By Roman Chuyan, CFA

- I show (again) that the stock market valuation is at its highest in at least 150 years.

- However, reason doesn’t apply in a bubble; instead, crowd mentality is in charge.

- What might trigger a turn in the market? I think inflation and rising rates are inevitable.

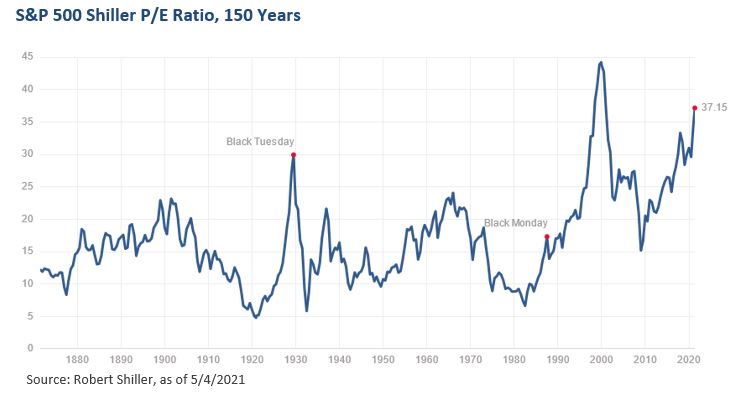

Stocks have continued to rise in April, taking the market to an even more-extreme valuation. While the S&P 500 reached an all-time high, corporate earnings haven’t rebounded from their early-2020 plunge, and in fact continued to decline through Q4-2020 (the latest final EPS available). These trends have brought valuation ratios to an extreme. In its 150-year history, Shiller’s cyclically adjusted P/E ratio, at 37, has been higher only in 1999-2000:

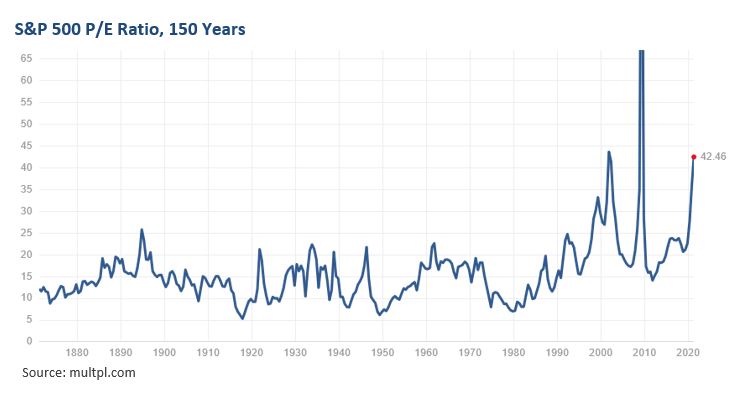

The “regular” P/E ratio is also extreme at 42. It exceeded this level only in 2001 and in 2008 when earnings plunged during recessions. So, it’s now at its highest non-recession level in at least 150 years:

As I wrote before, this is a bubble, plain and simple. Let’s keep in mind that reason doesn’t apply in a bubble. Presenting facts and analysis won’t change anything. Instead of rational decision-making, crowd dynamics is in charge – it will continue until it ends. But make no mistake, it will end as all bubbles do, in a crash. In today’s article, I speculate on what might trigger a turn in the market.

What might serve as a trigger? While it’s hard to predict – it could be almost anything – a few negative developments are already in the works:

- Rising inflation and interest rates: Both have begun to rise, and will likely continue – see below.

- Rising taxes: The plan to raise corporate tax from 21% to 28% hasn’t done any damage, but it still can when corporations and analysts project lower after-tax earnings. Personal income taxes will also rise, and possibly the capital gains tax.

- A geopolitical conflict: Tensions with Russia around Ukraine have escalated in recent weeks, and China appears to be emboldened regarding Taiwan and Hong Kong.

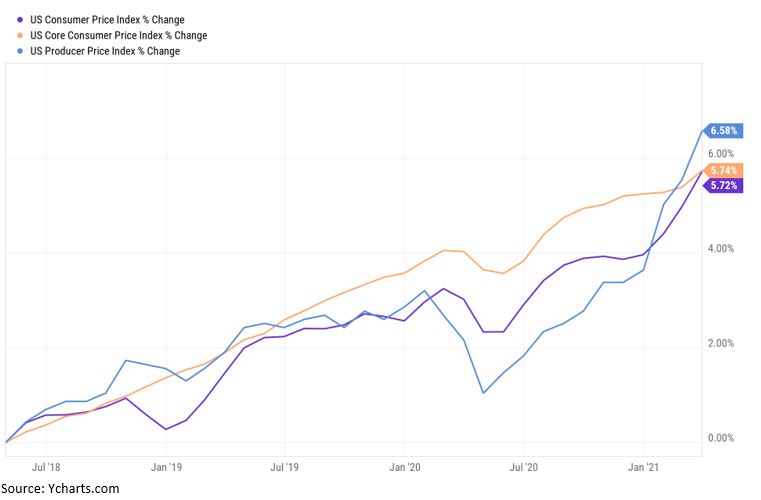

Among the three potential triggers, in my view inflation is the most inevitable. The rally in commodities in the past year pushed the producer price index (PPI) to 4.2%, its highest in 10 years. This began to filter into consumer (CPI) inflation, at 2.6%. You can see the progression, from commodities to PPI to core CPI, on this chart. Core CPI inflation (which excludes food and energy) is still low at 1.6%, but is likely to rise as economic growth and rising wages add to price pressure from high commodity prices.

Some of the rise in inflation rates (12-month rate of change) is due to the “base effect,” the drop in price indexes in early 2020. The base effect is temporary – it will go away by May-June. The chart below shows the price indexes over three years. You can see that inflation has accelerated in recent months, with PPI leading the way followed by CPI. This short-term acceleration means that inflation is rising beyond the base effect.

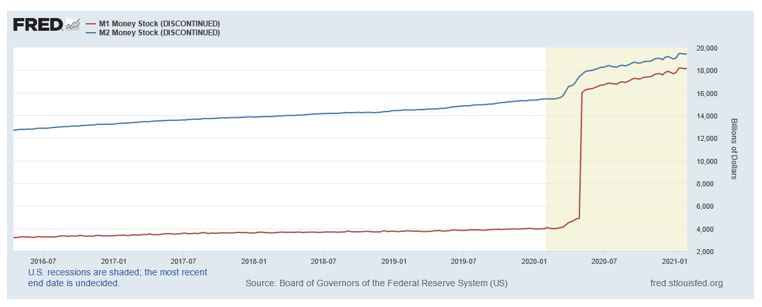

Inflation is rising due in large part to the Fed’s money-creation, which I wrote about in my recent commentaries. Someone noted to us the jump in money supply. Money supply measures jumped in May of 2020 coinciding with the stimulus at the time, and continued to rise this year. Specifically, the M1 measure (cash and checking accounts) inexplicably skyrocketed in that month to $16 trillion – a three-fold jump in the entire US money supply – and continued to rise to $18 trillion this year.

Such many-fold increase in money supply is unprecedented, and I can’t make sense of it yet. The St. Louis Fed’s economists attempt to explain it by a change in banking regulations. The data appears to be discontinued in February, adding to the mystery.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, SMArtX, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Source for the S&P 500 actual returns: S&P Dow Jones.

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.