Dividends took the lead among investing themes towards the end of 2022, but megacap tech growth has stolen the show. Whether via spikes for names like Nvidia (NVDA) or simply by growth for the S&P 500, tech has overshadowed dividends. Still, dividends have powerful benefits outside of the admittedly potent mix of current income and stock exposure. Together they make the bull case for a high-dividend ETF like the ALPS Sector Dividend Dogs ETF (SDOG).

SDOG’s approach relies on investing according to the “Dogs of the Dow” theory. According to that strategy, the ETF invests in a portfolio that chooses the strongest dividend-yielding names from each of the Dow’s ten components. That’s helped SDOG offer a 4% annual dividend yield, outperforming both its ETF Database Category and FactSet Segment averages.

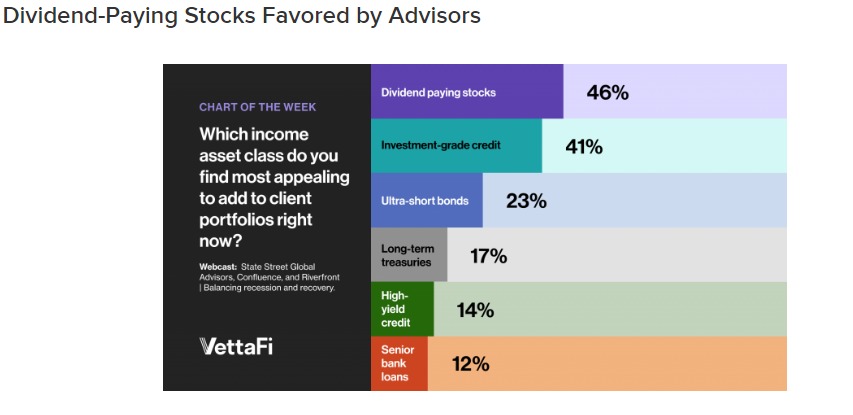

Dividend paying stocks have risen in popularity among advisors per a recent VettaFi webcast.

Those dividends, of course, are a powerful tool thanks to the current income they add to a portfolio. Not only that, dividends provide a helpful marker of firms’ health. At a time when any recession talk has focused on corporate profits, dividends can indicate which firms are better positioned. Dividends have also risen significantly in popularity among advisors.

See more: “Use Value Dividend ETF SDOG to Avoid Value Trap”

The True Bull Case for High Dividend ETFs

The true bull case for high dividend ETFs, though, may be in the potential reinvestment of those dividends. At a time when it does seem as though growthier investment opportunities have ruled the day, adding dry powder helps. That reinvestment process alone makes a great case for adding a high-dividend ETF allocation like SDOG.

SDOG charges a 36 basis point fee to track the S-Network Sector Dividend Dogs Index. Though it started the year with a rough performance patch, it’s still returned 1.6% over one year. SDOG’s 4% annual dividend yield comes with a $2.00 annual dividend rate, as well. With more than ten years under its belt, SDOG presents a seasoned route into dividends. So when looking at ETFs like the SPDR S&P 500 ETF Trust (SPY), remember the benefit of dividends to investors eyeing a big upswing.

For more news, information, and analysis, visit the ETF Building Blocks Channel.