Disruptive technologies are often thought of on a standalone basis, but their points of intersection may provide synergistic gains for investors.

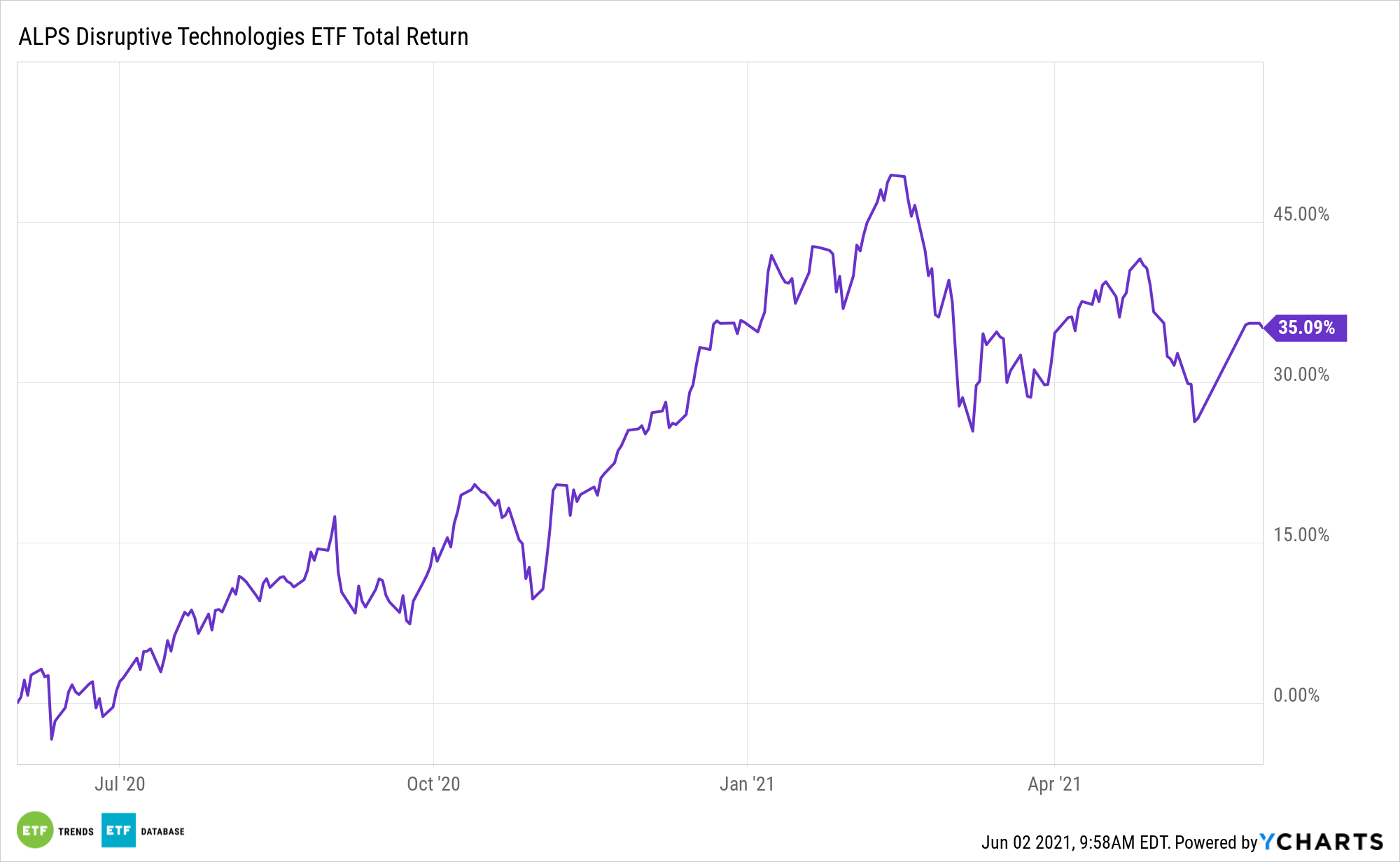

Owing to its depth and diversification, the ALPS Disruptive Technologies ETF (CBOE: DTEC) is an ideal avenue for tapping into not only emerging growth industries, but how these groups are linked to and dependent on one another.

Take the case of the recent cyber attack on the Colonial Pipeline. While that event highlighted the need for enhancing cybersecurity protocols and called attention to the long-term thesis for cybersecurity assets, it also shined a light on other industries’ dependence on robust cybersecurity measures.

Homing In on Healthcare

While not related to pipelines, healthcare is a prime example of a sector where multiple disruptive technologies converge – a theme DTEC offers leverage to. In many respects, the healthcare industry needs to shore up cybersecurity to better-safeguard patients’ data and personal information.

“Healthcare has not been spared, as shown by a flurry of breaches in the sector in recent months,” says Moody’s Investors Service. “In some instances, infiltration of hospitals and their computer networks are causing hospitals to direct care to alternative sites and slowing patient intake. The attacks put patients’ health at risk and will likely result in lost revenue, increased expenses and elevated reputational and regulatory scrutiny.”

Experts see cyber risk in the healthcare space as elevated because healthcare providers, particularly large hospital systems and big insurance providers, have access to significant amounts of sensitive personal data. That makes the industry extremely fertile territory for cyber criminals. Additionally, the boom in telemedicine, another theme represented in DTEC and one sped along by the COVID-19 pandemic, further underscores the need for healthcare providers to up their cybersecurity games.

“The growing interconnectedness of healthcare delivery and technology will continue to leave the sector vulnerable to breaches, as will its extensive use of third-party software vendors for clinical, billing and numerous other functions,” adds Moody’s.

For investors, it’s important to realize that many healthcare cyber attacks aren’t disclosed to the public. Yet as Moody’s notes, IT security firm VMware Carbon Black said there were a staggering 239.4 million attempted cyber breaches of its healthcare clients last year alone.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.