Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and Nick Peters-Golden debated the long-term investing case for gold ETFs. Have the yellow metal’s fundamentals fundamentally changed?

Karrie Gordon, staff writer, VettaFi: Hello again, Nick! It’s been some interesting times in markets lately with the failure of three regional banks on one side and mega-cap outperformance on the other. I hear in all the chaos you’ve managed to catch the gold bug and I thought it was worth chatting with you about why I think investing in gold ETFs doesn’t make sense for the long-term.

Nick Peters-Golden, staff writer, VettaFi: Hi Karrie! Yes, certainly times have been exciting. But bad news for markets can be good news for everyone’s favorite precious metal – and what’s the biggest source of bad news? Inflation, gold’s longtime harbinger.

Is Gold Still a Good Inflation Hedge?

Peters-Golden: Most investors have likely heard that gold is a good inflation play, but where does that relationship come from?

Put simply, the most powerful currency in the world, the U.S. dollar, is backed by “the full faith and credit” of the U.S. government — but that currency can still be significantly devalued by inflation. Gold’s value, in comparison, is much more durable. It’s real in ways that the dollar’s value can’t match – and traditionally, while the dollar loses value as prices rise, gold tends to rise.

That’s remained true even over the last year or so in which inflation has returned stronger than it has been in decades. Like a horror movie monster that survives fire and endless sequels, the Fed’s best efforts have slowed inflation down, but its impacts have remained seriously persistent.

All kinds of asset managers are predicting that the Fed will buck markets and not cut rates this year given how much ground they need to make up on inflation. If so, that bodes well for investing in gold ETFs. In fact, gold tends to do well in this exact scenario when looking back over the last fifty or so years, in which inflation is high but slowly, not quickly, falling.

Like anything in investing, gold ETFs have specific use cases within their role as inflation fighters. Investors and advisors should recognize that gold offers the best benefit as a long-term hold rather than a tactical investment.

While some might say that inflation is already so much under control as to invite a rate cut this year – a very dubious proposition – there are other arguments out there that a lot of this inflation is actually secular, driven by global factors like deglobalization that will see fundamental upward price pressures eating away at retirement funds, savings, and more for years to come. Gold is ready to buoy those portfolios amid every flavor of inflation for those who want to make the smart choice and diversify.

Gordon: Nick, I’m glad you’re kicking off the discussion with the argument for investing in gold ETFs as an inflation play, because historically, the metal has largely failed as an inflation hedge, according to some experts.

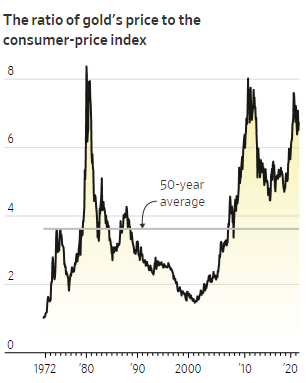

From 1972 (when the dollar was unpegged to gold) until now, the gold to Consumer Price Index ratio has been average of 3.6. As of the end of March 2023, the gold-to-CPI ratio was 6.4. A true inflation hedge would have maintained stability over that period and remained largely the same no matter how inflation was moving.

From 1972 until now, the gold to Consumer Price Index ratio has been average of 3.6.

Image source: WSJ

What’s more, during many periods of high inflation, gold prices have actually fallen. Between 1980-1984 CPI was roughly 6.5% while gold prices dropped 10%, and between 1988-1991 when CPI was 4.6%, gold tumbled 7.6%. More recently, from January 2021 when CPI was 1.4% through June 2022 when CPI peaked at 9.1%, the price of gold fell 4.77%.

