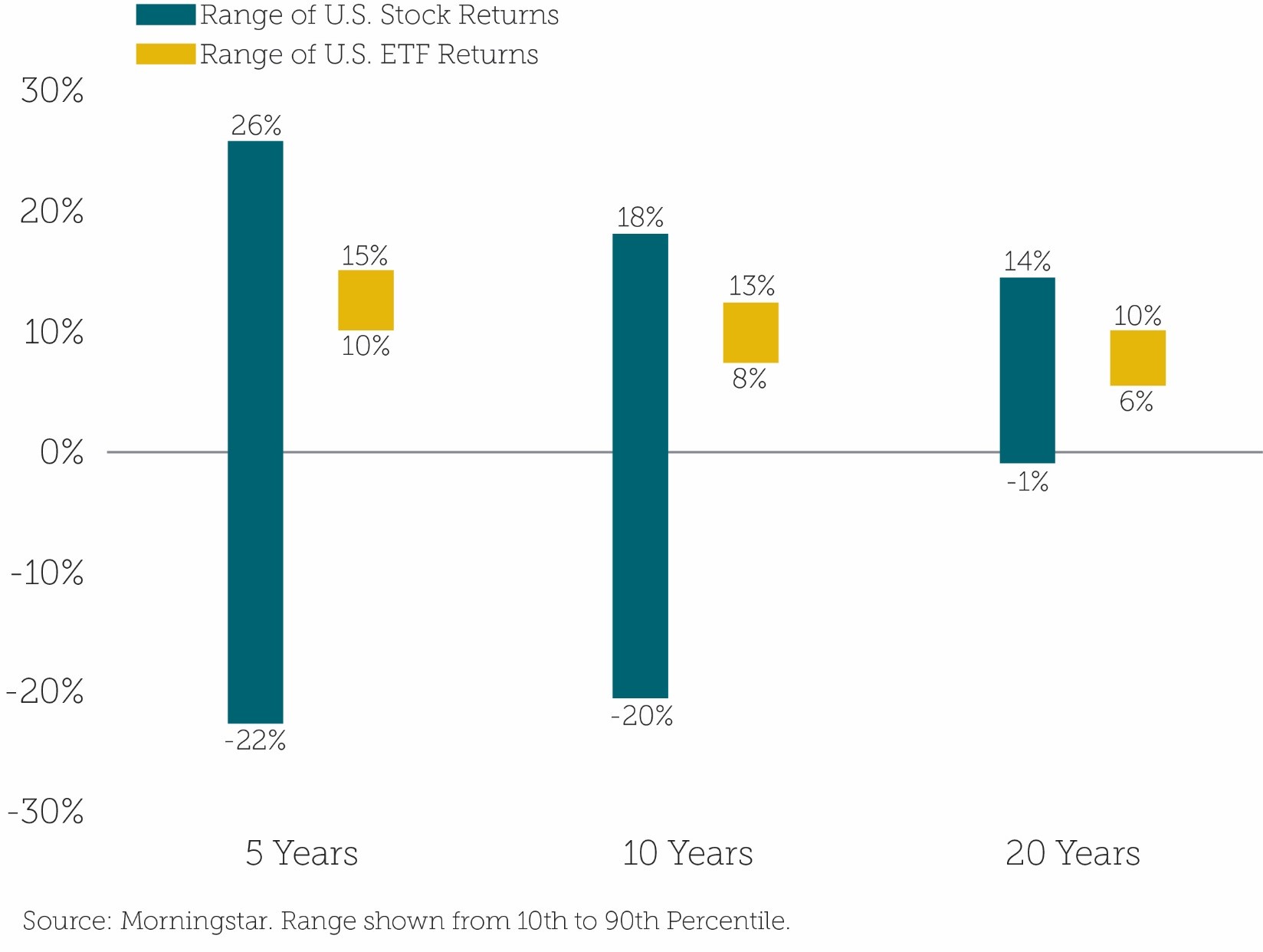

If we haven’t realized it yet, picking stocks is not an easy task. It’s especially tough to predict the big winners (less than 5% of stocks beat the index by more than 5% over 20 years). So, what is the remedy? Diversification, of course! Owning, say, a U.S. stock ETF increases your chances for outperformance — and, maybe better yet, reduces your chances for underperformance dramatically. As the chart below shows, the range of returns tightens and skews positive for ETFs versus individual stocks. For U.S. stocks, it’s also important to mention the chart shows only the range for surviving stock returns.

![]()

The ETF universe was dramatically smaller 20 years ago, but the idea of diversifying to reduce your risk of ruin still prevails. ETFs catch criticism for distorting prices, or for being a less-proper way to invest overall. Did I mention that despite the incredible returns, ETFs only own 6% of Netflix shares? Sophisticated investors need to accept that ETFs are here to stay and embrace their functionality and efficiency. Individual investors should realize that time is dramatically on their side, but picking stocks may prove to be a tougher road than they think. Deciding on what to watch on Netflix is a tough task, but it is nothing compared to picking stocks!

Grant Engelbart, CFA, CAIA, is a Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

Disclosure Information

The views expressed herein are exclusively those of CLS Investments, LLC, and are not meant as investment advice and are subject to change. No part of this report may be reproduced in any manner without the express written permission of CLS Investments, LLC. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed here and should understand that statements regarding fu¬ture prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance. Investing in any security involves certain systematic risks including, but not limited to, market risk, interest-rate risk, inflation risk, and event risk. These risks are in addition to any unsystematic risks associated with particular investment styles or strategies. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing. 1752-CLS-7/31/2018.