By Riverfront Investment Group

INTERVIEW WITH GLOBAL EQUITY CIO ADAM GROSSMAN

An annual tradition in Riverfront’s yearly Outlook is to publish wide-ranging and candid interviews with our key portfolio decision makers, and 2020 was no exception. Today, we are featuring the transcript of an interview recently conducted with Global Equity CIO Adam Grossman for the Outlook about what to expect in equity markets in the coming year. Chief Investment Strategist Chris Konstantinos is playing moderator here (and is frankly relieved to be asking these hard questions instead of having to answer them).

Q: Right now, the stock market is at all-time highs, but the bond market is also close to highs…this seems like stock and bond investors have opposite ideas about the future. Are these two views mutually exclusive and how do you see them resolving?

We don’t think they are mutually exclusive. The compensation a stock holder receives for taking on the extra short-term volatility of the stock market (known as the ‘equity risk premium’) played a role in 2019. Additionally, lower interest rates make stocks more attractive compared to bonds.

In the second half of 2018 as the Fed raised interest rates, the stock market fell as investors started to worry about recession. 2019 was a reversal of those fears as the slowdown investors were fearing materialized, forcing the Fed to lower interest rates three times. Lower short-term interest rates also brought longer term bond yields down, allowing both markets to do well in tandem. In addition, lower bond yields sent lower-volatility, higher dividend yielding “stocks that look like bonds” to a premium, alongside Growth stocks that have demonstrated an ability to grow in a low economic growth environment. In contrast, two common characteristics – Value and smaller size (both implicit proxies for optimism), were driven to multi-decade relative lows.

Looking out 3-5 years, we are factoring in a higher probability of a recession. We think this will be preceded by a pick-up in global growth, a return to rising interest rates, and outperformance of Value and small-caps relative to defensive equities.

Q: We are now in the longest single economic expansion in US history, and a decade into one of the most powerful equity bull markets. How do you justify further gains in the equity market from today’s starting point?

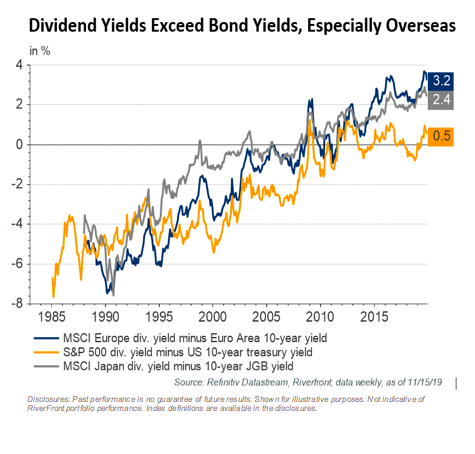

Stock returns are ultimately a function of two things: earnings growth and the valuation ‘multiple’ of those earnings that investors are willing to pay. Our view is that earnings are driven by economic momentum and corporate sentiment while multiples are driven by investor sentiment and the relative attractiveness of lower risk alternatives like bonds. In terms of sentiment, the lack of attractive yielding alternatives in the bond world, as can be seen in the chart (below), means that stock multiples may stay elevated for longer than would typically be expected – a benefit to the longevity of this bull market.

For certain sectors and themes, both earnings growth and/or further multiple expansion are possible in this cycle. But if and how this plays out differs depending on the sector – some areas are better set up for both multiple expansion and earnings growth than others, in our opinion.

For instance, cyclical US stocks and international stocks -both of which have been broadly left behind in the massive US Growth-stock rally of the past decade would benefit in many ways from broad economic expansion. For example, outside the US a combination of reforms, less trade friction, and accommodative fiscal and monetary policy that causes a bottoming of international economies could create a virtuous cycle of both sustained earnings recovery and improved sentiment over the next year or two.

There is also a subset of ‘stable growth’ companies that can continue to exhibit outsized revenue and earnings growth. These are increasingly found in areas such as technology, certain subsectors of healthcare, logistics, and defense. However, we believe further multiple expansion for traditional Growth and lower volatility stocks in general will be difficult going forward.

Given the maturity of both the global economy and market cycle, we will be monitoring and adjusting through the year for signs of a recession.