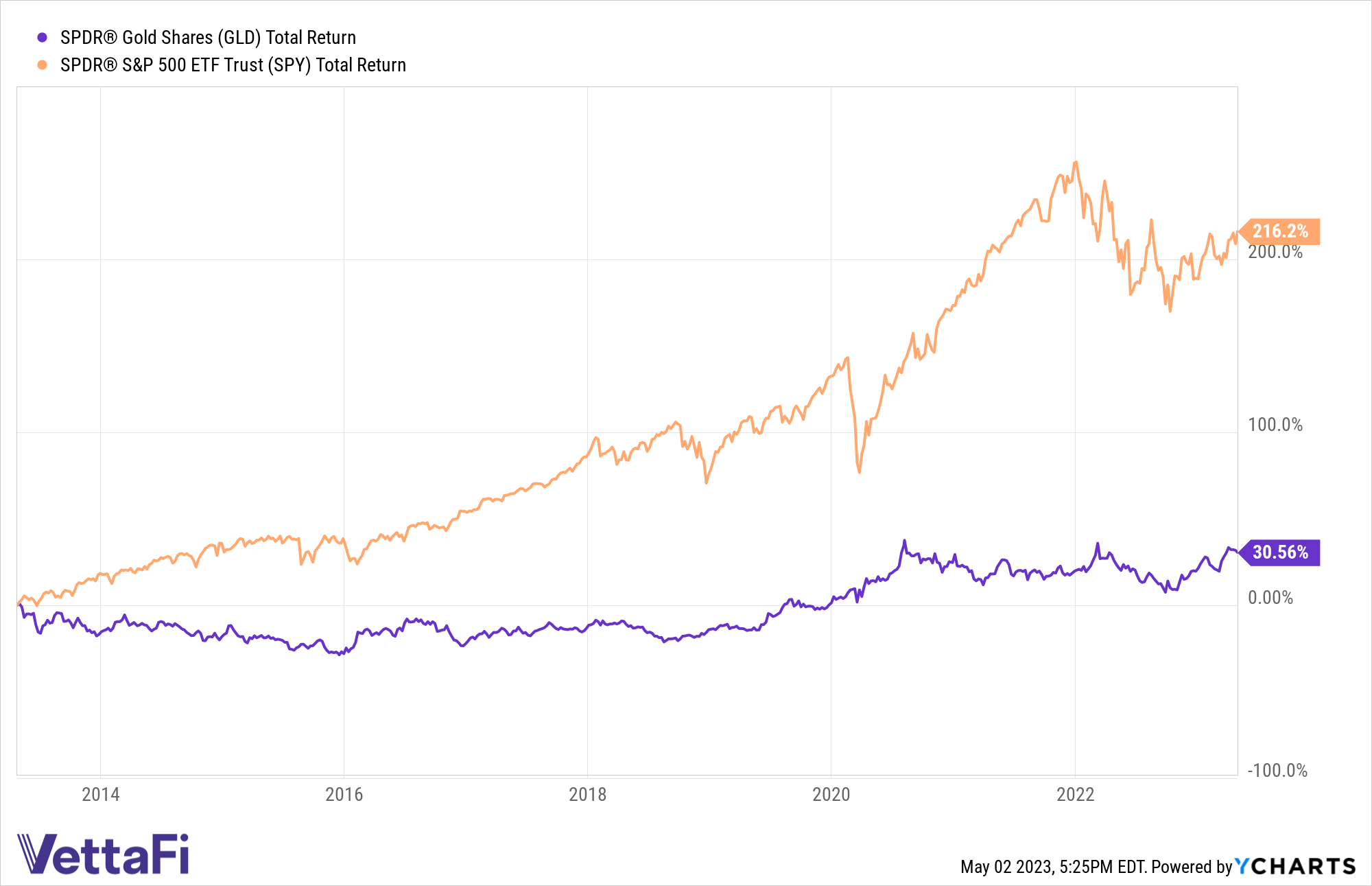

Investors that buy and hold gold over time not only aren’t getting the inflation hedge they were hoping for, but they’re also missing out on performance potential. As an asset, it underperforms most asset classes on long time horizons, including inflationary ones, but equities offer the most pronounced dispersion.

