Last week, I discussed the consumer discretionary sector making a big comeback in 2023 despite the overall market focus on innovation-oriented sectors like technology and communications services. Part of that has to do with softer second-half retail outlooks already priced into analyst and investor expectations. But perhaps the larger part has to do with a long-term shift in consumer spending habits. The pandemic caused an imbalance in goods purchases relative to services purchases. That has somewhat normalized over the past few months. But the ratio of goods-to-services purchases remains above historical levels. That means there still could be room for more services growth, particularly as we see demand rise in areas like travel. This note looks at what areas of the travel sector are performing best and how to invest in the travel rebound through ETFs.

Cruise lines and passenger air segments are in the lead.

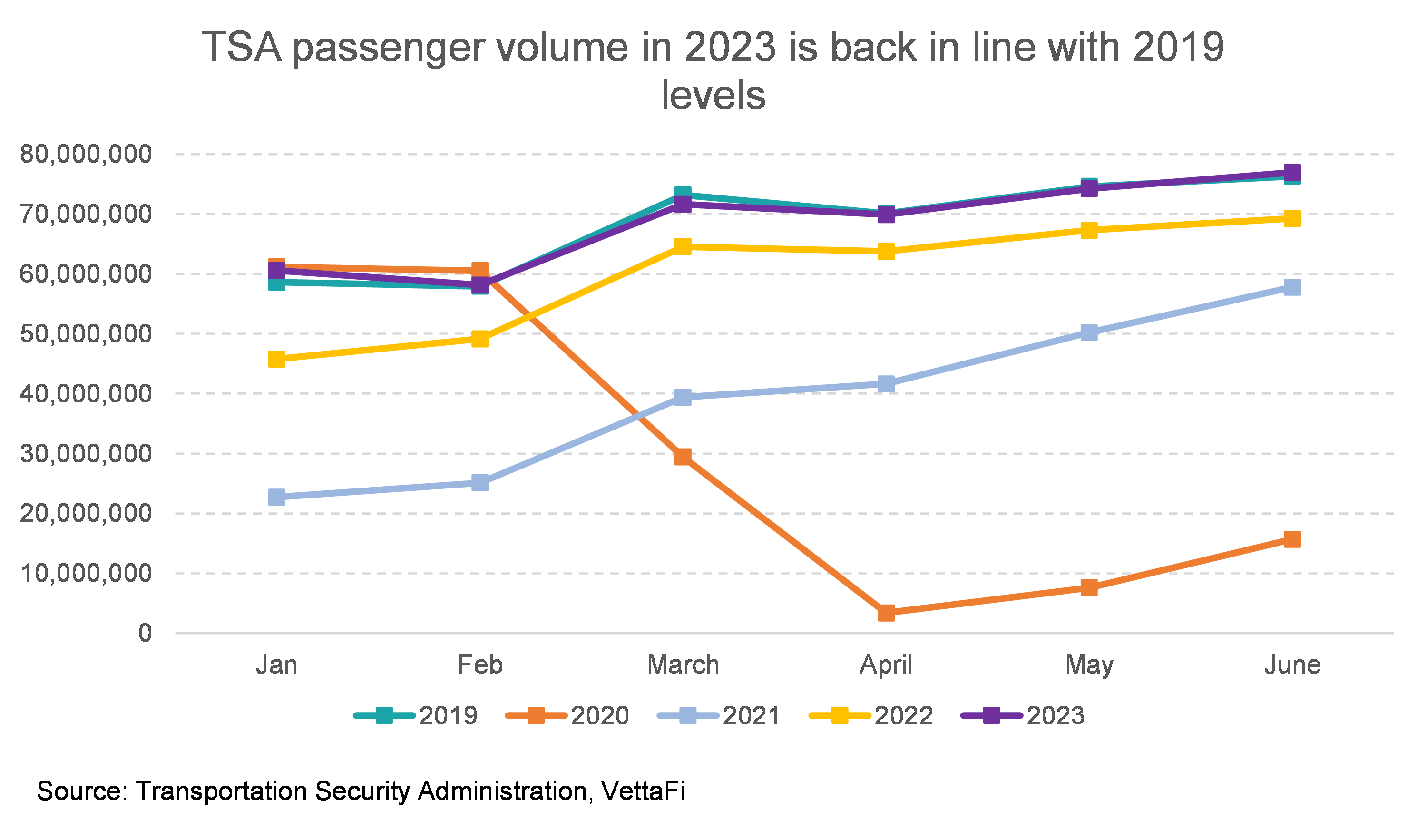

The best-performing stocks YTD in this segment have been cruise lines. Carnival Corp (CCL), Royal Caribbean Cruises (RCL), and Norwegian Cruise Line (NCLH) are up 119.7%, 99.8%, and 69.6%, respectively. These stocks were beaten down during the pandemic for several years and have just started to make a recovery although prices are still historically low. CCL, for example, is still down 65.2% from its price at the end of 2019. But the recovery in stock prices hasn’t just been a normalization from lows. Cruise lines have been reporting much higher demand. CCL recently reported bookings and customer deposits at all-time highs. Higher deposits have been driven by strong demand, bundled packages, and pre-cruise sales. The demand also extends to airlines. TSA passenger volumes are now back in line with 2019 levels. Delta Airlines (DAL) reported record revenue and earnings for 2Q23 citing strong travel demand including international flights and premium seats. Lower fuel expenses also contributed to the beat. The company predicts that strong demand will continue for years as consumer preferences continue to shift toward experience-based purchases.

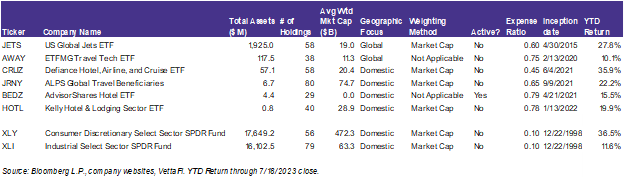

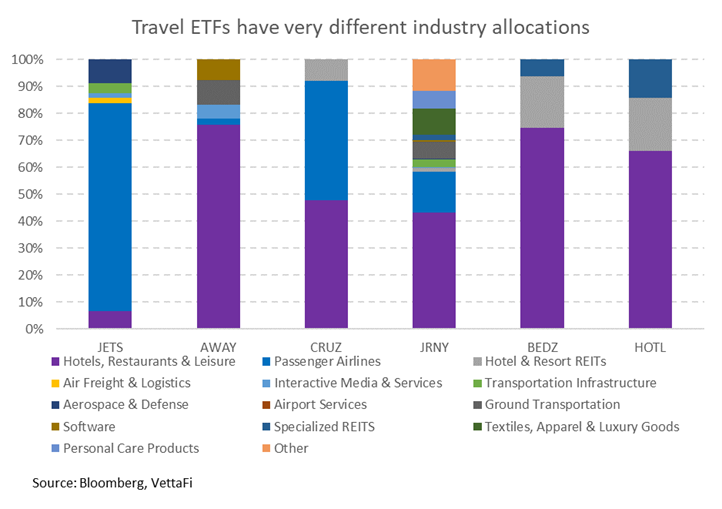

Travel ETFs have very different industry allocations.

Several travel ETFs range from broad-based travel ETFs, thematic ETFs, and airline or hotel segment ETFs. CRUZ is the broadest pure-play travel ETF and holds airlines, hotels, and cruise lines. Despite recent outperformance in cruise lines, CRUZ is the only travel ETF which holds these stocks (although you can also find them in broader consumer discretionary ETFs like XLY, for instance). While JRNY also holds hotels and airlines, it is a thematic play that also has an allocation toward travel beneficiaries like luxury goods and consumer finance. Some ETFs are targeted toward specific travel segments: JETS (which focuses on airlines), BEDZ and HOTL (which both focus on lodging), and AWAY (which focuses on travel technology).

Bottom Line:

The travel rebound continues to support the goods-to-services shift. Consumers are cutting back on buying physical items, but continue to spend on experiences like restaurants and travel. Investors may want to use ETFs to take advantage of the travel rebound. Additionally, the rebound is across broad travel segments. And it’s based on long-term shifts, rather than individual company performance.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for JRNY, for which it receives an index licensing fee. However, RNY is/are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of JRNY