The energy transition has seen positive momentum this decade, gaining broad regulatory support and increased investment. In a decarbonizing world, natural gas plays a critical role for energy security. Its use as backup power and as a coal replacement domestically leaves U.S. natural gas players well positioned in the coming years.

Renewable energies continue to come online at a remarkable rate. Last year, renewable energy capacity almost doubled year-over-year, adding 507 GW globally according to the International Energy Agency. That said, global energy demand still far exceeds renewable capacity.

Domestic Energy Breakdown

In the U.S., renewable energy made up 22% of all electrical power in 2022 reported the U.S. Energy Information Administration (EIA). Renewable energy sources generated 874 billion kilowatt hours (kWh) last year while coal generated 665 billion kWh. However, natural gas remains the primary source of electrical power domestically.

Natural gas plays a critical role in the energy transition. While industries and economies work to transition away from heavy greenhouse gas emitting fuels, it provides a cleaner local alternative to coal. Liquefied natural gas (LNG) generates 40% less carbon dioxide than coal, reported the National Grid Group.

Switching from coal to natural gas brought domestic emissions down by approximately half since 2005 John Porter, Senior VP and Chief Financial Officer of Williams (WMB), explained last year in a fireside chat hosted by Morgan Stanley and VettaFi.

See also: “Williams (WMB) and the Golden Age for Natural Gas”

Natural Gas Ensures Energy Security

The EIA anticipates natural gas will remain the primary source of energy in the next two years, contributing 1,700 billion kWh annually. It’s a reliable source of energy while more renewable energies come online and coal plants are decommissioned.

By 2026, coal capacity drops by half. As increasingly more coal plants retire, capacity drops from 318GW, as measured in 2011 at peak coal use, to 159 GW. By 2030 that number drops to 116GW, with 173 plants in total retiring according to the Institute for Energy Economics and Financial Analysis. Renewable energy uptake is growing rapidly but not fast enough to account for these domestic coal plant decommissions.

Natural gas also provides critical energy security while renewable energy technology evolves. The U.S. power grid infrastructure requires an enormous overhaul to hold and store renewable energy reliably. Currently the capacity factor of wind and solar is just 10-30% Porter explained.

In comparison, natural gas has a capacity factor of 100%. This makes it enormously valuable for electricity providers to keep on hand for backup power generation. As more renewable energy capacity is created, natural gas backup capacity will also increase due to its critical role in energy security and reliability.

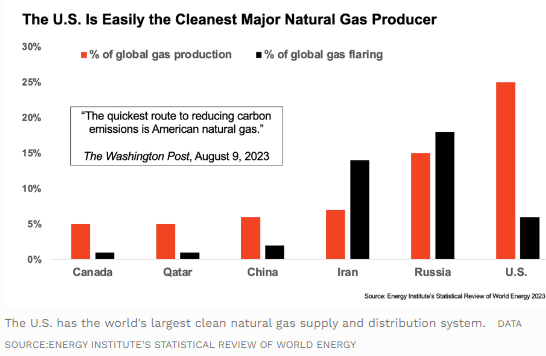

Due to recently passed regulations within the U.S. as well as increased use of third-party certifiers, U.S. natural gas takes the top spot globally for least amount of GHG emissions produced, reported Forbes. Russia, meanwhile, is the dirtiest. It makes U.S. LNG particularly attractive for European countries transitioning away from Russian fossil fuel reliance.

Image source: Forbes

U.S. natural gas and all its associated industries are well-positioned as the climate transition continues. Midstream companies that store, process, and transport this cleaner liquid fuel benefit from long-term demand and ongoing reliance. What’s more, should gas and LNG demand decrease, many pipelines could potentially be repurposed to instead transport hydrogen and captured carbon dioxide.

See also: “The Staying Power of Oil and Gas Pipelines”

This leaves midstream companies and their various pipelines strongly positioned within the energy transition. This resilience makes them attractive both near- and long-term, and worth consideration.

For more news, information, and strategy, visit the Energy Infrastructure Channel.