Many advisors underestimate the number of MLPs/midstream companies steadily growing their dividends.

Income is a primary reason why many advisors use MLPs and energy infrastructure companies in portfolios. The segment is known for offering generous income and for being more defensive than other subsectors of energy.

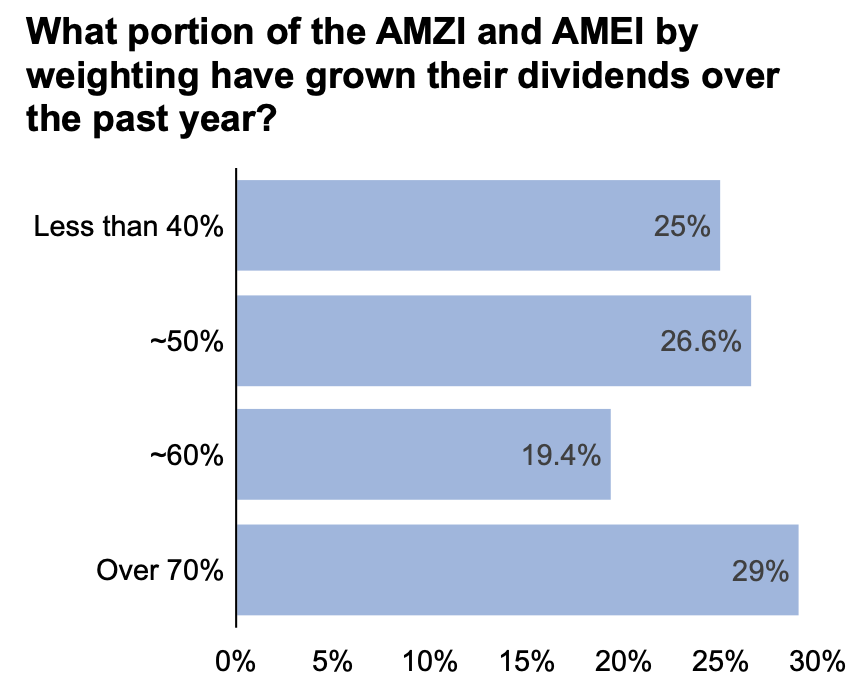

When asked what portion of the Alerian MLP Infrastructure Index (AMZI) and the Alerian Midstream Energy Select Index (AMEI) by weighting have grown their dividends over the past year, just 29% of respondents accurately chose over 70%, according to Why Your Income Portfolio Needs Energy Infrastructure (Date: June 6, 2023. Sample size: 316 respondents, 30% RIAs).

Notably, the majority (roughly 52%) of respondents said that around 50% or less of AMZI and AMEI by weighting have grown their dividends over the past year. Therefore, advisors will likely be pleased to learn the number is much higher.

Source: VettaFi

As of May 31, over 83% of constituents in the AMEI by weighting have grown their dividends year-over-year. Meanwhile, over 72% of the AMZI by weighting have grown their distributions year-over-year. Above all, no constituents in AMZI or AMEI have cut their dividends since July 2021.

See more: “1Q23 MLP/Midstream Payouts Solid as Equities Wobble”

Under the Hood of the AMZI and the AMEI

The AMZI is a capped, float-adjusted, capitalization-weighted composite of energy infrastructure MLPs that earn the majority of their cash flow from midstream activities. Investors can access the AMZI with the Alerian MLP ETF (AMLP).

Conversely, the AMEI is a composite of North American midstream energy infrastructure companies. Furthermore, the index comprises MLPs (25%) and corporations (75%) that are engaged in the pipeline transportation, storage, and processing of energy commodities. The Alerian Energy Infrastructure ETF (ENFR) provides exposure to the AMEI.

In the upcoming livecast on July 10, Energy Infrastructure Beyond Natural Gas: LNG and NGLs, SS&C ALPS Advisors and VettaFi will discuss how midstream benefits from the growing global demand for liquefied natural gas and the less familiar but critical petrochemical building blocks, natural gas liquids.

See more: “U.S. LNG Projects Advance Even as Global Prices Slump”

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and ENFR, for which it receives an index licensing fee. However, AMLP and ENFR are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and ENFR.