Looking back 10 years, SPDR Gold Shares ETF (GLD) has generated returns of 30.56% while the SPDR S&P 500 ETF Trust (SPY) offered returns of 216.2%. More recently, since the onset of the pandemic in March 2020, GLD has risen 24.55% compared to SPY’s 47.92% gains to date.

SPY has outperformed GLD since 2013, by almost 200%.

Can Gold Be a Portfolio Diversifier?

Peters-Golden: You bring up an important point Karrie, about the benefits of holding gold. Sure, it doesn’t pay the rent. But one key source of its overall value is how it provides a source of diversification that few other investments can match.

A few years ago, all finance folks could talk about was alternatives – liquid alts, alternative strategies, and how to package exposure to illiquid alternatives into an ETF. What folks have forgotten is that gold is the OG diversifier.

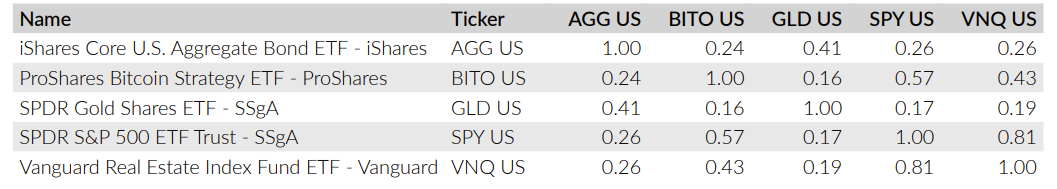

Thanks to some of the powerful tools at LOGICLY, a platform now part of VettaFi, we can actually see these asset correlations firsthand. For example, GLD only shows a 0.17 correlation to SPY over time, which is lower than bitcoin (BITO) or real estate (VNQ). It also only shows a 0.41 correlation to bonds, as proxied by the iShares Core U.S. Aggregate Bond ETF (AGG).

GLD shows little correlation to portfolio assets like stocks, bonds, real estate, and even Bitcoin.

Source: LOGICLY

During the 2008 Financial Crisis, for example, equities, hedge funds, real estate, and most commodities got walloped by a generational market event. The latter group of those have a reputation as a source of diversification, but when investors and advisors needed them to step up, they wilted. It was gold, instead, that not only held its own but increased in price between December 2007 and February 2009.

While there are certainly all kinds of diversifiers out there, few have such strong records and as much liquidity as gold. Yes, you could go for an involved, high-fee alts ETF that tries to bring a hedge fund strategy to a wider market. But often the fees for those strategies are eye-popping, around 90 bps or more.

What’s more, gold is also vastly more liquid. If investors and advisors are concerned about investing in fixed income for liquidity issues, how about alts? How many long/short contracts and derivatives approaches can one take before getting a bit worried about the liquidity of the underlying holdings in an alts ETFs? Gold is simple, liquid, and a cheaper source of proven diversification.

Gold As a Play on Investor Fear

Gordon: That’s a great point about diversification, it’s one of the great appeals of gold for investors. But before you go diving into a pool of gold coins a la Scrooge McDuck, I think I should take a couple of minutes to talk about how reliant gold’s price is on fear, and how unpredictable and transient demand can be.

As with any commodity, gold’s value is determined by supply and demand, but unlike most other commodities, that demand is fairly constricted to two primary use cases: jewelry and as a store of value, with minimal industrial use compared to other metals. It’s an asset with demand, and price, driven on the investment side primarily by investor fear. Demand for gold always spikes sharply around periods of extreme economic stress, driving prices up, but then historically falls within a year, dragging prices back down once more. In other words, outside of the bursts of high demand, gold prices tend to remain fairly flat.

