![]() By Grant Engelbart, CLS Investments

By Grant Engelbart, CLS Investments

Netflix is an impressing stock. Despite some recent turbulence, its returns make even its FANG (Facebook, Amazon, Netflix, and Google parent Alphabet) counterparts pale in comparison — a 10-year annualized return of 59% (that’s more than 10,000% cumulative)! All the FANG (or FAANG or FAAMNG) names have been remarkable for investors; although, it’s unlikely many have weathered the volatility. Each FANG stock has had a drawdown of more than 60% (except Facebook, which went public most recently and has only had a 40% drawdown so far), with three members experiencing peak-to-trough declines of 80% or more. But despite those large drawdowns, investors are attracted to the allure of picking a lottery stock or two and sailing off into the sunset.

Without the benefit of hindsight, how realistic is investing in a Netflix, say 10 years ago, and holding that stock until today? In investing, time is very much your friend. It’s often shown that over long periods, say 10 years or more, stocks are positive an overwhelming majority of the time, which is true and great! But that analysis is typically based on broadly diversified index returns. Choosing a less diversified group of individual stocks can become more challenging than many think, even with time on the side of investors.

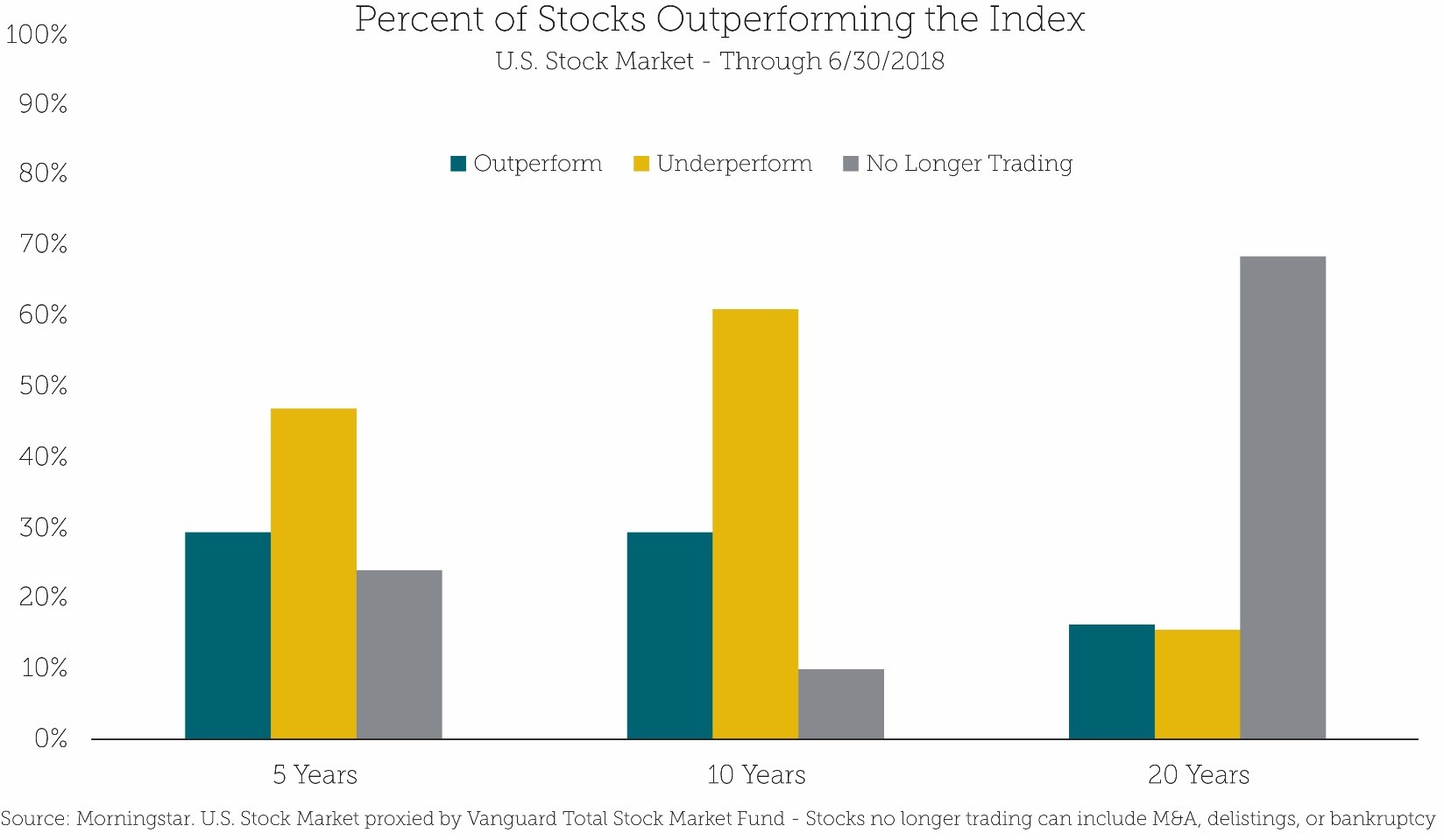

The chart below shows the percentage of stocks that outperformed the broad index, underperformed, or are no longer trading over the time frames shown below. Stocks could no longer be trading for a variety of reasons — merger or acquisition (likely good for investors), index delisting, or bankruptcy (likely bad for investors).

Over the last five years, less than 30% of all stocks available five years ago have outperformed the index as of June 30, 2018. That means 47% have underperformed and an amazing 24% are no longer trading. The shrinking number of U.S.-listed stocks seems to be shrinking faster. Over the last 10 years, the number of underperformers jumped to more than 60%. Back two decades, the number of stocks no longer trading really jumps out, and the percentage that outperformed was a measly 15%.