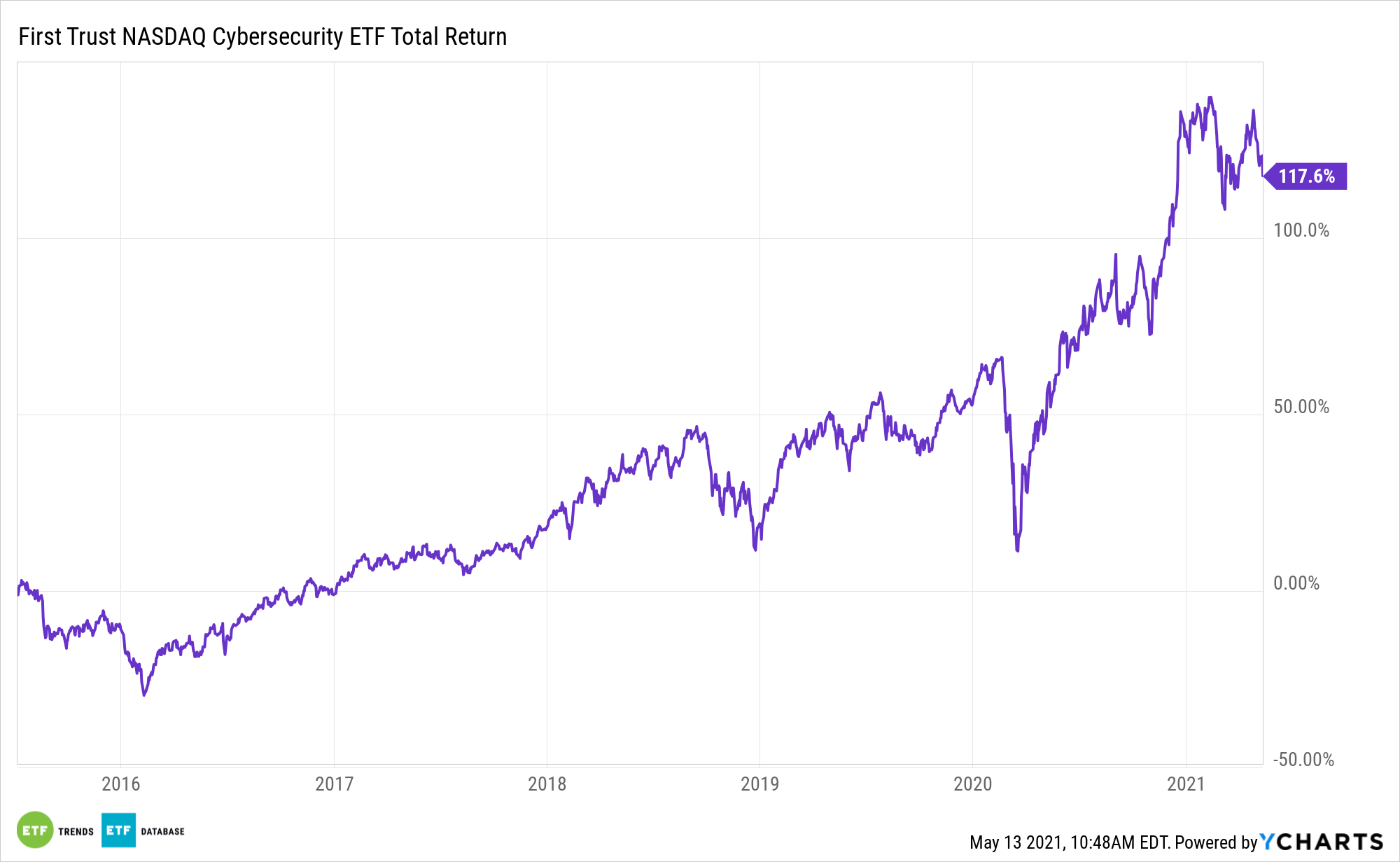

While technology stocks are badly bruised, the ransomware attack on Colonial Pipeline is renewing interest in cybersecurity equities, a theme that could benefit the First Trust NASDAQ Cybersecurity ETF (NYSEArca: CIBR).

As has been the case over the history of cybersecurity stocks and exchange traded funds evolving into credible portfolio pieces, large-scale hacks generate ample mainstream and financial media attention. That has a way of stoking investors’ interest in the asset, but there’s more to the story.

The “heightened threat environment, networking changes due to the coronavirus changing how security works, legislation ramping up fines for miscues, spending becoming proactive and commanding a larger portion of IT budget, and these headline grabbing breaches all help the demand,” says Morningstar analyst Mark Cash.

As for near-term implications, the Colonial Pipeline cyber attack proves the utility of cybersecurity equities. Over the week, CIBR is beating the S&P 500 Technology Index by more than 100 basis points.

A Good Time to Call on CIBR?

CIBR seeks investment results that generally correspond to the price and yield of an equity index known as the Nasdaq CTA Cybersecurity IndexSM, which is comprised of securities of companies classified as “cybersecurity” companies by the CTA.

Broadly speaking, many cybersecurity stocks, including some CIBR components, aren’t cheap even after recent declines. That’s usually the case across an array of disruptive tech segments. However, there are valuation bright spots with some well-known names in the group, including some CIBR holdings.

“While valuations on some cybersecurity stocks are hard to justify, Cash says, overall, the outlook is positive for the group. And some, such as Palo Alto Networks and Check Point Software Technologies are currently undervalued compared to his fair value estimates for the stocks,” according to Morningstar.

Check Point and Palo Alto Networks combine for 6% of CIBR’s roster. There are even reasons to be enthusiastic about Dow component Cisco Systems (NASDAQ:CSCO), long seen as a laggard among mature tech companies.

“The company is the dominant supplier of switches, routers, cybersecurity, and complementary networking products. We believe that Cisco–which earns about 6% of revenue from cybersecurity-related businesses–is uniquely positioned to interweave complimentary necessities, like networking and security, together to provide comprehensive solutions for clients,” adds Morningstar.

Cisco is CIBR’s largest holding at a weight of 6.90%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.