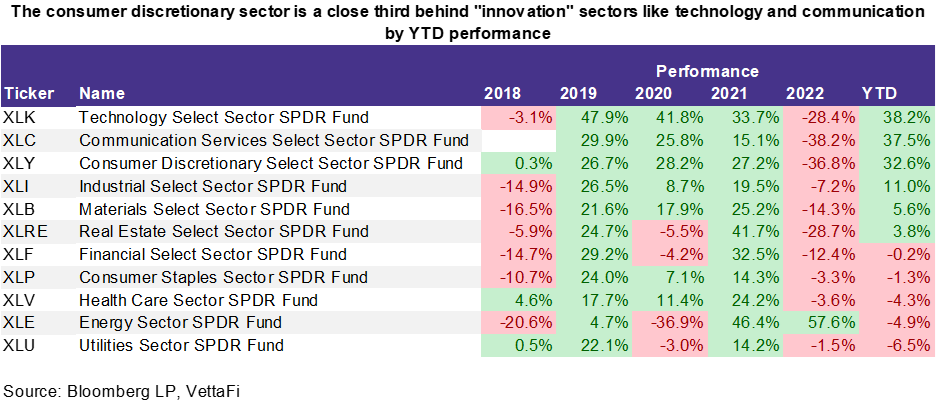

Consumer spending has softened over the past few months. And many companies that depend on consumer spending — particularly those in the apparel and accessories industry — are forecasting a continued softening in the consumer in the second half of 2023. Despite strong brand recognition, companies like Levi’s (LEVI) and Nike (NKE) are among the companies forecasting consumer-driven headwinds in their recent earnings calls. But out of the S&P 500 sectors, the consumer discretionary sector has remained surprisingly resilient and is performing almost as well as “innovation” sectors like technology and communication. What is driving the outperformance in the consumer discretionary sector? This note looks at trends in consumer discretionary beyond the popular apparel and accessories industry. And it examines how consumers are spending money.

Who are the top performers in the consumer discretionary sector?

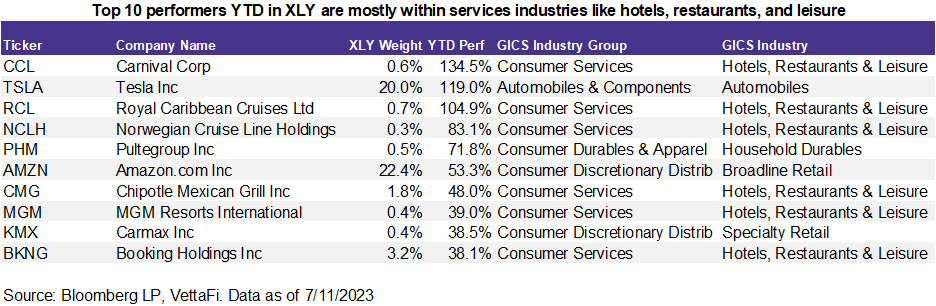

The consumer discretionary sector is diversified beyond much more than retail and apparel names. Much of its growth is driven by large-cap names like Amazon (AMZN) and Tesla (TSLA). Amazon has continued to grow in popularity. Consumers increasingly favor the speed and convenience of online shopping and fast shipping. Additionally, Amazon earns revenue from its cloud-based services and shares many characteristics with a fast-growing tech company. Tesla has also enjoyed growth as the market leader in battery electric vehicles. Even after losing market share, the company still has about 62% market share in the U.S. Service-based industries like hotels, restaurants, and leisure heavily drive growth in consumer discretionary. Consumers have shifted spending away from goods (like clothing, accessories, and furniture). Cruise lines are notably some of the highest performers due to a multi-year downturn in the pandemic.

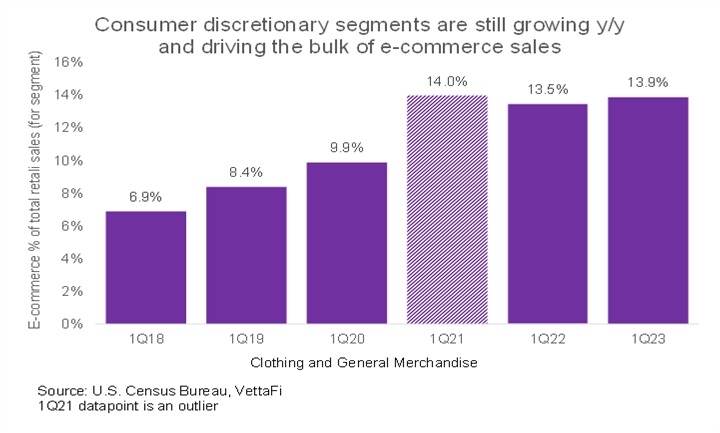

Trend 1: Consumers are shifting their buying preferences online.

