Summary

- Midstream/MLPs tend to outperform the broader market in years of high inflation, and though it has cooled from its mid-2022 peak, inflation is likely to remain elevated in 2023.

- Energy infrastructure companies largely provide services for fees under long-term contracts, which typically include annual inflation adjustments. The high inflation in 2022 supports rate increases in 2023.

- To the extent revenue increases from inflation adjustments outpace rising costs, that should help companies’ bottom lines.

Energy infrastructure companies have handily outperformed the S&P 500 over the last two years of elevated inflation. Certainly, midstream’s real asset exposure and the broad strength in energy has helped, but importantly, many midstream contracts also include annual inflation adjustments. Inflation has moderated, but the high inflation from 2022 largely has yet to be reflected in midstream rates, particularly for liquids pipelines. Today’s note examines midstream and MLP performance in years of elevated inflation and explains why last year’s high inflation could be a tailwind for midstream this year and beyond.

Midstream and MLPs tend to outperform in years of elevated inflation.

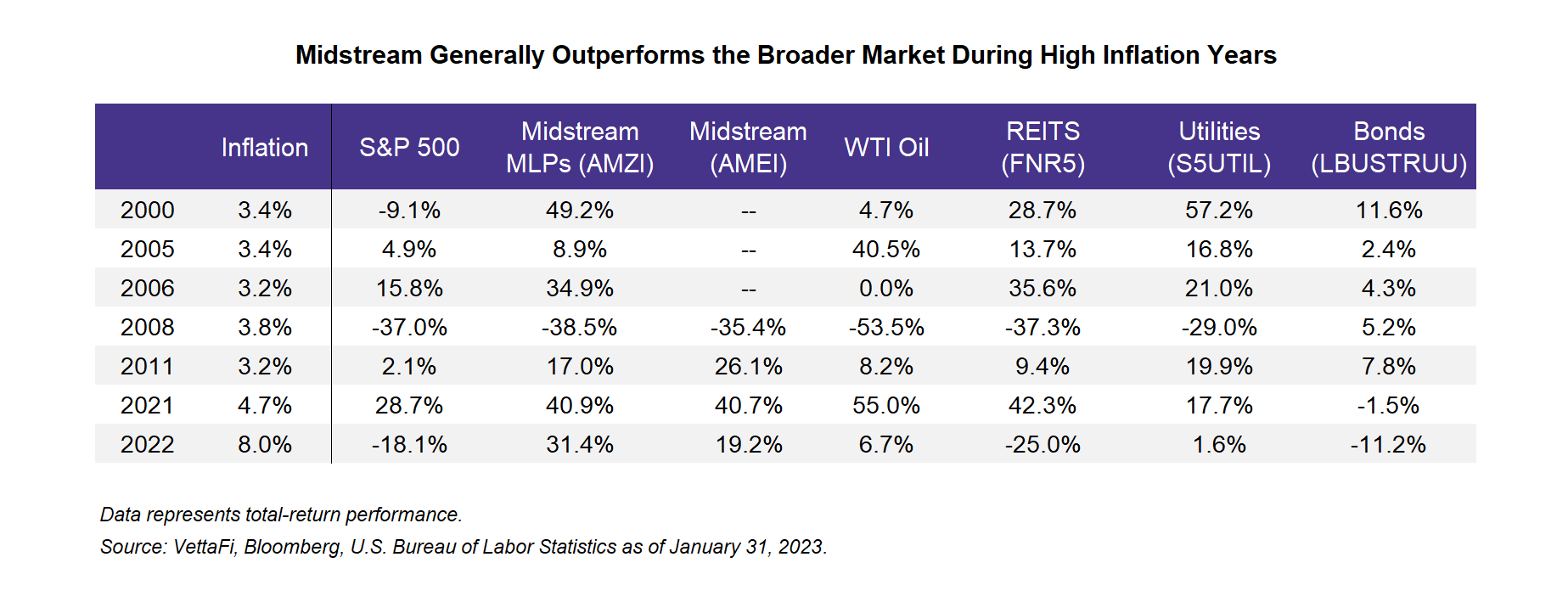

Including 2022, there have been seven years since 2000 when inflation was above 3.0%. MLPs, represented by the Alerian MLP Infrastructure Index (AMZI) in the table below, outperformed the broader market in six of those seven years. The exception was 2008, when MLPs underperformed the S&P 500 by just 150 basis points. Broader midstream is represented by the Alerian Midstream Energy Select Index (AMEI), which is 75% corporations and 25% MLPs. While AMEI’s history is limited, it has outperformed the broader market in the four years of high inflation since 2008.

