By RiverFront Investment Management

WE BELIEVE ABANDONING A STRATEGIC PLAN FOR EMOTIONAL REASONS IS USUALLY A MISTAKE

DIVERSIFICATION IS A CHOICE: You can choose to have all your investments in cash, a single stock, a single bond or a single asset class, such as US stocks. This is a perfectly legitimate strategic decision but doing so requires a high degree of confidence in the future potential of that choice. The more concentrated a portfolio, the more the inherent specific risk.

Choosing to diversify is, first and foremost, an exercise in humility – a recognition that the future is hard to predict. It is also an exercise in self-control. As soon as you buy multiple investments, one of them is going to be doing less well in a given time period. Thus, diversification can be frustrating. The inherent rationale for diversification is that the winner will not always be the same investment, and that balance will lead to a smoother (less volatile) journey.

In our opinion many strategies have merits but switching between these strategic choices for emotional reasons can lead to the unwanted effects of timing – buying near the peak or selling near the bottom.

WHEN DIVERSIFICATION BECOMES ‘DE-WORSIFICATION’. After a prolonged period of underperformance by one asset class it is appropriate to ask: “Has something fundamentally changed and what are my expected returns?” This should be a rational decision, but research by firms that monitor the investor behavior of people managing their own 401Ks shows it is often an emotional decision that results in lower returns.

Past performance is no guarantee of future results. Shown for illustrative purposes only. Not indicative of RiverFront portfolio performance.

Some recent examples of prolonged out/underperformance which have caused emotional frustration are listed below:

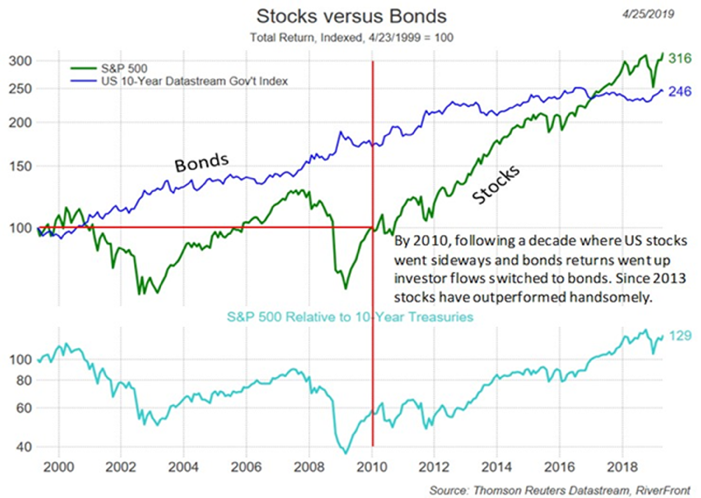

STOCKS vs BONDS

US stocks spent the decade from 2000 to 2010 going sideways with two major bear markets… a tough experience. During that time, US bonds produced steady returns. Perhaps as a result, since 2010, flows into US bond funds have been consistently greater than flows into US stocks and yet, as the chart on page 1 shows, stocks have had one of their best nine years on record relative to bonds. As we said, predicting the future is hard, looking backwards is easy, but not always helpful.

VALUE vs GROWTH

Around the world Growth stocks – according to Ned Davis, have significantly outperformed Value stocks since 2007. In the US this has been driven by the significant outperformance of the Technology sector. Value investors are probably ready to throw in the towel, despite the fact that value investing has actually had similar returns over the last 30 years in the US, with significantly big swings in relative performance to dampen volatility by owning both.

INTERNATIONAL vs DOMESTIC STOCKS

From 2008 to 2018, US stocks have significantly outperformed developed International stocks, but the outperformance is now at an extreme by historic standards. From 2000 to 2008, the opposite was the case. In our opinion, the chart below shows that since the inception of the MSCI Europe, Australasia, and Far East Index (EAFE), there have been 2 major 25-year regimes of out-performance and under-performance. There have also been several multiyear counter-trend moves. There is no sign that the current phase of under-performance is ending (which is why Riverfront is neutrally positioned), but since we see relative value and what looks to us like extreme under-performance, we think this is the wrong time to abandon diversification into EAFE in favor of US stocks.

Source: CRSP (LC Stocks = Deciles 1&2) & MSCI. Trend lines are approximate and shown for illustrative purposes only. Not indicative of RiverFront portfolio performance. Past performance is no guarantee of future results.

We sense a visceral frustration with international stocks since 2009, not because their returns have been poor in absolute terms but because US returns have been so far above average.

RIVERFRONT’S STRATEGIC APPROACH: Riverfront is a believer in diversification and in making asset allocation changes as prices and yields present opportunities. We seek to add value by making these adjustments based in part on our 5-10-year outlook for future returns (Price Matters®). We must admit that our Price Matters process, which is by definition a value discipline (it seeks to buy low and sell high), has meant that we have been under-exposed to US stocks since they returned to their long-term trend in 2015.

By contrast our “Yield Matters” philosophy suggests that the yield at the start of an investment period is the dominant determinant of returns over the subsequent 10 years.This belief led us to anticipate low absolute returns from bonds and as result, to maintain a consistent bias to stocks over the last 10 years. We submit that few of the investors we met in the aftermath of 2008 wanted an all stock portfolio, which speaks to the emotional challenges of extreme price volatility. We believe balanced portfolios have delivered on the hopes that clients had 10 years ago but, as is always the case in a diversified portfolio, have not kept pace with the best performing asset class, which has been US stocks.

IN CONCLUSION: Behavioral Finance, which seeks to understand the way human emotions affect decision making, demonstrates the tendency of recent performance (say the last 3 to 5 years) to unduly influence behavior. Investors tend to want to add to outperformers and reduce underperformers. This despite evidence that stocks tend to be mean reverting over these timeframes. We urge investors who are frustrated with diversification to look at the historical evidence of its benefits and costs, to be wary of giving up on it after extremes of relative performance, and to confirm that the merits of diversification (less asset class specific risk) remains important. If so, then it makes little sense to us to abandon it because it has delivered lower returns than the S&P 500.

BOTTOM LINE: As soon as you own more than one investment, there will be winners and losers over every timeframe. The purpose of diversification is to recognize that winners rotate and to seek lower portfolio return swings, and more consistent returns over market cycles.

Important Disclosure Information

Diversification does not ensure a profit or protect against a loss.

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the portfolios’ composite benchmarks.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Technology and Internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

It is not possible to invest directly in an index.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

US Benchmark 10-Year Datastream Gov’t Index: Benchmark indices are based on single bonds. The bond chosen for each series is the most representative bond available for the given maturity band at each point in time. Benchmarks are selected according to the accepted conventions within each market. Generally, the benchmark bond is the latest issue within the given maturity band; consideration is also given to yield, liquidity, issue size and coupon.

The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada.

CRSP Universe: Market Cap index information calculated based on data from CRSP 1925 US Indices Database ©2016 Center for Research in Security Prices (CRSP®), Booth School of Business, The University of Chicago. Used as a source for cap-based portfolio research appearing in publications, and by practitioners for benchmarking, the CRSP Cap-Based Portfolio Indices Product data tracks micro, small, mid- and large-cap stocks on monthly and quarterly frequencies. This product is used to track and analyze performance differentials between size-relative portfolios.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 589752