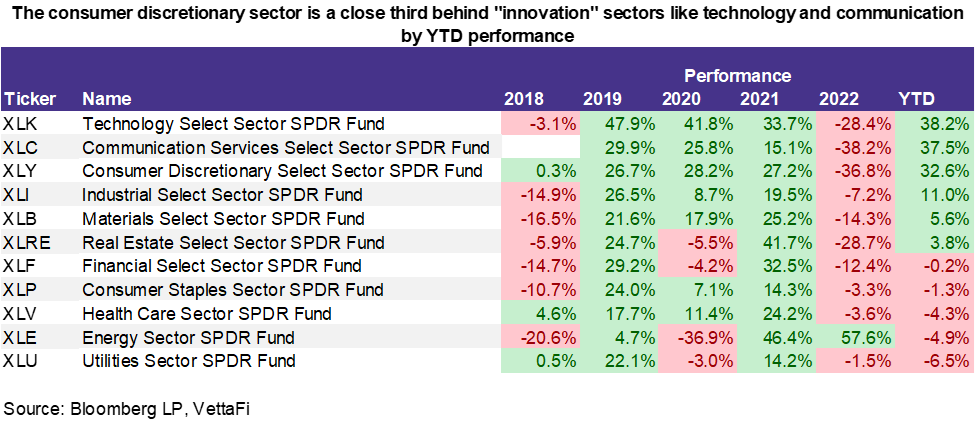

This week the VettaFi Voices discuss sectors (beyond technology, as we just discussed that sector recently) this week. Everything but consumer staples, energy, healthcare, and utilities are up YTD if you’re looking at the Select Sector SPDRs.

However, only three are outperforming SPY so far — information technology, communication services (which is right on tech’s heels), and consumer discretionary.

Aren’t those underperforming sectors exactly where investors would flock if a recession was happening or imminent? The flows are pretty confusing too — there have been outflows from XLK, the technology SPDR, but sizable inflows of $2.2 billion into communication services. Those last two are the top-performing two sectors.

What is going on with sectors?

Todd Rosenbluth, director of research: Investors have been turning to communication services ETFs like the Communications Services Select Sector SPDR Fund (XLC) for exposure to the strong-performing Meta and Alphabet stocks. But money has flowed into the Invesco QQQ Shares (QQQ) and the Invesco NASDAQ 100 ETF (QQQM), which are soon to be lightly rebalanced later this month.

But if investors were truly concerned about a recession, the defensive sectors like healthcare and utilities would be in favor. Yet the Health Care Select Sector SPDR Fund (XLV) and Utilities Select Sector SPDR Fund (XLU) are not pulling in money. I still think the growth sectors are likely to lead the market higher.

Roxanna has a great piece on consumer discretionary out this week.

But all of those ETFs are market-cap-weighted, and we have seen interest in equal-weighted products this year. The Invesco S&P 500 Equal Weight Technology ETF (RSPT) pulled in more than $500 million this year, with strong interest starting in May. There are concerns given how concentrated XLK is, and investors want more diversification.

YOLO Consumers

Heather Bell, managing editor: Honestly, I don’t have much to add to this conversation. I do, however, have a lot of questions! Roxanna and Todd, Jeremy Siegel just wrote a commentary for WisdomTree that talked about the “YOLO consumer” who is having a last hurrah of summer spending before reality hits. They’re funding what he called “one of the last good stretches for the economy” before markets get uncomfortable in September and October. Do you think that’s an accurate picture? (I may or may not have gone full YOLO for Amazon Prime Day.)

Rosenbluth: You are not alone, Heather. Amazon said it had its biggest sales day ever ever despite Amazon Prime Day being over the summer. AMZN is the heavyweight in the Consumer Discretionary Select Sector SPDR Fund (XLY) and the Vanguard Consumer Discretionary ETF (VCR).

Roxanna Islam Swan, associate director of research: This topic has great timing because this week I wrote a note on XLY and also participated in a consumer discretionary panel on TD Ameritrade Network! I think what’s been happening with the consumer discretionary sector and XLY has been pretty impressive. Year-to-date, it’s been performing just under XLK and XLC, which are more “innovation-focused” sectors that have been benefitting from the AI boost. The next best-performing sector after XLY has been the Industrials Select Sector SPDR Fund (XLI), which is only +11% compared to +33% for XLC, as of July 12, 2023.