Q: Speaking of Value versus Growth…the long-term underperformance of Value versus Growth and the recent rally in Value assets has a lot of investors talking. Given your view that Value will shine at some point in 2020, how might you position portfolios?

Most measures of Value that we track are at multidecade lows relative to Growth. So, our strategy here is to slowly rotate from our Growth-oriented portfolio themes into Value-oriented themes as we see “green shoots” of price and economic momentum.

As we see momentum eventually return to the Value space, we are lucky to have a large pond to fish from, between US Value-oriented companies and most international stocks. We think it will pay off for investors to be patient with this theme and not to over-allocate too early.

We are attracted to the financial sector by the growing gap between short and long-term interest rates, which improve bank profit margins and stimulate lending activity. Like other cyclicals, we believe financials will benefit from a combination of fewer policy shocks and a bottoming of global economic data. Over the long-run, an improved economic backdrop could eventually bring long-term interest rates above zero across the world, which would also help earnings for the beleaguered financial sector.

Q: Technology has been a standout now for many years running…how do you think about the opportunities and risks in this space?

Let’s start with the opportunity…. US Technology has been a favorite sector of mine over the last few years. We are believers in the competitive advantage that a data monopoly gives some of the largest tech companies, and we see tremendous potential in cloud-based software companies. We believe that in an environment of low interest rates, the wind is at the backs of all US corporations, should sentiment improve, and a myriad of technology companies will be there with solutions to help those firms manage their growth, profiting alongside every partnership they make. From a risk standpoint, regulation of the largest tech companies appears to be creeping closer. A few years ago, fears of anti-trust or some other significant regulation seemed very far off. The events of the past few years on the political side have shined a spotlight on privacy issues and pushed government oversight to the forefront.

So, with two conflicting signals, our position continues to be that we will favor technology stocks as long as economic and price momentum remain aligned, as they are today.

Q: What are some of your highest conviction positions in the US side of the portfolio? Why?

In the Riverfront portfolios, we have been trying to focus on companies and industries that possess a combination of what we believe to be three very important characteristics for the current economic backdrop:

SECULAR TOP-LINE GROWTH: Not surprisingly, in a low GDP growth environment, investors seek out companies and industries that can demonstrate consistent revenue (top-line) growth.

EFFICIENT AND PRUDENT USE OF DEBT: One of the benefits of low interest rates is that debt costs are low. Well-run companies can use debt to grow earnings by reinvesting in their business or via stock repurchase. We favor companies that have the ability and willingness to do both.

ABILITY TO “GET PAID TO WAIT”: In a low-interest rate environment, investors often look to dividends as a way to replace the lack of returns available in bonds or at the bank. We believe companies that pay dividends out of steadily growing free cash flow will continue to be outperformers in a “low and slow” growth environment. Stable cash flow can often be found in businesses with established brands whose goods are less linked to broad economic trends.

We are increasingly finding these traits in areas such as US financials, software and services, certain healthcare niches, consumer-oriented logistics companies, defense contractors, and other companies who can consistently grow cash flow to redistribute back to shareholders in the form of growing dividends.

Q: What about on a regional basis? Which countries or international themes do you think have meaningful upside?

Japan, Germany, and broad Emerging Markets are the three areas we see as having the most meaningful potential upside. We think growth coming out of China would be the common catalyst, and Japan is already well positioned for a pickup in growth, in our view. Germany and Emerging are in more of “show me” state, where we think we need to see stronger evidence of a turn, but we think that if data does improve in 2020, the degree of undervaluation in these areas will reward investors that take the risk.

Q: How does your view on the US dollar factor into your portfolio positioning?

Our view is that the Dollar is at a secular high. We believe some recovery in non-US economic data could be the first catalyst in a multi-year retreat for the dollar. Tactically we are positioned against this view through our underweight in Europe.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions: You cannot invest directly in an index

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI Europe Index — measures the equity market performance of the developed markets in Europe. The MSCI Europe Index currently consists of 16 developed market country indices.

MSCI Japan Index — is a free float-adjusted market capitalization index that his designed to measure the equity market performance of the developed markets in Japan.

Bond yield is the return an investor realizes on a bond.

Dividend yield is the ratio of a company’s annual dividend compared to its share price.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 1037779