Looking to save money, consumers are shopping online for deals and discounts. Many consumers also prefer the simplicity of ordering online. People are spending more time working at home and less time on the road. E-commerce has become less of an alternative to brick-and-mortar and more of a complement. Retailers that can diversify their operations with e-commerce may be better positioned over the next few months as they compete for a smaller share of consumer spending.

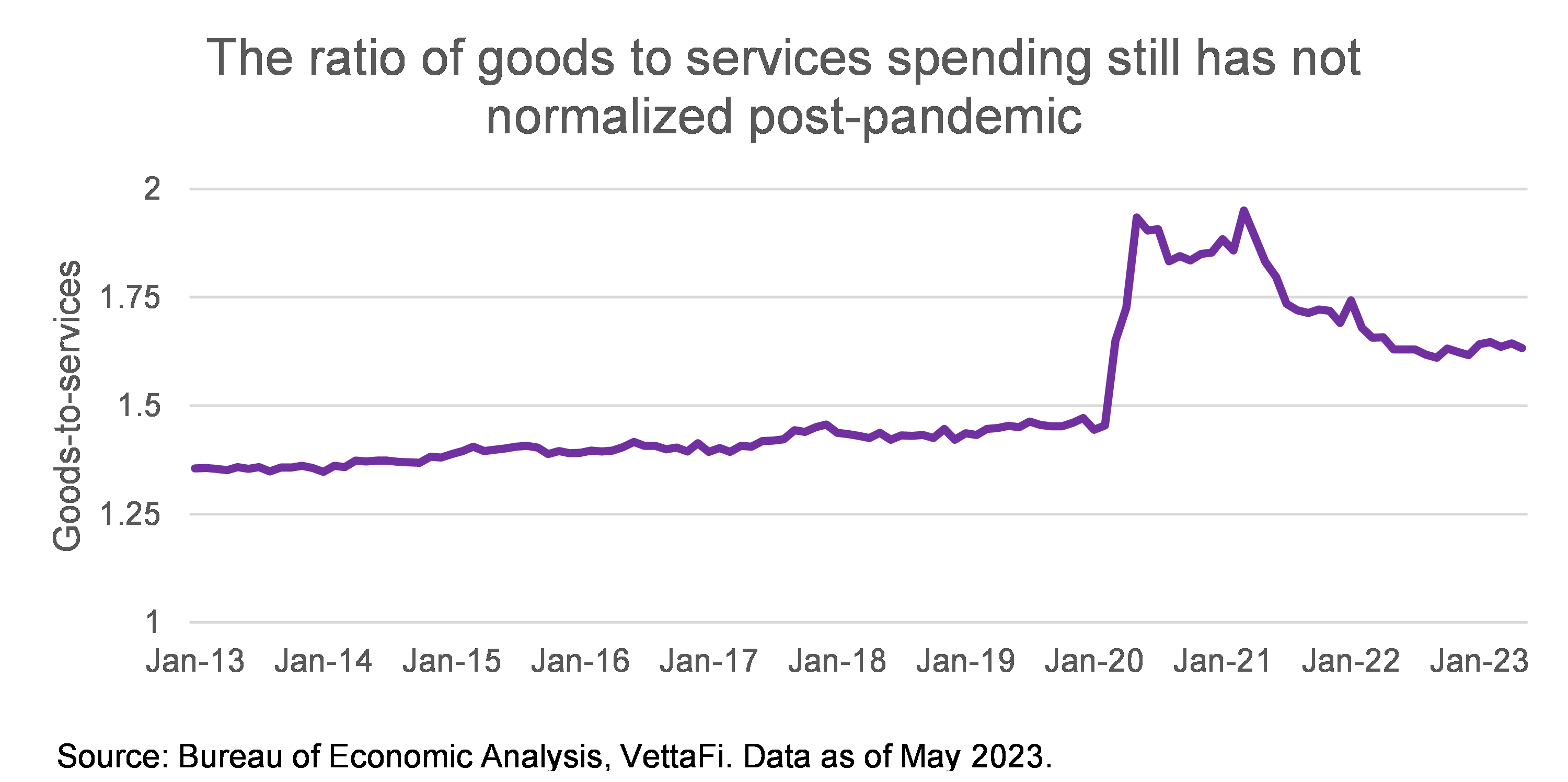

Trend 2: The shift to service industries continues and still has room to grow.

During the height of the pandemic, consumers ordered goods online at record levels. After only three years, consumers likely still have plenty of furniture, clothes, and other items in their homes. And given the state of the housing market, many people may still be renting or stuck in smaller homes they intended to upgrade. This means there isn’t much space for more goods. Consumers are more likely to spend their limited cash on services and entertainment like travel and restaurants. Restaurants are an area within consumer discretionary that could be particularly well-positioned. Food-away-from-home isn’t as expensive as it was compared to food-at-home, according to the U.S. Bureau of Labor Statistics. And while the shift away from goods back to services has been happening for months, consumers are still spending significantly more on goods. And that means there’s still some room for normalization back to more services spending. The data below shows the ratio of goods to services. It doesn’t include necessary services like housing, healthcare, and financial services.

