The energy sector remains volatile in 2024, driven by persistent supply and demand imbalances. As oil and natural gas move in increasingly diverging directions this quarter, the benefits of midstream exposure for investors become apparent.

Oil hit a new high for the year in trading Monday with WTI futures trading at $81.33 a barrel. Ongoing global geopolitical conflict continues to generate upward pressure on oil prices. Meanwhile, the two-month capitulation of natural gas prices remains ongoing.

Natural gas prices suffer from a supply surplus on the heels of a mild winter. April 2024 natural gas futures currently trade at $1.71 per MMBTU as of midday Monday trading. It’s a sharp drop-off from mid-January highs of $3.31.

While the two major energy commodities continue to diverge, midstream companies exhibit ongoing resilience. Midstream energy companies are responsible for the transportation, storage, and processing of oil and natural gas. As such, these companies offer the potential for a differentiated return stream compared to targeted oil and gas investing.

The Benefits of Midstream Investing

Earnings guidance for midstream remains cautiously constructive this year, with forecasts for modest growth. The business models of MLPs are fee-based and dependent on volumes of oil or gas moved, stored, or processed. This allows for MLP companies to offer annual outlooks as well as more long-term estimates.

For a more detailed look at the Midstream earnings forecasts, see also: “2024 EBITDA Guidance: Midstream/MLPs See Growth”

The fee-based model MLPs use offer a number of benefits. These models allow for the potential to buffer some of the volatility of the underlying commodity’s prices. They also prove a boon for cash flow during periods when oil or gas prices fluctuate significantly.

These cash flows in turn benefit investors in the form of yields. The Alerian MLP ETF (AMLP) has a 7.4% trailing 12-month yield as of 03/15/24 with an indicated yield of 7.55%. Indicated yield takes the most recent dividend and annualizes it before dividing by the current share price, and is forward-looking.

AMLP seeks to track the performance of the Alerian MLP Infrastructure Index (AMZI). The index is capped, float-adjusted, and capitalization-weighted, and contains MLP companies that derive most of their cash flow from midstream.

MLPs Offer Differentiated Returns Within Energy

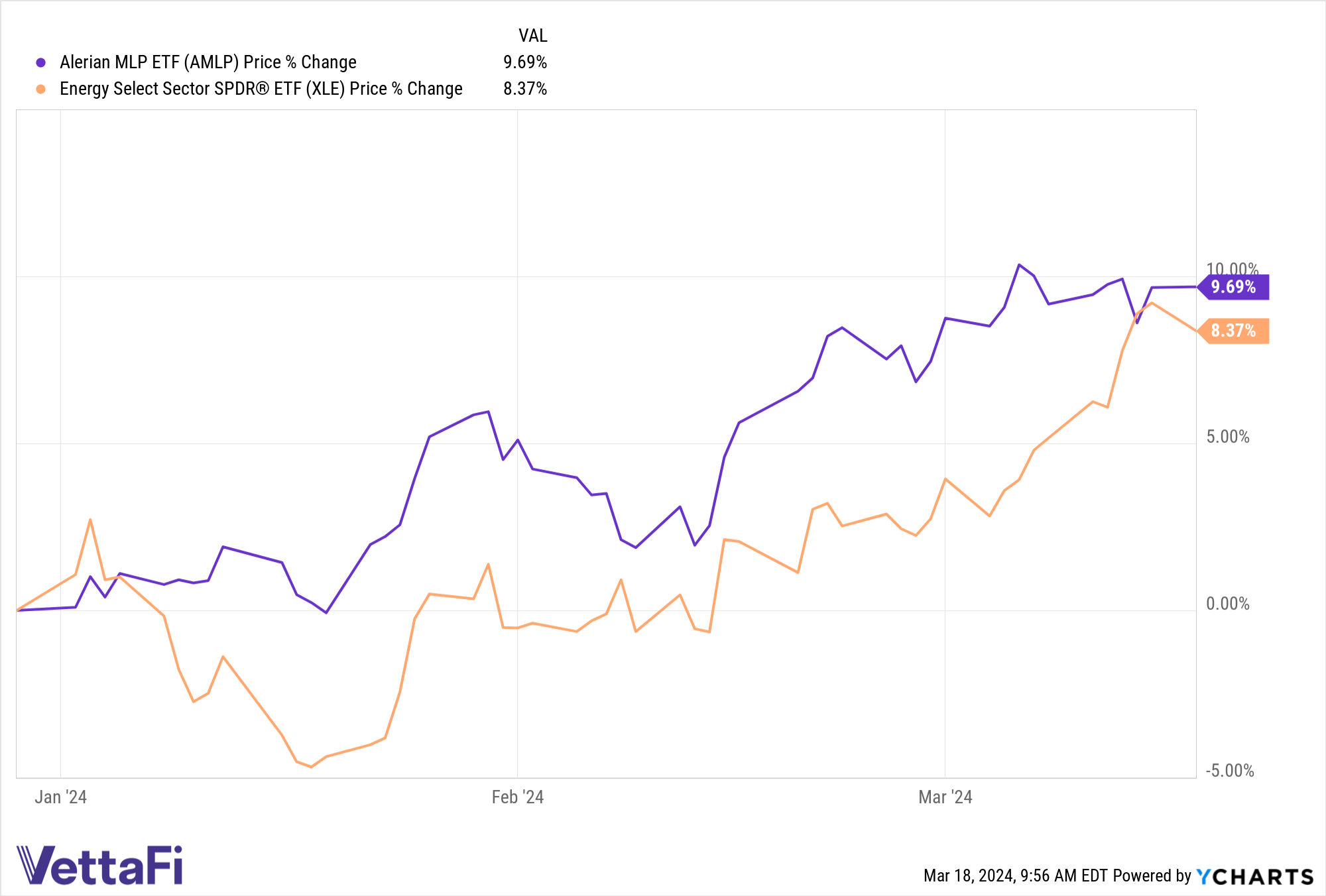

AMLP is up this year compared to the broader energy sector, as measured by the Energy Select Sector SPDR Fund (XLE). While XLE has suffered from significant outflows this year, down a net $1.6 billion as of 03/15/24, AMLP continues to generate consistent inflows. AMLP is up $83 million this month with solid inflows, and net flows of $192 million YTD.

The performance of AMZI in the last month was buoyed in large part by strong guidance, earnings, and distributions by Western Midstream Partners LP (WES). WES provided guidance for a 52% base distribution growth for the first quarter, increasing to $0.875 per unit. The company is up 20.37% YTD as of 03/15/24 and makes up 12.18% weight of the underlying index.

Midstream companies offer energy sector exposure while providing a differentiated return stream from the commodities themselves. Given yields, a constructive 2024 outlook, and a business model that offers the potential to buffer oil and gas price volatility, investors would do well to consider targeted exposure this year.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and MLPB, for which it receives an index licensing fee. However, AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.

For more news, information, and analysis, visit the Energy Infrastructure Channel.