The interest rate narrative continues to fluctuate as markets remain highly responsive to incoming economic data. It creates challenges for investors looking to time longer duration bond exposures or forecast equity performance. For investors looking for opportunity amid volatility, midstream MLPs offer generous yields and have seen solid performance in recent years while still trading at appealing valuations.

The first quarter brought strong returns for equities and the broad energy sector. Rising oil prices in March lifted returns for the sector. However, midstream master limited partnerships (MLPs), a subset of the energy space, edged out the broader energy sector for performance in the first quarter.

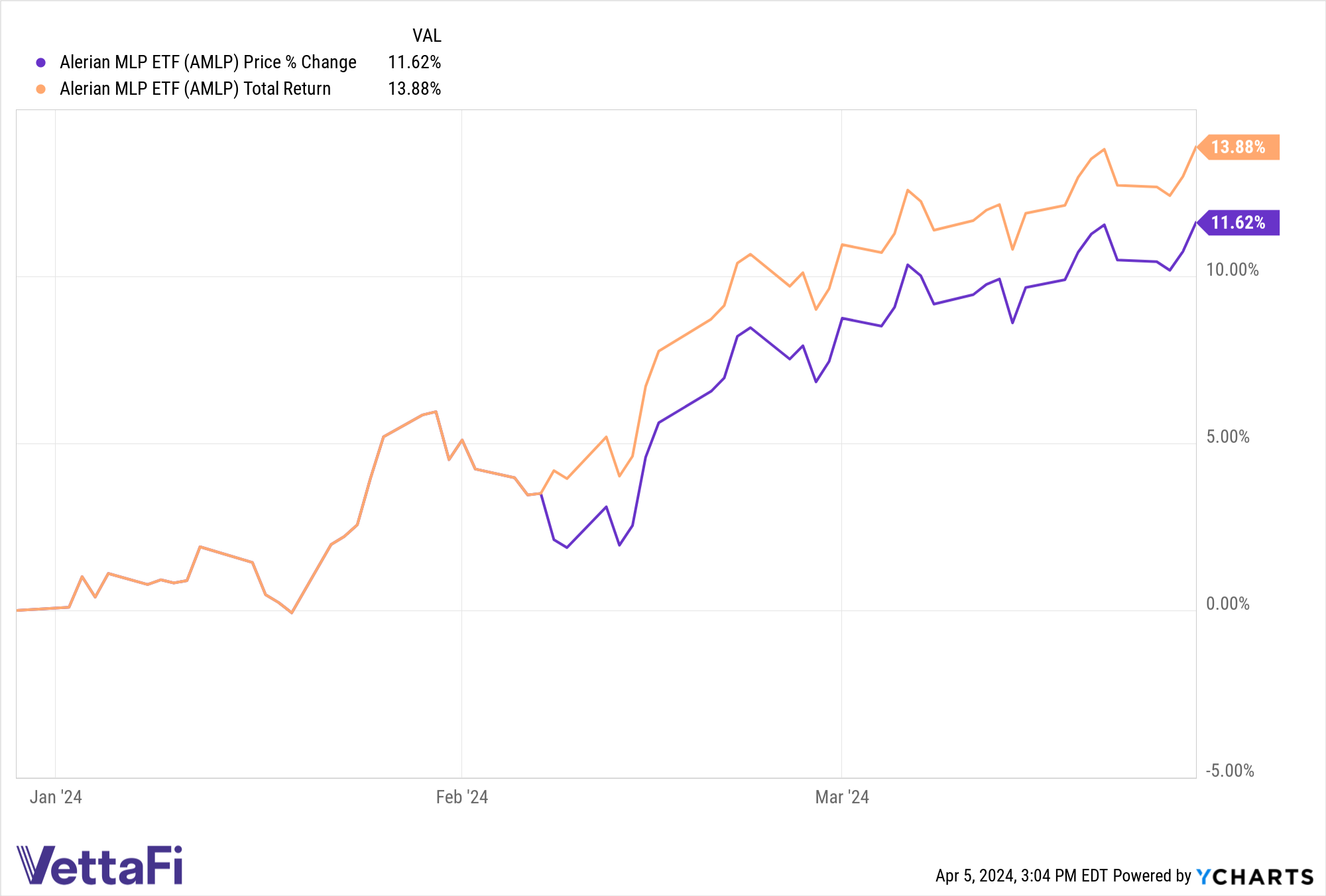

The Energy Select Sector SPDR ETF (XLE) ended Q1 2024 up 13.51% on a total return basis. Meanwhile, the Alerian MLP ETF (AMLP) closed the quarter up 13.88% on a total return basis according to Y-Charts data.

See also: This MLP ETF Outperforms the S&P 500 YTD

MLPs Offer Attractive Valuations

Despite strong performance, MLPs still trade at discounted valuations relative to history as measured by their forward EV/EBITDA. AMLP seeks to track the performance of the Alerian MLP Infrastructure Index (AMZI). The index is capped, float-adjusted, and capitalization-weighted, and contains MLPs that derive most of their cash flow from midstream activities.

AMZI ended the first quarter with a forward EV/EBITDA multiple of 8.59x. This measurement is based on 2025 Bloomberg consensus EBITDA estimates and compares a company’s value to its earnings. Midstream is unique within the energy sector in that these companies are often able to provide outlooks more than a year ahead.

“Multi-year guidance reinforces the benefits of midstream’s fee-based businesses and cash flow stability,” Stacey Morris, CFA, head of energy research at VettaFi explained earlier this year.

See also: Beyond 2024: Examining Multi-Year Guidance for Midstream

What’s noteworthy about AMZI’s forward EV/EBITDA multiple is that it currently falls slightly short of its three-year average of 8.82x. This creates a window of opportunity for investors.

MLPs offer energy sector exposure while providing a differentiated return stream and less exposure to commodity prices. These companies are responsible for the transportation, storage, and processing of oil and natural gas. Their business models provide a buffer to price volatility in oil and gas, making them a great diversification opportunity within the energy sector.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB).

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and MLPB, for which it receives an index licensing fee. However, AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.

For more news, information, and analysis, visit the Energy Infrastructure Channel.