By RiverFront Investment Management

For most of us, August is the month when we are trying to make the most of what is left of summer. For students of the markets, however, that sense of fun-seeking is often replaced by an underlying sense of dread that the months of August, September and October are known for being volatile. If we stopped the clock today, August 2019 would likely be viewed as living up to its seasonal reputation. In a few days’ time, investors went from breathing a sigh of relief that the Federal Reserve had cut rates to holding their breath because of the rapid re-escalation of trade fears and slowing economic data. In these moments, following our investment processes and controlling the variables that we can control are most critical. It requires focusing on the known, while being aware of the unknown.

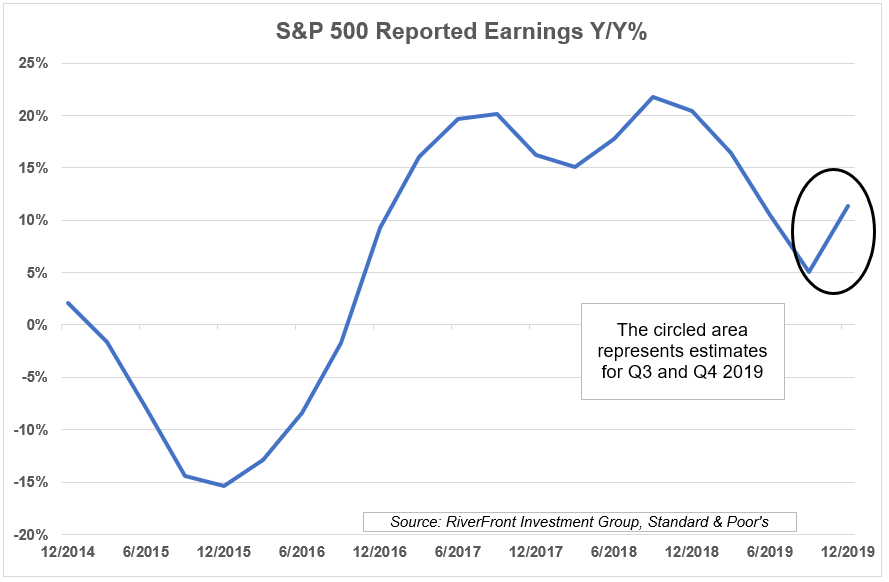

THE KNOWN: We know that 2019 earnings have deteriorated when compared to last year: Most companies in the S&P 500 have reported earnings for the second quarter. On average, the results have been better than the lowered expectations, which is how earnings season for the first quarter played out. Although earnings are slowing, there has not been an earnings recession since 2015-2016. We believe market valuations reflect this deceleration. The chart below shows the expected turnaround in reported earnings as we move through the remainder of the year with positive comparisons expected to resume in the third and fourth quarter.

Slower earnings growth is not optimal, but it isn’t a surprise, especially after the extraordinary earnings growth of 2019 that resulted from lower corporate taxes. Even against the backdrop of slowing earnings, market multiples have stayed consistent throughout the year at around 16-17x forward earnings, which suggests to us that investors are looking for the earnings reacceleration to be meaningful as we transition into 2020.

We know that the US economy is slowing: As discussed in previous Weekly Views, we are not forecasting a recession for the US. Instead, officials at the Federal Reserve have suggested that we are simply in a “new normal” range that will be defined by slower economic growth. In June, the Federal Reserve Bank of San Francisco published their Economic Letter in which economists noted that a range of 1 ½%-1 ¾% GDP growth is a reasonable expectation given demographic trends such as slower work force growth and slower productivity levels. Employment data, industrial production, personal income, and business sales are still in positive territory, which keeps us cautiously optimistic. While growth may be slower than we would like, it is still growth that is above that of most other developed countries. This is a contributing factor to our preference for US equities over international.

We know that sentiment affects portfolio positioning: The US consumer carries the bulk of the US economy and is responsible for two-thirds of GDP. Importantly, two indicators that are used to gauge the consumer are still strong – consumer confidence and retail sales. In last month’s consumer sentiment report from the University of Michigan, it was noted that consumers were resilient, economic confidence has been stable since the beginning of 2017, and there is a renewed sense of personal financial optimism. The preliminary data for July will be published on August 16th and will be closely monitored to determine if escalating trade tensions are beginning to meaningfully impact consumer confidence.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

US business sentiment is also on our radar as we watch for signs of deterioration in hiring plans, capex spending, and sales forecasts. Recent data revealed that business leaders view both current economic conditions as well as the economic outlook as moderately pessimistic. The NFIB Small Business Optimism Index fell in June to 103.3 from 105 in May with capital spending plans declining. Additionally, it was noted that uncertainly levels were as high as they have been since March 2017.

Since consumer sentiment is strong, but business sentiment has deteriorated, we’re not adding additional equity risk to our portfolios at this time.

THE UNKNOWNS: We believe two significant unknown variables that could continue to create volatility in the global markets are the outcomes for the trade war between the US and China as well as a resolution to Brexit. The latest chapter in the US/China saga is that new tariffs are scheduled to go into effect on September 1. The negative impacts will reach further than just the economies of these two countries given the global economic integration that exists today. On the other front, it is looking more likely that Great Britain will leave the European Union without a deal by the October 31st deadline. This adds another level of growth uncertainly across Europe. Some economists already believe the UK economy is in a recession. As these events continue to create downward pressure on growth across developed international and emerging equity markets, our portfolios have lower relative exposures to these areas, and we favor US equities across all strategies.

KNOWING THE DIFFERENCE: We view the recent market volatility as a pullback within the context of an ongoing bull market in US stocks. Trade and Brexit headlines have affected markets on and off for the last 12 months. Until we see outcomes that we believe will have a direct impact on earnings, significant portfolio adjustments are not warranted, in our view. Currently, our tactical monitor readings remain positive for US equities, which we think are attractive relative to bonds. Furthermore, US bonds are attractive to global investors given their higher relative yields, which is why we recently shifted some cash to bonds in our shorter horizon portfolios.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

You cannot invest directly in an index

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The small business optimism index is compiled from a survey that is conducted each month by the National Federation of Independent Business (NFIB) of its members. The index is a composite of 10 seasonally adjusted components based on the following questions: plans to increase employment, plans to make capital outlays, plans to increase inventories, expect economy to improve, expect real sales higher, current inventory, current job openings, expected credit conditions, now a good time to expand, and earnings trend.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 925051