Midstream investors may be wondering how rising crude oil prices will affect investments in energy infrastructure.

Both U.S. and international crude oil prices are on pace for the third straight weekly gain.

West Texas Intermediate crude (WTI), the U.S. benchmark, ended Thursday at $90.16, the highest since last November. Meanwhile, Brent crude settled at $93.70, marking a 10-month high for the international benchmark.

Energy commodities saw modest price gains in August, with crude oil and natural gas prices up 2.24% and 5.08%, respectively. U.S. oil prices have climbed about 13% in 2023.

Inflation accelerated for the second consecutive month in August, with the increase largely driven by a spike in gasoline prices, which were up 10.6% during the month.

Saudi Arabia and Russia last week announced they would extend voluntary cuts to oil production until the end of the year. OPEC+ initially announced production decreases last October with further surprise cuts in April.

The extension of output cuts by Saudi Arabia and Russia through year-end is expected to lock in a substantial market deficit through the rest of 2023, the IEA said on Wednesday.

How Rising Oil Prices Impact Midstream Investments

MLPs are less sensitive to moves in commodity prices given their fee-based business models, which support stable cash flows.

See more: “Midstream Sees Strong Free Cash Flow Generation in 2023”

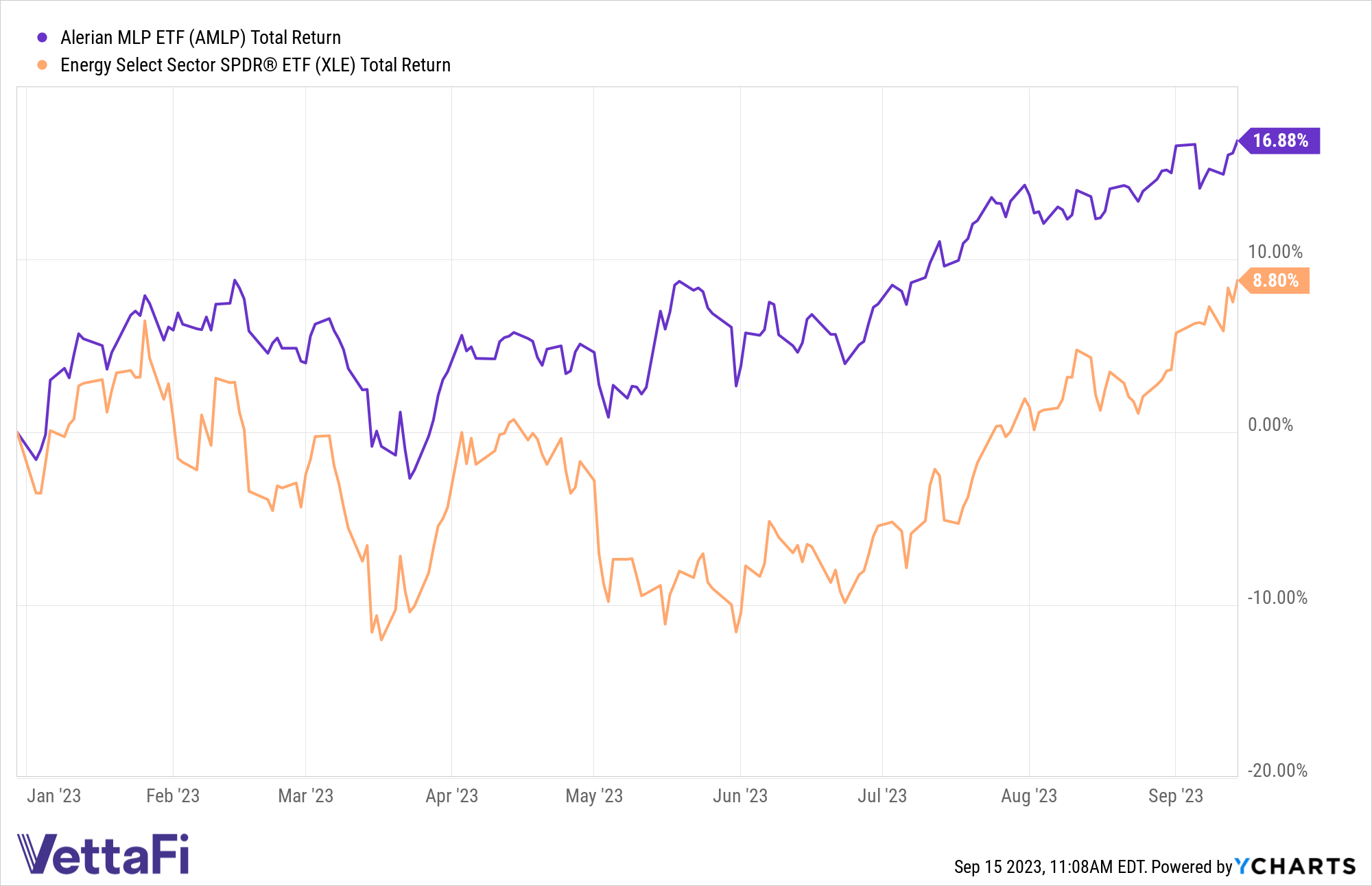

MLPs will likely benefit from improved sentiment if oil prices continue to increase. Conversely, MLPs are likely to hold up better than other energy sectors if oil prices decline. This resiliency was demonstrated earlier in 2023 and has contributed to MLPs’ year-to-date outperformance.

The Alerian MLP ETF (AMLP) is up 16.9% year to date, handily outpacing broader energy. AMLP is a composite of energy infrastructure MLPs that earn most of their cash flow from midstream activities.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.