By Dave Haviland, Beaumont Capital Management

Remember this? It’s late in 2007 and the banks have already started their downward spiral. As their prices fell, their dividend yields rose. Most “high yielding,” “high dividend” or “dividend achiever” type ETFs/funds rebalance quarterly, so at year end, what did they do? They loaded up on bank stocks.

The bank stocks, as we now know, continued to fall and eventually cut or eliminated their dividends, forcing a sale from these types of ETFs/funds at or near the low—and the ETFs/funds suffered accordingly.

Many investors buy these funds expecting a relatively safe and stable yield. Do you own a fund or ETF that fits this description today? If so, caveat emptor! It’s important to understand how the dividend investment (ETF or mutual fund) selects the companies it invests in. A high dividend yield can indicate a company is having problems—just like in the 2007 example above.

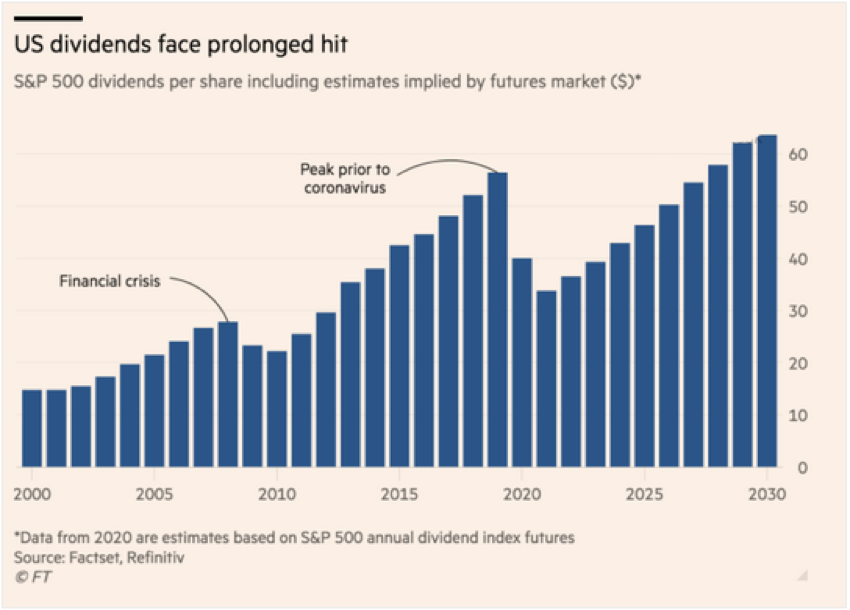

As the chart below shows, many companies are projected to or already have cut or eliminated their dividend. The “catch a falling knife” scenario is going to happen again, or perhaps it just did at the end of the first quarter. In fact, it could be even worse than 2007. Just a few months ago, many quality companies in industries such as hotels, travel, entertainment, restaurants, and manufacturing were great dividend payers. Did your dividend-oriented ETF/fund just load up on struggling companies that are being decimated by the Covid-19 fallout? You might want to find out!

Source: Financial Times, from 4/6/20

In today’s world of ultra-low to negative interest rates, many investors are turning to stock dividends to create portfolio income to live off of. If your objective is to buy high quality, high yielding companies and not simply buy companies with the highest yield outright—which often times are risky businesses—then make sure you understand exactly how your dividend ETFs are composed. The objective is to own companies that are growing their yield and/or have paid their dividend consistently for many years, not to buy companies with high yields due to falling price. Funds/ETFs with a robust set of quality screens can help to mitigate this risk. One such example is O’Shares FTSE U.S. Quality Dividend ETF (OUSA), which we have used ourselves to accomplish this goal.

One way to evaluate this is looking at the Beta of sample Dividend ETFs. For example, in the chart below you can see the broad-based increase in “Beta” for two of the largest AUM Dividend ETFs compared to O’Shares’ OUSA below. As the coronavirus crisis began to unfold in March, each ETF’s sensitivity to the market increased, but the constraints and screens used by OUSA to avoid concentration and lower quality companies has resulted in lower risk during a time of extreme market strain.

Source: Koyfin; Beaumont Capital Management (BCM). Data is for the period 12/19/2019 through 4/20/2020. See disclosures for more information on each ETF represented in the chart. Past performance is no guarantee of future results.

A version of the process used by OUSA was developed for Kevin O’Leary (Mr. Wonderful from Shark Tank) back when he sold his prior company and began managing his family trust. Stable, quality income was a major goal. OUSA is designed to invest in large and mid-capitalization, dividend-paying issuers in the United States that meet certain market capitalization, liquidity, high quality, low volatility and dividend-yield thresholds. The high quality and low volatility requirements are designed to reduce exposure to high-dividend equities which have simply experienced large price declines and may be at risk to pay their dividends consistently.

We have no monetary incentive in or for O’Shares other than investing in OUSA. Please do your own research, but this is another sleepy “gotcha” that is worth pointing out. Good luck!

This article was contributed by Dave Haviland, Portfolio Manager and Managing Partner at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.