While fixed income ETFs remain popular with advisors, we sense a shift in sentiment. Now that the Federal Reserve has paused raising interest rates, many advisors are also looking to alternative income strategies.

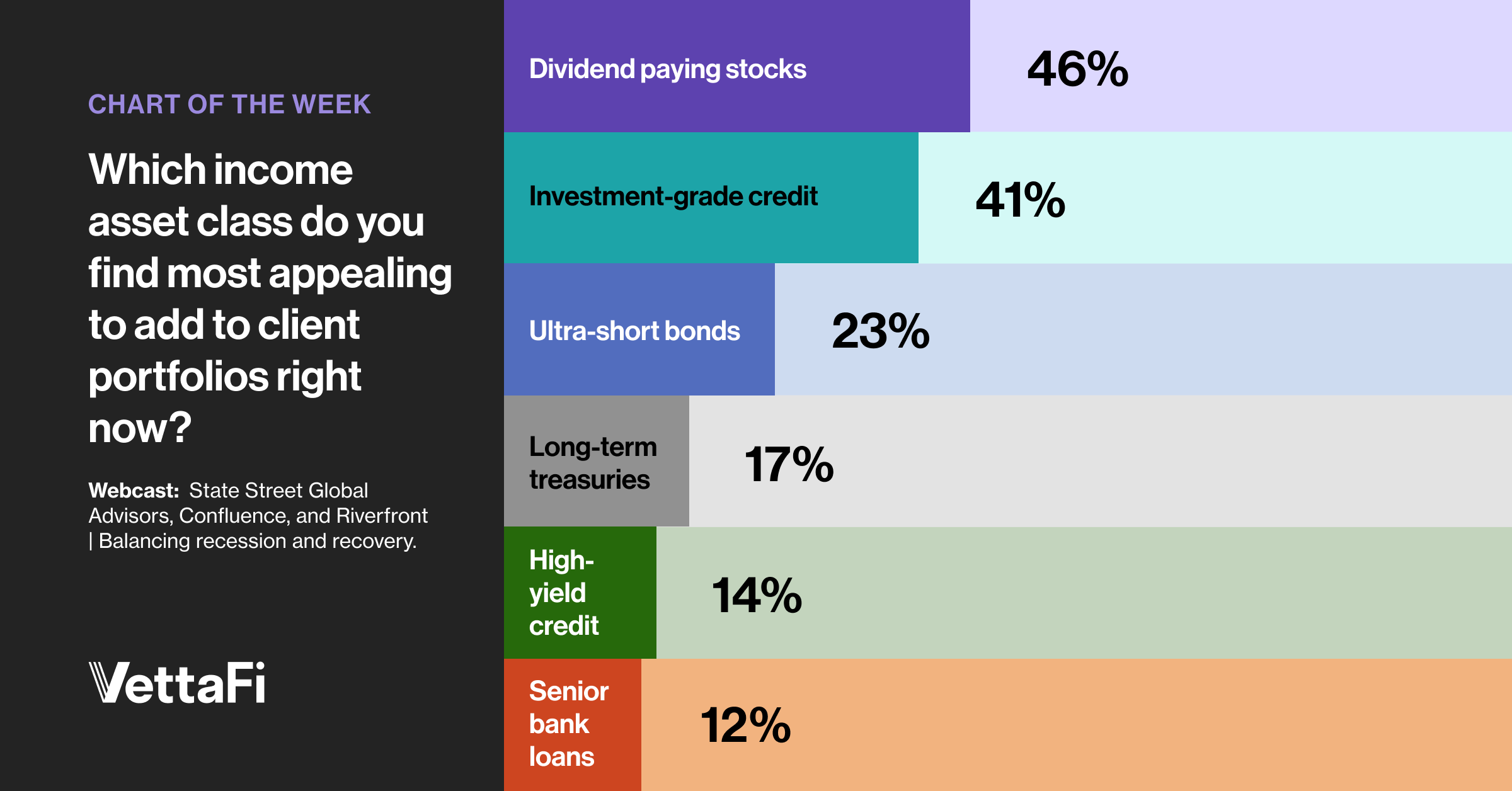

In a mid-June webcast with State Street Global Advisors, VettaFi asked advisors a key question: “Which income asset class do you find most appealing to add to client portfolios right now?” Investment-grade credit was the most popular fixed income choice selected (41%). However, more advisors (46%) chose dividend-paying stocks.

Dividend-Paying Stocks Favored by Advisors

With the SEC yield on the extremely conservative SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) recently hitting 4.9%, we will focus on high-dividend-yielding ETFs. Such funds should provide more capital appreciation potential than short-term bond funds, albeit with more risk. Unlike dividend growth ETFs, high-dividend-yielding ETFs are constructed based on the income generation of equity constituents.

VYM Is the Largest of the High-Dividend ETFs but Is Not Alone

The largest of these is the Vanguard High Dividend Yield ETF (VYM), which manages $49 billion. VYM is tilted toward value sectors like financials (20% of assets), consumer staples (15%), and healthcare (14%). Key holdings include JPMorgan Chase, Johnson & Johnson, and Procter & Gamble, but the fund has more than 450 holdings. The ETF recently had a 3.3% 30-day SEC yield and a modest 0.06% expense ratio. However, there are other lesser-known, more concentrated, and high-yielding ETFs in the investment style worthy of attention.

For example, the Invesco High Yield Dividend Achievers ETF (PEY) has $1.3 billion in assets spread across 51 positions. Relative to VYM, PEY is more exposed to financials (26% of assets) and utilities (19%), with only 1.6% in healthcare companies. KeyCorp, Lincoln National, and Pinnacle West Capital are some of the fund’s top positions. PEY sports a 4.8% 30-day SEC yield, even with a higher 0.52% expense ratio.

Taking an Equal-Weight Approach With the Dogs

The ALPS Sector Dividend Dogs ETF (SDOG) has $1.2 billion in assets invested in 52 stocks. Relative to PEY and VYM, SDOG is more diversified at the sector level. Information technology is the largest at 10.3% of assets, with healthcare and industrials also just above 10%. Meanwhile, at 9.6%, energy is the smallest of the sectors. Medtronic, Intel, and Stanley Black & Decker are examples of stocks inside the fund. SDOG has a 4.5% 30-day SEC yield and charges a 0.36% fee.

The VictoryShares US Large Cap High Dividend Volatility Weighted ETF (CDL) has $360 million in assets spread over 100 holdings. Utilities (24% of assets), financials (18%), and consumer staples (12%) are the largest sectors of the portfolio. Coca-Cola, Consolidated Edison, and Southern Company were among the positions. CDL offers a 3.9% 30-day SEC yield for a 0.35% expense ratio.

For advisors seeking income through dividend-paying stocks, there are strong alternatives to the widely held Vanguard ETF. Of course, it pays to understand what’s inside.

For more news, information, and analysis, visit the ETF Building Blocks Channel.