The last few years underscored the need for portfolio diversification across asset classes as correlations and concentration grew. Within the energy sector, midstream Master Limited Partnership (MLP) companies sometimes end up an overlooked opportunity by investors. This year, that’s to their detriment.

The S&P 500 is on track to end the first quarter with the best performance since 2019. The broad equity index looks to close the quarter up approximately 10%. For comparison, the S&P 500 logged a 13.1% gain in the first quarter of 2019, reported CNBC.

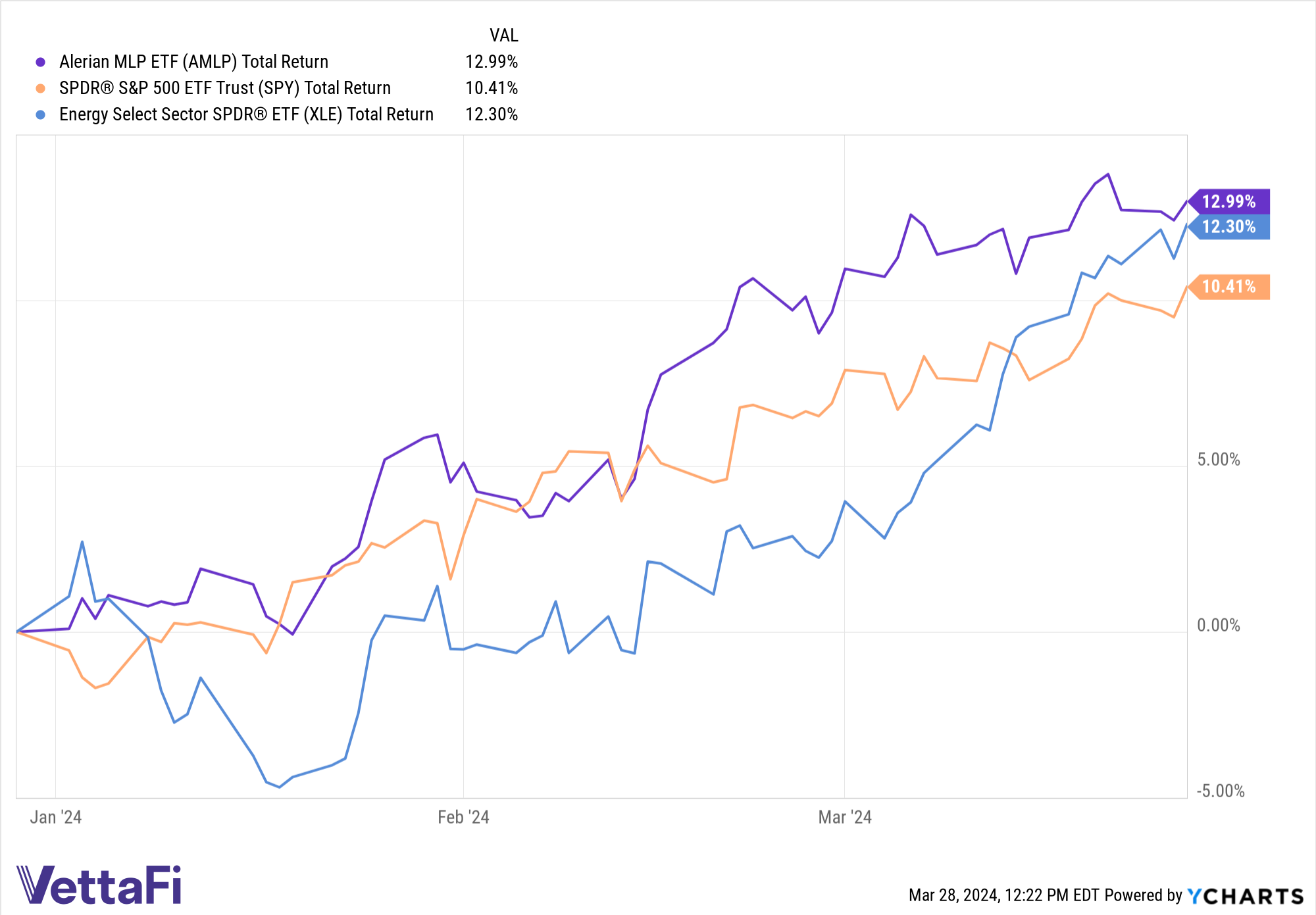

As strong as broad equity performance is, the Alerian MLP ETF (AMLP) outperforms year-to-date. AMLP generated total returns of 12.99% YTD while the SPDR S&P 500 ETF Trust (SPY) is up 10.41% as of 03/27/24 according to Y-charts data.

It’s also been a great year for the energy sector, buoyed by rising oil prices. Oil prices are up 13.54% as of 03/27/24 and crossed above $80 a barrel for the first time this quarter in March. However, AMLP also currently offers better total returns than the broader energy sector this year. Since January 4, AMLP consistently outperformed the Energy Select Sector SPDR ETF (XLE).

MLP Investing: Diversification Bang for your Buck

The fund’s total return performance underscores the benefits of midstream MLP inclusion within energy exposures. It also provides a strong, diversified return profile within energy as well as broad equity allocations.

It’s important to note that neither SPY nor its targeted energy subset, XLE, include MLP exposure. While both major indexes share the same four midstream corporations, none are MLPs. Investors would have to allocate separately to capture the benefits of MLPs.

AMLP seeks to track the performance of the Alerian MLP Infrastructure Index (AMZI). The index is capped, float-adjusted, and capitalization-weighted, and contains MLP companies that derive most of their cash flow from midstream.

MLP companies offer energy sector exposure while providing a differentiated return stream. These companies are responsible for the transportation, storage, and processing of oil and natural gas. Because MLP business models have the potential to buffer oil and gas price volatility, it makes them particularly attractive when prices gyrate.

The fee-based models also prove beneficial for cash flow when gas or oil prices fluctuate. This leads to noteworthy yields for investors. AMLP currently has an indicated yield of 7.48% as of 03/27/24. Indicated yield takes the most recent dividend and annualizes it before dividing by the current share price, and is forward-looking. The fund has a trailing 12-month yield of 7.33% as of the same period.

MLP investing provides a number of benefits for portfolios. AMLP’s total returns and diversification make it a strong complement to existing energy allocations. Its diversified return stream also makes it a strong addition to broad equity exposures for those investors with an eye towards concentration risk.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB).

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and MLPB, for which it receives an index licensing fee. However, AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.

For more news, information, and analysis, visit the Energy Infrastructure Channel.