Trend 3: Travel rebound boosts hotel, lodging, and cruise line industries.

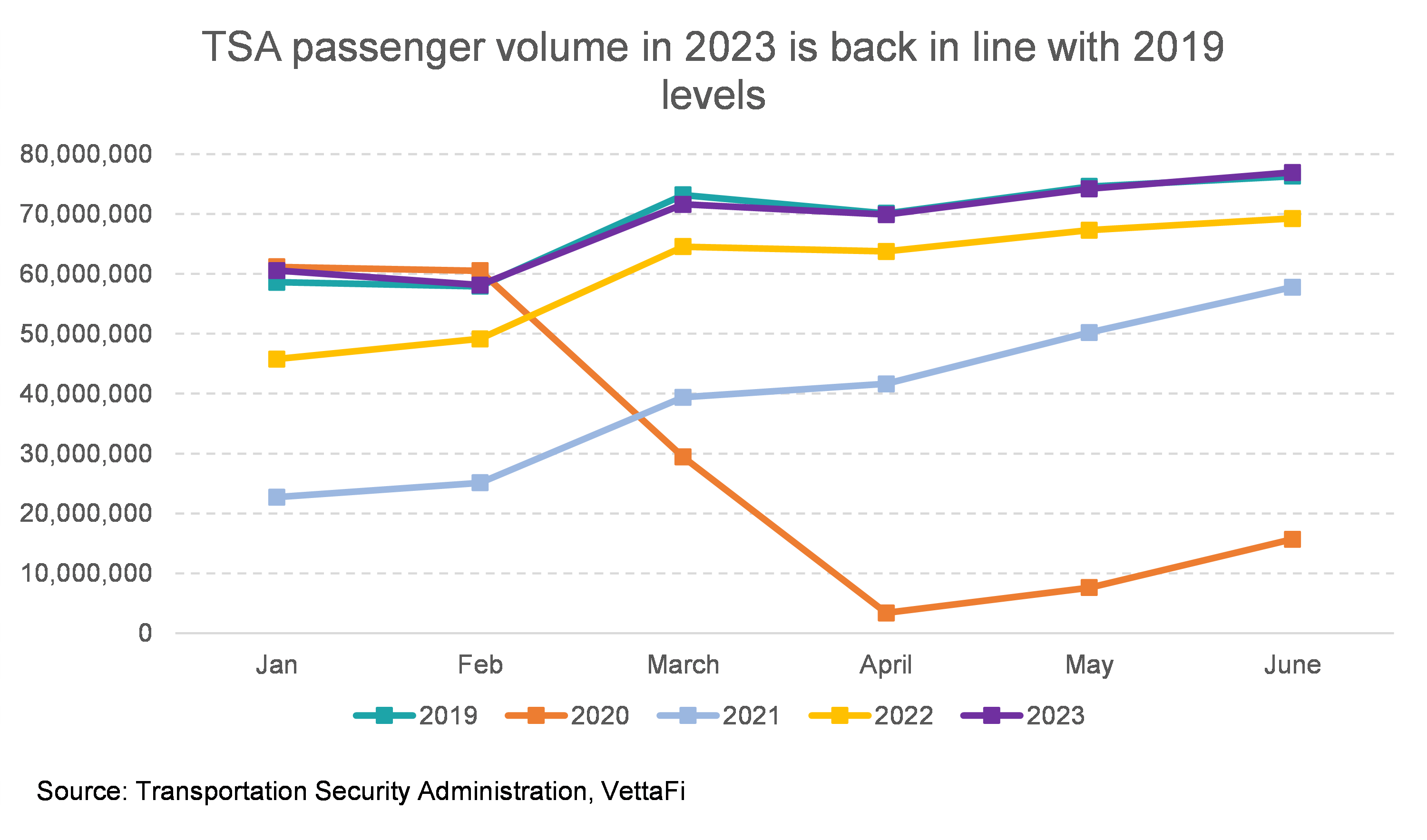

As part of the shift to the services sector, consumers are also spending more money on travel. TSA passenger throughput is now back to 2019 levels and significantly above 2021-2022 levels. While airlines are traditionally considered industrial stocks, other consumer discretionary travel stocks have also been benefitting from increased travel including hotels and cruise lines. Cruise lines have been some of the highest outperformers since they were among the hardest hit during the pandemic.

Bottom Line:

While consumer spending is softening, there is more to the consumer discretionary sector beyond clothing, accessories, and other goods. Consumers are shifting spending away from goods and into services like restaurants, hotels, and entertainment. And since these were among the hardest hit stocks during the pandemic, outperformance has been driving the consumer discretionary sector to levels similar to “innovation” sectors like technology and communications.

For more news, information, and analysis, visit the ETF Building Blocks Channel.