The ALPS International Sector Dividend Dogs ETF (IDOG) hit 10 years of operation last month. While dividends may not have the same luster that they had last year, they still have a role to play. For an international dividend ETF like IDOG, that means guiding investors towards foreign firms able to issue regular dividends. That means more than just adding current income. With IDOG hitting a key buy signal, it could be time to take a closer look.

The international dividend ETF currently offers a 4.84% annual dividend yield. That outperforms both its ETF Database category average and its FactSet segment average. Investors like current income as a source of ballast, but dividends can also be reinvested in other opportunities. Perhaps most importantly for IDOG, however, is dividends’ ability to guide investors towards healthier companies.

Firms that issue dividends tend to have better cash flow or stronger balance sheets. That allows them to return cash to investors as dividends, with stronger dividends then helping indicate which firms to watch. That helps domestically, but it may help even more when investing in markets where investors may have less information.

See more: “Travel Demand Returns, What ETF to Land On?“

IDOG looks to provide a high dividend yield from stocks with a balanced sector profile, excluding U.S. and Canadian stocks. The international dividend ETF looks to eliminate the “counter-cyclical” biases that tend to show up in other yield-weighted dividend strategies. That’s led the fund to hold foreign stocks like Dutch multinational Koninklijke Philips N.V. (PHG) in its top-weighted holdings. PHG offers a 4% annual dividend yield, with a solid forward P/e ratio, per YCharts.

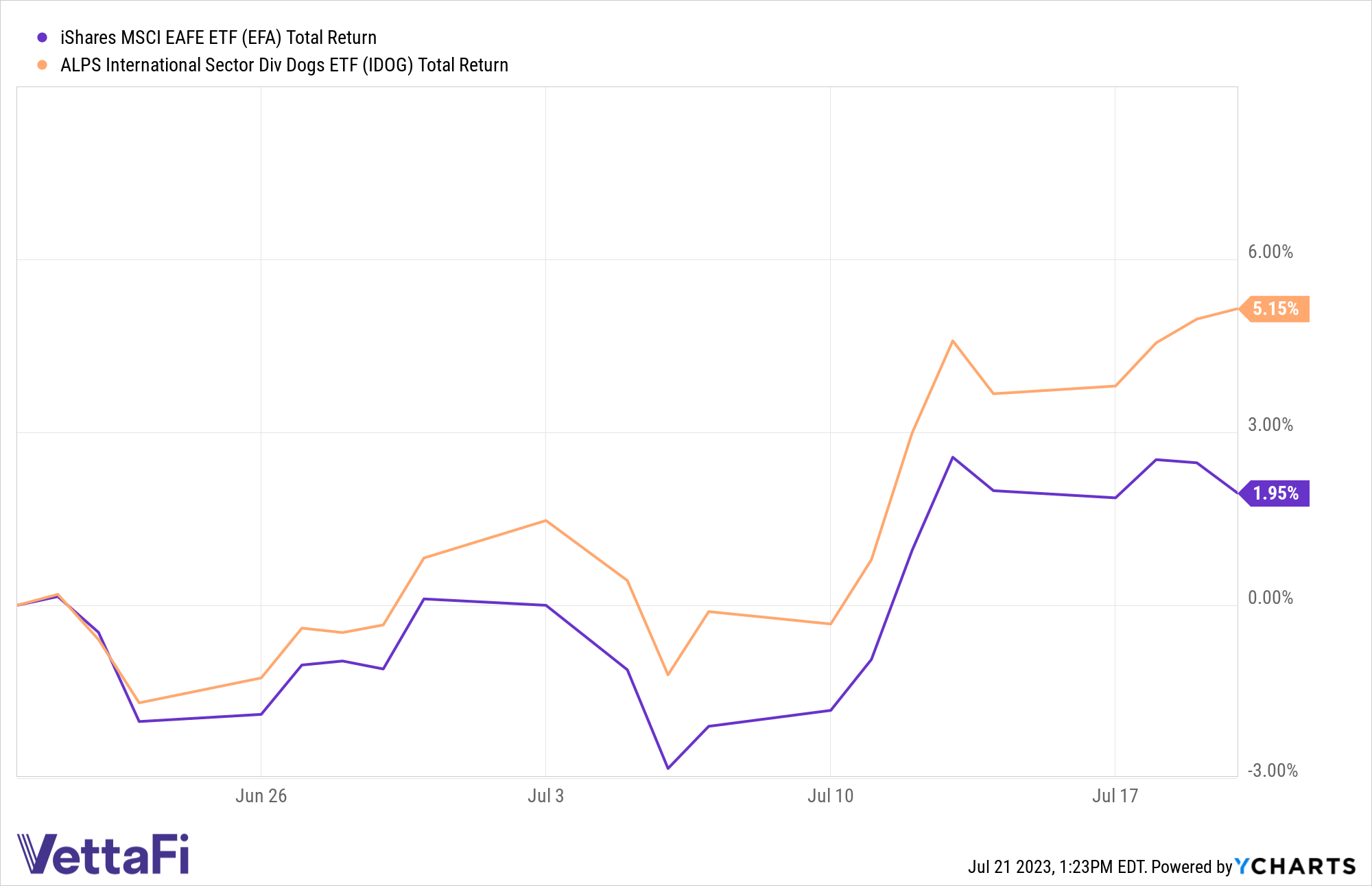

Based on its technical indicators, the strategy is sending a buy signal, as well. The ETF’s price rose above its 50-day simple moving average (SMA) earlier this month, suggesting momentum behind the strategy. IDOG has also returned 18.7% YTD, outperforming its averages over five-year, three-year, one-year, YTD, three-month, and-one month metrics. What’s more, IDOG has also outperformed the iShares MSCI EAFE ETF (EFA) over the last month.

International dividend ETF IDOG has outperformed rival foreign equities ETF EFA over one month.

U.S. equities are expensive right now, despite the positive feelings from a possible soft landing. Should the lagging impact of rate hikes start to hurt, it may be worth having some international equities that aren’t as tied to that phenomenon. For those investors looking to diversify away from the U.S., IDOG could be an option to consider.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for IDOG, for which it receives an index licensing fee. However, IDOG is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of IDOG.