In the past couple of years, ETF-oriented advisors have turned their attention to free cash flow ETFs. Free cash flow is the cash available after a company has paid expenses, interest, taxes and long-term investments. With such cash, a company can pay dividends, repurchase shares, make acquisitions or retain it for the future. When measured relative to its enterprise value, free cash flow yield can be an indication of an attractive valuation on a high-quality stock.

The Herd Leader

The largest of these free cash flow ETFs is the Pacer US Cash Cows 100 ETF (COWZ). The $22 billion ETF has seen most of its assets arrive in the last three years despite launching in 2016. COWZ owns shares of 100 companies in the Russell 1000 index with the highest free cash flow yields. Energy and health care companies like Bristol-Myers Squibb, Exxon Mobil, EOG Resources, and Valero Energy were recent top-10 holdings.

Year-to-date through March 27, COWZ 11.6% gain was stronger than the 10.2% for the iShares Russell 1000 ETF (IWB).

Adding Growth Tilt to High Quality Value Investing

In June 2023, the VictoryShares Free Cash Flow ETF (VFLO) launched. Its asset base has risen to $230 million aided by $85 million of new money in 2024. One of the ways VFLO is different from COWZ is the former has an additional growth filter. This offers a forward-looking approach to free cash flow yield.

“Our research has shown that you can screen high free cash flow yield companies for growth without sacrificing valuation,” explained Michael Mack, associate portfolio manager for VictoryShares.

Indeed, relative to the Russell 1000 Value index, the Victory US Large Cap Free Cash Flow index has outperformed during periods when both value and growth styles were in favor. VettaFi runs the Victory index behind VFLO.

Starting with a universe of 400 profitable large-cap companies, VFLO narrows the universe to 75 with the highest free cash flow yields. Removing the weakest, it then owns shares of 50 companies with the highest expected growth prospects. Health care and energy companies were well represented in VFLO too with Centene, Chevron, Cigna Group, and Elevance Health among its largest positions.

As of March 27, VFLO’s 14.2% total return in 2024 was ahead of COWZ and IWB.

How Are Advisors Using the ETFs

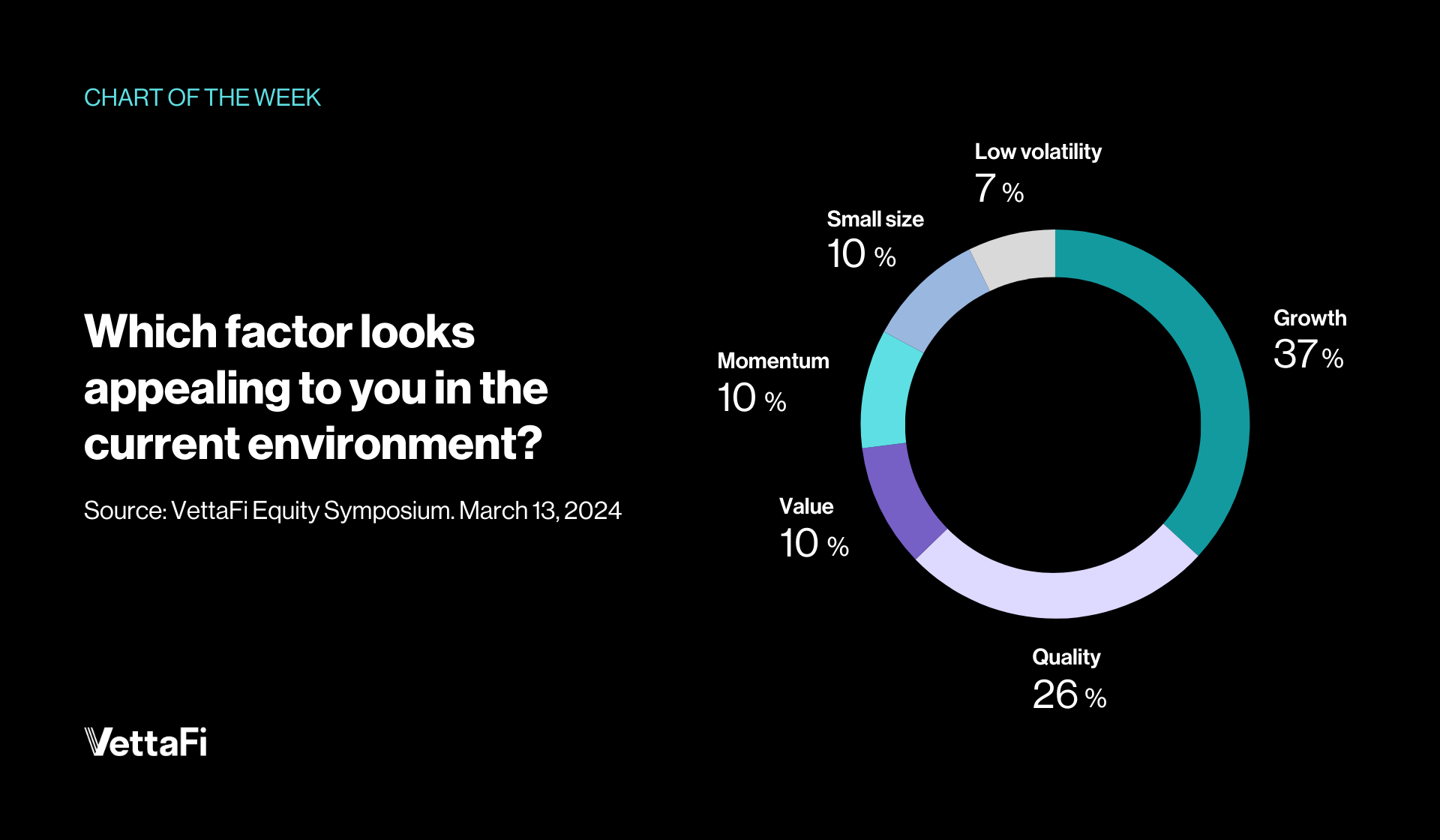

In a recent article, we highlighted that while growth was in favor, many advisors were turning to other factors. Quality (26%) and value (10.3%) were considered more appealing than momentum (9.9%), small size (9.9%), and low volatility (7.3%) in March 2023.

“We are seeing VFLO being used to replace traditional value ETFs,” noted Mack. “However, we also are seeing advisors combine value and quality together.”

Both Pacer and VictoryShares also offer small-cap versions of COWZ and VFLO for those that want to add in small size. Meanwhile, Amplify and Global X now offer cash flow ETFs. There are a lot of use cases for free cash flow ETFs so it’s good for advisors to have options to consider.

For more news, information, and analysis, visit VettaFi | ETF Trends.