed may serve as another reason to keep investors sidelined. We believe this is a mistake. We don’t see a debt crisis on the horizon and for this reason remain comfortable with buying US equities and holding US debt.

However, we do expect large fiscal debt burdens to come with consequences. Since debt essentially involves ‘borrowing from the future,’ we anticipate that growing debt burdens perpetuate the ‘low and slow’ economic growth environment that has existed since the Financial Crisis. Over the last 12 years, we believe that ‘low and slow’ growth has widened the income divide among Americans, contributed to higher levels of equity volatility and caused many investors to remain under-invested in equities.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1188862