By Kostya Etus, CFA, Senior Portfolio Manager, CLS Investments

“Sorry, Vern. I guess a more experienced shopper could have gotten more for your seven cents.”

–Gordie, Stand by Me (1986)

At CLS, we have discussed the “race to zero” many times in our commentary as both ETFs and mutual funds compete for assets by lowering expenses. Ultimately, the end investor should benefit as lower cost is typically better in most aspects of life. Additionally, lower expense ratios have historically been associated with stronger returns when comparing various funds. But if we peel back a layer and take a more in-depth look at expense ratios versus investment returns, we find a couple surprising observations.

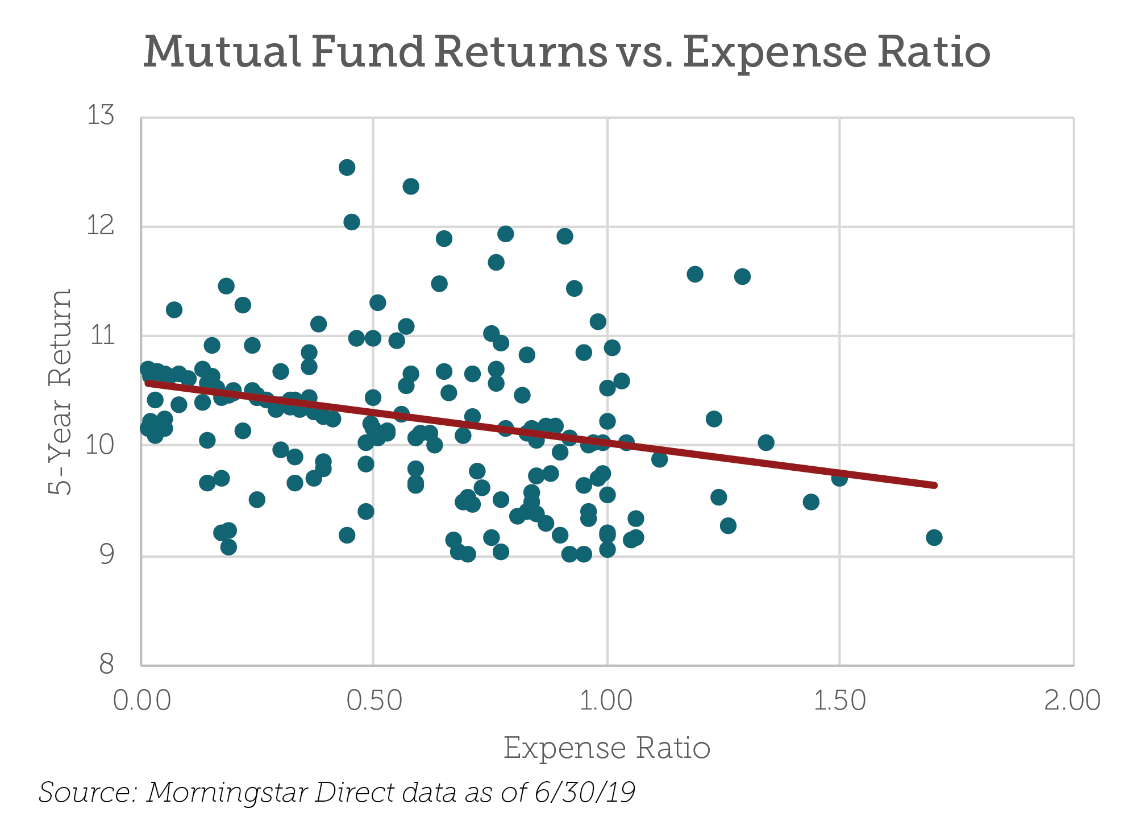

Mutual Fund Returns vs. Expense Ratios

The chart below plots five-year returns and expense ratios of mutual funds (oldest share class of each fund) within the Morningstar U.S. Large Blend Category (for example, funds that benchmark against the S&P 500) and only including the top half of performers to make the data cleaner.

As you can see, there is a negatively sloping relationship between returns and expenses, meaning that more expensive funds tend to underperform. This relationship has been thoroughly researched and should come as no surprise.

