By Doug Sandler, Chris Konstantinos & Rod Smyth, RiverFront Investment Group

Reasons to remain invested in stocks

Two issues, trade policy and central bank policy, have caused most of the recent volatility in stocks, in our view. Both concerns are valid, as they represent changes from an established status quo, and both were discussed in our 2018 Outlook: Tug of War.

As laid out in last week’s Weekly View, our view on trade is that the goal of the administration is fairer trade, not tariff escalation…but the latter is a credible risk and the resultant uncertainty introduces risk. The effects of the gradual unwinding of global central bank balance sheet expansion, known as Quantitative Easing (QE), coupled with the Federal Reserve’s journey of interest rate increases is another unknown. We are likely to discover in the coming years how much long-term interest rates around the world have been held artificially low by these policies.

Countering these risks is a synchronized global business cycle expansion that has significant upward momentum. Therefore we believe it will take a significant policy mistake by central banks to bring the cycle to an end. We see this as unlikely. Our assessment of the Fed, the European Central Bank (ECB) and the Bank of Japan (BOJ) is that they are all still in “pro-growth” mode. The ECB and BOJ are trying to decide how long to maintain their aggressive pro-growth stance now that their economies are back on a growth trajectory. In the US, the debate is about whether the Fed should raise rates 3 or 4 times in 2018 in response to robust employment growth and government stimulus.

We believe the time to worry about a bear market in equities is when there is strong evidence of a potential recession and we simply don’t see it – points we’ve touched on in past Weekly Views. This week, we provide two more data series emblematic of a strong U.S. and global growth trajectory: employment and trade.

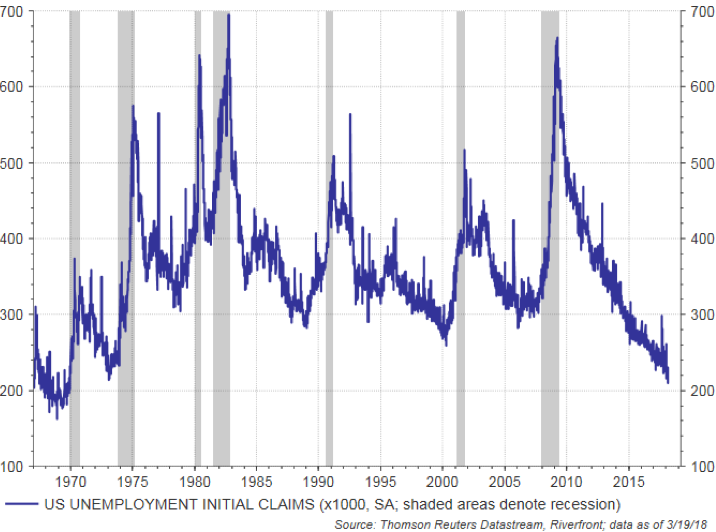

Positive Growth Indicators: Employment

Our favorite timely indicator of the employment situation in the US is the weekly “initial unemployment claims”. In early 2009, the peak was comparable to the early 1980s. The latest data is still making new lows (see chart, at right). The jobs market is showing no signs of deteriorating and yet wage growth is still contained. This is a good backdrop for stocks, in our opinion. Europe is several years behind the US, but unemployment rates across the Eurozone are falling, with little sign of inflation, also very benign.

![]()

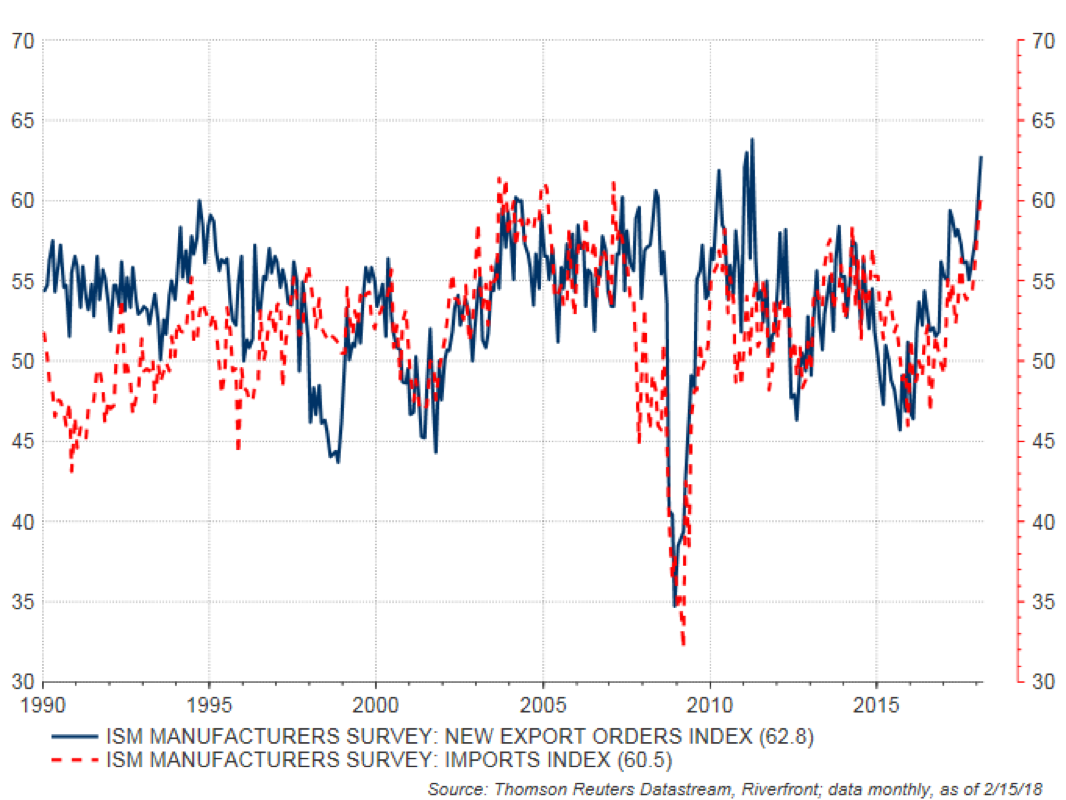

Positive Growth Indicators: Business confidence and global trade are booming

From the purchasing managers survey (conducted by the Institute of Supply Management) global trade appears to be booming. The survey is a sentiment indicator measuring whether the respondents feel things are getting better or worse. As you can see, the respondents are seeing higher rates of both exports and imports which suggests to us that demand in both the US and the rest of the world is accelerating (see chart, below).

Riverfront Positioning:

RiverFront remains biased towards stocks over bonds, due to solid global economic growth that’s translating into earnings growth worldwide, relatively easy monetary policy, and lack of valuation excesses. For these reasons, we continue to run an overweight position to stocks in all our balanced portfolios and are selectively adding equities during the current correction because our tactical models are suggesting the odds of positive returns are better than average.

Doug Sandler, CFA, is Global Strategist; Chris Konstantinos, CFA, is Chief Investment Strategist; and Rod Smyth is Director of Investments at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.