Sentiment improved for commodities in April after falling out of favor in March relative to U.S. and international equities, according to VettaFi data. Meanwhile, equity ETFs dedicated to the energy sector also received increased engagement on VettaFi’s platform compared to other U.S. sectors. We believe these trends are related but also worthy of further education.

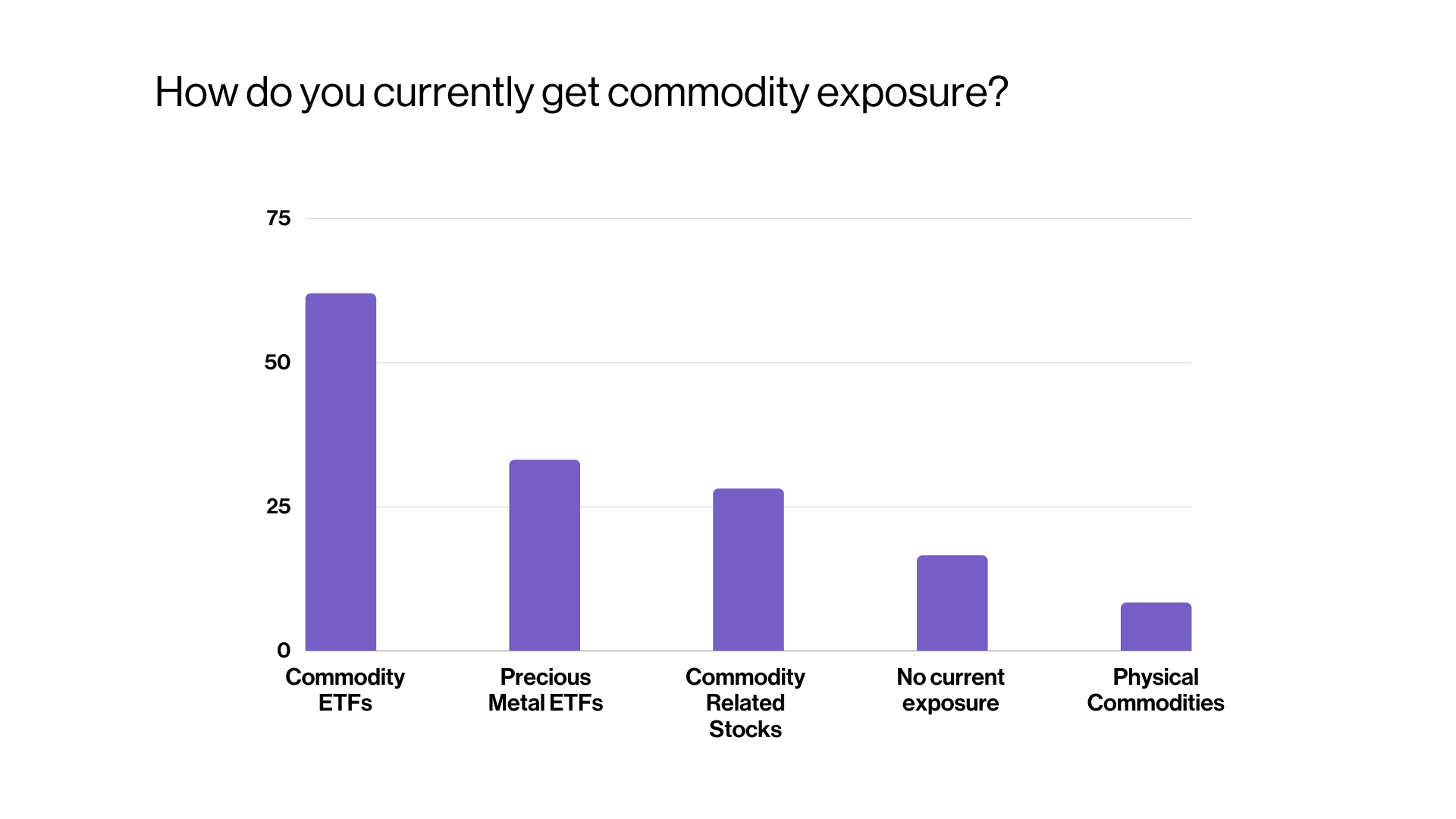

During a late April webcast with abrdn, VettaFi asked the advisor audience how they received commodity exposure for their client portfolios. Advisors could select more than one option.

While 62% of respondents said their commodity exposure comes from commodity ETFs, a combined 61% selected either precious metals ETFs (33%) or commodity-related stocks (28%). Meanwhile, 17% responded they had no exposure to commodities at all.

Source: VettaFi

Commodity Exposure Is More Than Energy ETFs

Although many advisors think of energy and materials equity-based securities as a proxy for commodity exposure, ETFs tied to these investments perform quite differently.

“Energy stocks tend to have a strong correlation with oil prices, but they each have unique drivers,” explained Stacey Morris, head of energy research at VettaFi. “Oil prices tend to be sensitive to headlines and macro factors. These range from OPEC+ announcements to demand data points, to weekly U.S. inventory reports and dollar fluctuations. Prior to the pandemic, energy stocks often lagged the recovery in crude prices. Energy companies were in the penalty box for overspending and wrongly focusing on production growth instead of investor returns.”

However, energy producers and oil refiners reported record earnings last year. They used their significant free cash flow from higher commodity prices for buybacks and dividends. In turn, that helped catapult global energy stocks. While energy stocks are generally down year-to-date through April, they have held up better than oil and natural gas prices. In the one-year period ended April, the iShares Global Energy ETF (IXC) was up 17%, while the United States Oil Fund (USO) was down 12%, according to VettaFi LOGICLY data.

IXC owns large stakes in BP (BP), Chevron (CVX), Exxon Mobil (XOM), and Shell (SHEL). The same stocks are also in broad equity ETFs like the SPDR S&P 500 ETF (SPY) or the iShares Core MSCI EAFE ETF (IEFA).

Meanwhile, the Alerian MLP ETF (AMLP), a less oil-sensitive ETF, was up just over 5% in 2023. That was due to stable cash flow generation of its holdings, including Magellan Midstream Partners (MMP) and Plains All American (PAA).

Gold ETFs Also Popular Access Point

In 2023, there have been net inflows into both the leading physical gold and gold miner ETFs, yet they haven’t performed in sync in the recent past. The SPDR Gold Shares ETF (GLD) rose 5% in the last 12 months, while the VanEck Gold Miners ETF (GDX) declined 1.6%, per LOGICLY. GDX owns equity stakes in companies like Barrick Gold (GOLD) and Newmont (NEM). The latter is also owned by SPY.

See more: “Bull vs. Bear: When Investing in Gold, Find What Glitters”

Advisors who think of ETFs like AMLP, GDX, and IXC as part of their commodity exposure (as opposed to equity exposure) are likely overexposed to equities. They’re susceptible to incurring performance records that may be incompatible with their expectations.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

VettaFi LLC (“VettaFi”) is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of AMLP.

Data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.