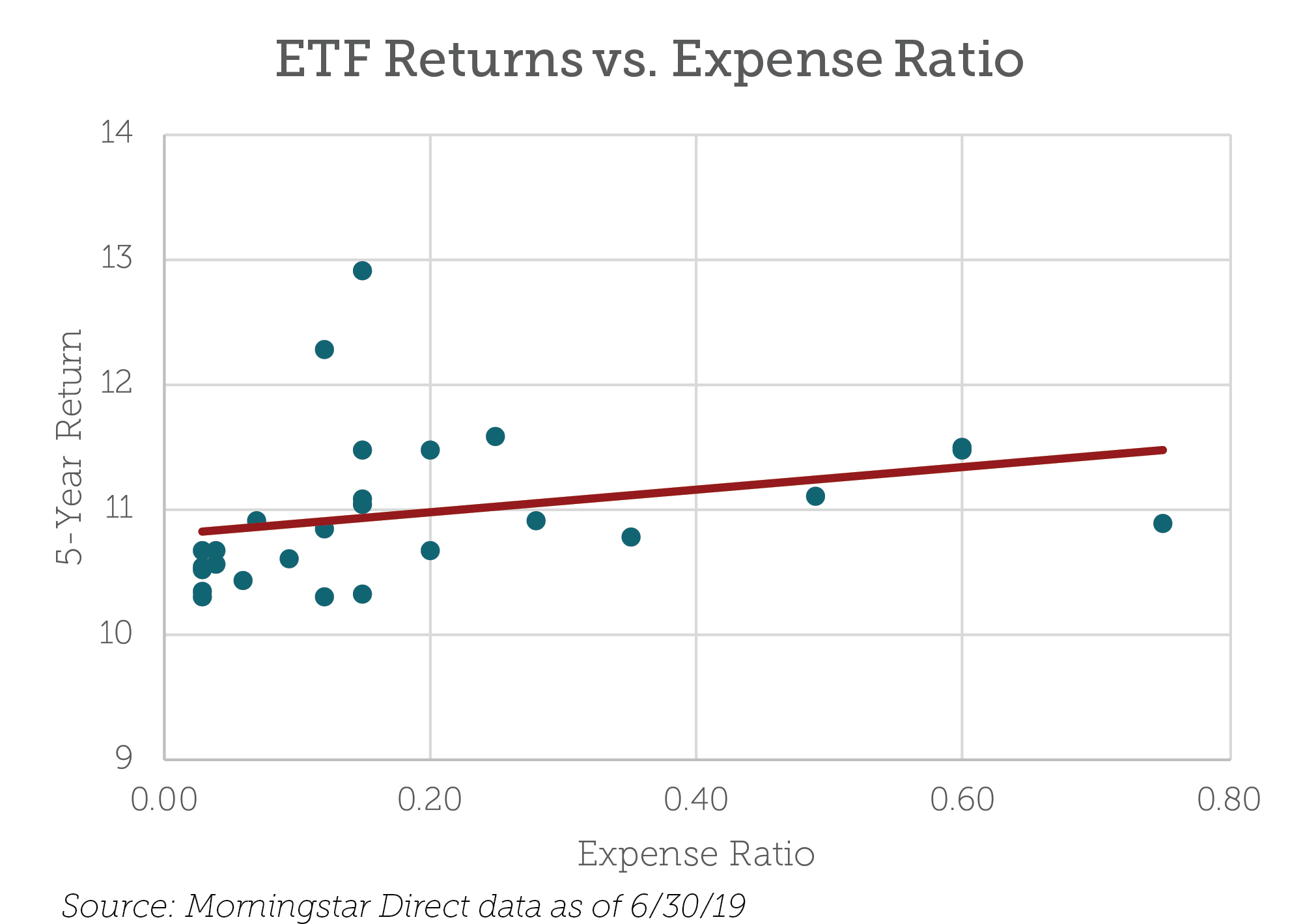

ETF Returns vs. Expense Ratios

The chart below plots the same data points as above, but for ETFs. First, the range of expenses is noticeably tighter for ETFs, topping out at only 0.75%. That means all of the ETFs would plot on less than half of the mutual fund range, highlighting just how much cheaper ETFs really are.

But more importantly, and surprisingly, it is an upward-sloping relationship, meaning that more expensive funds have generally outperformed. How can this be?

Related: The Various Flavors of Quality ETFs

The reason can be summed up in three simple words: rules-based approach. Most of the higher-expense ETFs are smart beta products, meaning they don’t track a traditional market-cap-weighted index. By tilting away from market-cap, these ETFs are able to capture alpha generated by other factors, such as minimum volatility or quality. But more expensive actively managed mutual funds also tilt toward these factors, so why don’t they generally outperform?

The key point is not the factors. It is that these smart beta ETFs still track an index and have to follow a consistent methodology. By maintaining a disciplined, rules-based, approach, they are able to avoid any behavioral biases in their investment methodologies, leading to outperformance.

Note that there are more complex asset classes, such as small-cap stocks, where active management certainly has an edge. But when dealing with simpler classes, such as large-caps, a rules-based passive approach may be just what the doctor ordered.

As the race to zero heats up, it is important to understand what you are buying and remember that cost may not be the best driver of your decision.

Kostya Etus, CFA, is a Senior Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing. 0947-CLS-7/31/2019