Despite this, the hedge component did well during this period in August. They started the correction slightly out-of-the-money, but the hedge did perform its intended role as the markets sold off. Moreover, in subsequent months the DRS was able to “claw back” some of its initial losses. This phenomenon is explored in the duration section.

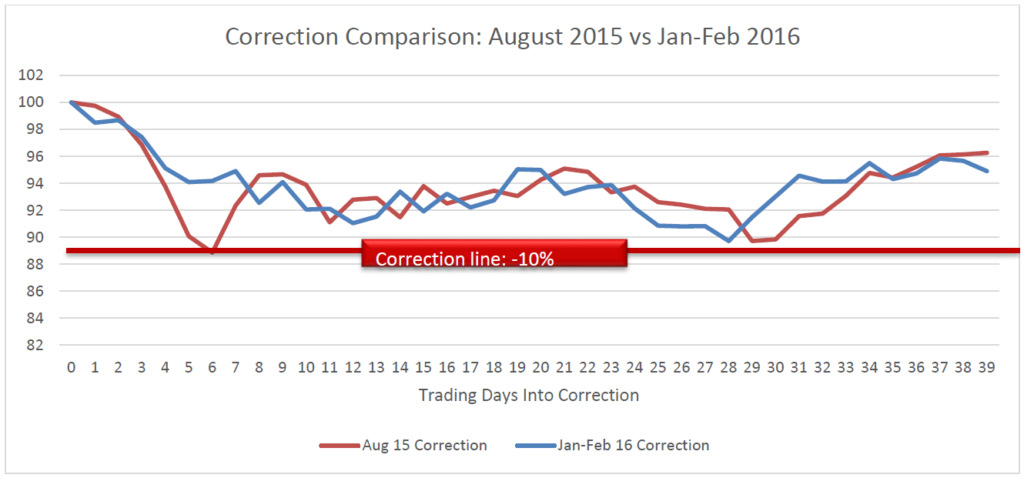

The chart below provides a visual comparison of the early 2016 correction to the August 2015 sell-off.

![]()

Managing Expectations during a Downturn

Many are on edge during market sell-offs and may sometimes have misguided expectations about their investments. Proper expectations are one of the most important elements of an investment strategy and plan because it helps investors keep their cool during heated market movements and help them avoid getting out too early.

Swan’s Defined Risk Strategy was designed so that elements of it could protect and potentially even profit during market downturns. If markets never sold off, there would be no reason to hold the Defined Risk Strategy (DRS).

At the beginning of a market sell off, the DRS will likely participate in more of the initial downward move. But this characteristic doesn’t necessarily apply to the performance of the DRS over an entire cycle. An investor might look at a week when the S&P 500 is down 5% and the DRS is down 4% and incorrectly assume that if the market goes down 50% that the DRS will lose 40%. The initial hit is usually the worst while follow up losses are less.

The DRS is constructed so that if the market does keep moving down, the DRS’s performance tends to level off. It catches less and less of a downturn the longer and further the market falls.

In a subsequent post, we discuss the second factor, the magnitude of the sell-off.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.