Beaumont Capital Management (BCM)

Articles by Beaumont Capital Management (BCM)

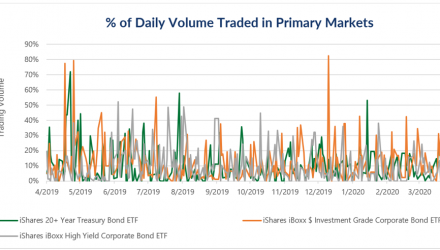

Investors Need Not Fear the Traditional Diversified Portfolio – A Historical Perspective

By Brendan Ryan, CFA Partner, Portfolio Manager For much of 2023, investors were leery of holding traditional risk assets given…

Brendan Ryan, CFAPartner, Portfolio Manager

As a Portfolio Manager for BCM, Brendan helps lead the firm’s investment activities with a focus on fundamental analysis. He contributes to ongoing market research, product enhancement and development, as well as thought leadership. Additionally, as a Partner of the firm, Brendan assists in overseeing all business, finance, and distribution activities of BCM.

He serves on the BCM investment committee and is additionally responsible for assisting with trading of the BCM strategies and operational support. He currently holds the Series 65 securities license and is a CFA® Charterholder.

Prior to joining BCM full-time, Brendan worked in Beaumont Financial Partners’ wealth management division, where he focused primarily on fundamental equity research. Prior to joining Beaumont, Brendan had spent time working for Brown Brothers Harriman & Co. after receiving his B.A. in Economics from Boston College.

Denis Rezendes, CFAPartner, Portfolio Manager

As a Portfolio Manager for BCM, Denis helps lead the firm’s investment activities with a focus on quantitative analysis. He contributes to ongoing market research, product enhancement and development, as well as thought leadership. Additionally, as a Partner of the firm, Denis assists in overseeing all business, partnership, and distribution activities of BCM.

He serves on the BCM investment committee and is additionally responsible for assisting with trading of the BCM strategies and operational support. He currently holds the Series 65 securities license and is a CFA® Charterholder.

Prior to joining Beaumont, Denis worked for River and Mercantile Solutions and Boston Trust and Investment Management Company. He is a graduate of Babson College with a B.S. in Business Administration, with a concentration in Finance.