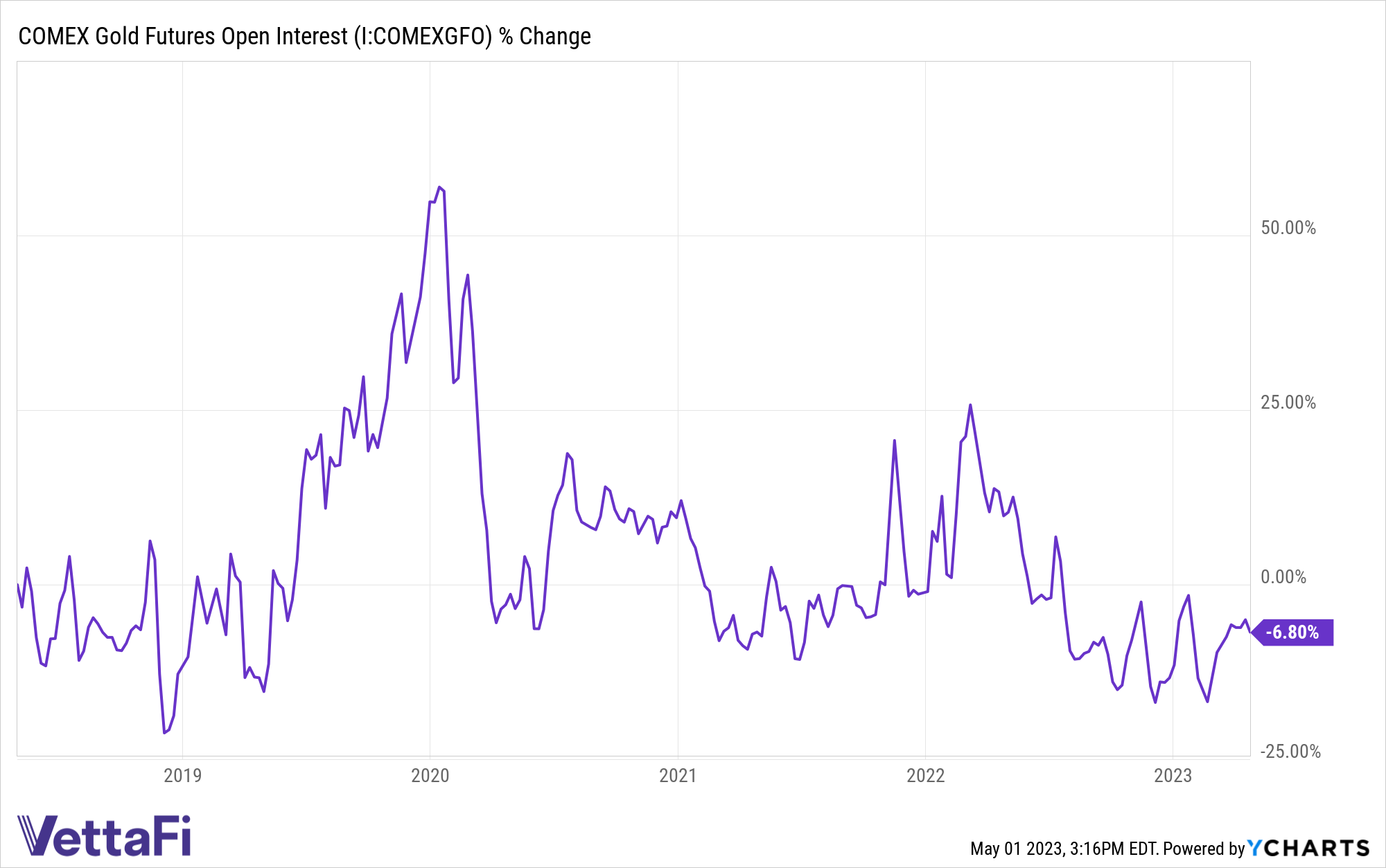

There are two main ways to assess demand for gold, both through gold futures and through investor demand via major gold ETFs like the SPDR Gold Shares (GLD). On the futures side, the largest spike in demand in the last five years came in January 2020, as measured by gold futures open interest (the amount of futures contracts held at the end of every trading day by market participants). The second highest demand spike beyond the onset of the pandemic came in March 2022 when Russia invaded Ukraine.