Though inflation has moderated from its 2022 peak of 9.1% in June, it was still high at 6.5% as of December 2022. It will arguably take time for inflation to fall back to more normal levels. Indeed, the median forecast for inflation in 2023 is 3.8% according to Bloomberg. While past performance is no guarantee of future results, midstream/MLPs have shined in inflationary periods. Importantly, last year’s inflation numbers could be a tailwind in 2023 and beyond.

High inflation in 2022 likely supports pipeline rate increases in 2023+.

Energy infrastructure companies largely provide services for fees under long-term contracts, which typically include annual inflation adjustments. Companies will often discuss how much of their revenue or EBITDA has inflation escalators or will identify certain business lines or contract types that have inflation adjustments built into them (see this 2022 note for company examples). Many annual reports will include a statement about expecting to pass higher costs onto customers in the form of higher fees as has been done historically and as permitted by regulations and competition.

Pipelines that transport liquids like crude, natural gas liquids, and refined products (gasoline, diesel) tend to follow the Federal Energy Regulatory Commission’s (FERC) Oil Pipeline Index, which sets a ceiling for rate increases based on the Producer Price Index for Finished Goods (PPI-FG) and an adjustment (currently PPI-FG – 0.21%). Pipelines that use the FERC index adjust rates each July based on the preceding year’s PPI-FG. On July 1, 2022, rates were able to increase by 8.7%. For 2022, PPI-FG is estimated at 13.5%, which would imply a ceiling rate increase of 13.3% for July 2023 that would be in effect through the end of June 2024.

On their earnings call on Thursday, the management team from Magellan Midstream Partners (MMP) provided their expectations for rate hikes on their refined product pipelines, of which 30% are subject to the FERC index and 70% are not. Overall, MMP expects to increase rates by around 8.0% on average on July 1. If they do not take the full 13.3% increase on pipelines subject to the FERC index, MMP noted that they retain the ability to make up the difference in the future. In general, management expects higher rate increases for its pipelines following the FERC index, but it sees healthy rate increases across the board, supporting the estimated 8% increase.

To be clear, rising pipeline rates are not going to be a windfall for the midstream space, as costs have also likely gone up, but there is the potential for margin improvement. To the extent revenue increases from the inflation adjustments outpace increased costs, that should help companies’ bottom lines. During their recent Investor Day, management of Kinder Morgan (KMI) noted the projections for the FERC index to be over 13% and explained that two-thirds of their refined product segment EBDA has annual inflation adjustments largely driven by the FERC index. For the terminal segment, 75% of EBDA has annual price escalators. Management noted that they have been successful in the past at keeping rising costs from outpacing the revenue increases, implying incremental margin.

Bottom Line:

The last two years have demonstrated that energy infrastructure companies can perform well in periods of elevated inflation. With inflation likely to remain high in 2023 and contract adjustments yet to fully incorporate the sky-high inflation of 2022, ongoing inflation can be a tailwind for energy infrastructure companies given their real asset exposure and the annual inflation adjustments typically built into their contracts.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX).

VettaFi LLC (“VettaFi”) is the index provider for AMLP, MLPB, ENFR, and ALEFX, for which it receives an index licensing fee. However, AMLP, MLPB, ENFR, and ALEFX are not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of AMLP, MLPB, ENFR, and ALEFX.

Related Research:

Inflation Worries? Not for Midstream/MLPs

Midstream/MLPs: Well Positioned for Inflation

For more news, information, and analysis, visit the Energy Infrastructure Channel.