A Softer Second Half

I think this has also been counterintuitive. I’ve been hearing a lot of large, well-known retailers talk about a softer consumer, especially in the second half of the year. But a lot of that, I think, has already been priced in. Investors know the consumer, while resilient, can’t stay strong forever. Within apparel and other retail goods, I think there’s going to be a softer second half. However, depending on how individual companies position themselves for the long term, stocks prices might not be hit as much as you’d expect.

We saw this with Helen of Troy (HELE)‘s earnings report on Monday. They did slightly better than expected (although it still saw negative sales and earnings year-over-year), and the stock price was up ~18.5% that day. If you look at XLY, you can see how diverse the consumer discretionary sector is — it’s not just apparel and retail goods.

Rosenbluth: Roxanna’s above data shows how out of favor the defensive sectors have been from a performance standpoint. Given where short-term bond yields are, it is understandable that people would prefer to own the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) or the iShares Short Treasury Bond ETF (SHV) than XLU for the income.

Islam: As Todd was saying, there’s a large allocation to both Amazon and Tesla. And other top performers are mostly in service-based sectors, which I think will be a large shift going forward. We’ve been hearing about the goods-to-services shift for a while. However, if you look at Personal Consumption Expenditures index data from the U.S. Bureau of Economic Analysis, there’s still a large gap between goods/services spending now vs. pre-pandemic levels.

Consumers at Capacity

Part of it is that consumers have less money to spend. Also, we already have a bunch of goods at home. The start of the pandemic was only a couple of years ago. That means there’s probably a big chance we still have a bunch of clothes, furniture, and other items filling up our homes. Add that to the current state of the housing market. A lot of consumers are stuck renting or couldn’t upgrade their homes as intended. We’re in a situation where people probably have too many “things” in their homes.

We’ll likely see more spending go into restaurants. There’s just not as big of a gap between eating away from home and eating at home as there was before. I also think we’ll see spending go into travel. We’re finally at a point where TSA passenger throughput in 2023 is equivalent to 2019. From a performance perspective, many of these travel stocks, particularly cruise lines, were beaten down for several years due to the pandemic. Now, they’re able to make a much stronger recovery.

Rosenbluth: Speaking of the strong performance of travel stocks in consumer, Carnival is now the largest stock in the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RSPD), and Norwegian Cruise Line is third, (I was unaware this was a S&P 500 company) with Domino’s Pizza in second. Unlike XLY, no stock dominates like Amazon and Tesla. 2.4% gets the top weighting

Islam: It’s crazy — top performers in XLY are Carnival, Tesla, Royal Caribbean, and Norwegian. Big comeback for cruise lines!

Travel-Related Stocks

Bell: The Defiance Hotel Airline and Cruise ETF (CRUZ) is up almost 36% year-to-date. That’s not much shy of what XLK has been doing this year.

Roxanna, I don’t know if you already addressed this, but is travel a main driver behind XLY’s performance? Looking at its holdings, it’s got quite a few stocks associated with travel.

Islam: There are several travel stocks in there, but they add up to only 8% in weight! Most of the outperformance is from Amazon and Tesla, which are together ~42% of the total weight

Rosenbluth: Energy as represented using cap-weighted XLE is down in 2023, after a strong run in 2021 and 2022. But as Stacey Morris recently pointed out in her piece this week, energy infrastructure is doing much better. The related ETF, in my opinion, is AMLP, which is up more than 10%. That’s ahead of S&P 500 real estate and materials sectors, per Roxanna’s data.

Stacey Morris, head of energy research: That’s right, Todd. With MLP yields at 7.7%, the income really enhances total return and further differentiates energy infrastructure from broader energy.

Rosenbluth: Wow, Stacey. That’s more than double XLE’s yield. It’s a shame MLPs are not included in S&P 500 and thus XLE.

Defensive Sectors Out of Favor

Bell: I’m just still kind of astounded by the fact that the “safer” sectors are so out of favor. There’s just so many financial experts and market participants predicting a recession. Inflation looks to have eased again, so maybe we’re going to dodge that. But, still, these are sectors covering necessary things like electricity and healthcare and banks and food. Why are they performing so poorly in comparison to everything else and seeing negative returns this year?

Rosenbluth: With bond yields climbing due to rising rates, defensive dividend yielding sectors like utilities are far less appealing.

Islam: It’s hard for many investors to see a recession in the near term, especially with the current job market. It seems like there’s still some more room for growth and pent-up demand in consumer spending that’s still being squeezed out despite cooling.

For more news, information, and analysis, visit the Equity ETF Channel.