Open interest on COMEX gold futures is much lower than it was in 2020.

Since March 1, 2022, gold futures open interest has dropped -31.62%; since January 2020 it’s dropped -39.81%.

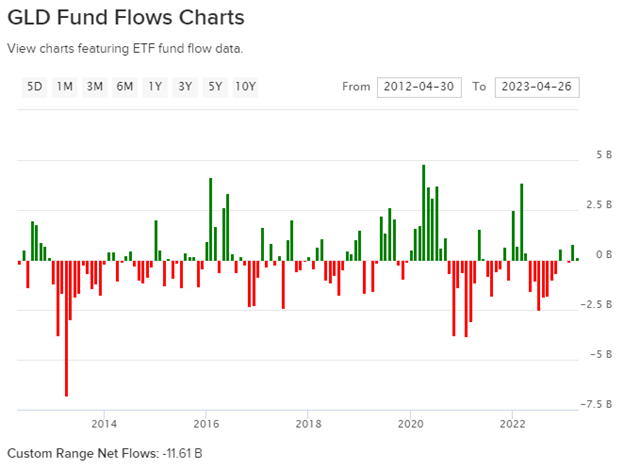

Perhaps a better way to gauge gold demand (remember those price spikes?) and its rapid return to mean as investor fear subsides is through flows into and out of gold funds, using GLD as a proxy for the space. GLD experienced $20.8 billion in net flows between February 2020 through September 2020 but then had -$18.42 billion in net flows between October 2020 through December 2021.

Between May 1, 2012 and December 31, 2012 (during the gold bubble when prices peaked at $1,917 an ounce) GLD had net flows of $4 billion. The following year GLD had total net flows of -$25.11 billion. Moving forward to present times, GLD is down -$9.33 billion in the last 12 months.

GLD has seen net outflows of almost $12 billion over a ten year period.

Image source: ETFdb.com

Prices tend to peak rapidly for gold on a sharp increase in demand, but that demand always retreats to — or sometimes even below — levels before the price spike. These are not investors looking to buy and hold but instead chasing trends, which in the case of gold, can be notoriously hard to capture, and relatively short-lived.

It’s an asset that almost always returns to mean — since the beginning of FactSet’s flows tracking information in 2012, GLD is down a net -$11.61 billion. Demand, though significant in sharp peaks, is never sustained, creating unpredictable pricing pressures with equally significant drawdowns over long time horizons.

If it’s a diversifier you’re looking for, might I point you in the direction of gold’s next-of-kin, silver, which has broad and diversified industrial demand, while also being a store of value as well as a portfolio diversifier. The iShares Silver Trust (SLV) has outperformed GLD on a 1-year (9.65% returns versus GLD’s 4.32% returns), 3-year (SLV’s 65.24% vs GLD’s 16.2%), and 5-year basis (SLV’s 50.06% vs GLD’s 48.09%).

Golden Prospects for Portfolios With Miners

Peters-Golden: At the end of the day, investing in gold ETFs isn’t just about finding a store of value for inflation or a powerful source of diversification – it’s also a long-term investment play with the potential to grow. You make an interesting point about where its price should be, but I’m looking toward where its price actually is and where it’s going. And in the long term from now, it’s got strong potential to provide a solid return on an initial investment.

We could focus on the short-run factors playing into the case for gold right now, but let’s talk about the long-term. Gold is determined by supply and demand, but what makes it special is that it simultaneously acts as a value store, and a commodity, and has the potential for long-term equities-related growth via the opening and closing of mines.

Gold mining is a bit like breathing – even while the economy is focused on the latest flashy AI-related gizmos or gadgets, gold mining is happening. Because gold’s value is so high relative to other commodities and it retains that special status as a potent store of value, gold mining firms are pretty durable sources of growth. You don’t have to just listen to me on gold mining companies, either – our VettaFi Voices had a great chat on gold’s merits and gold mining ETFs a few weeks back, as well.

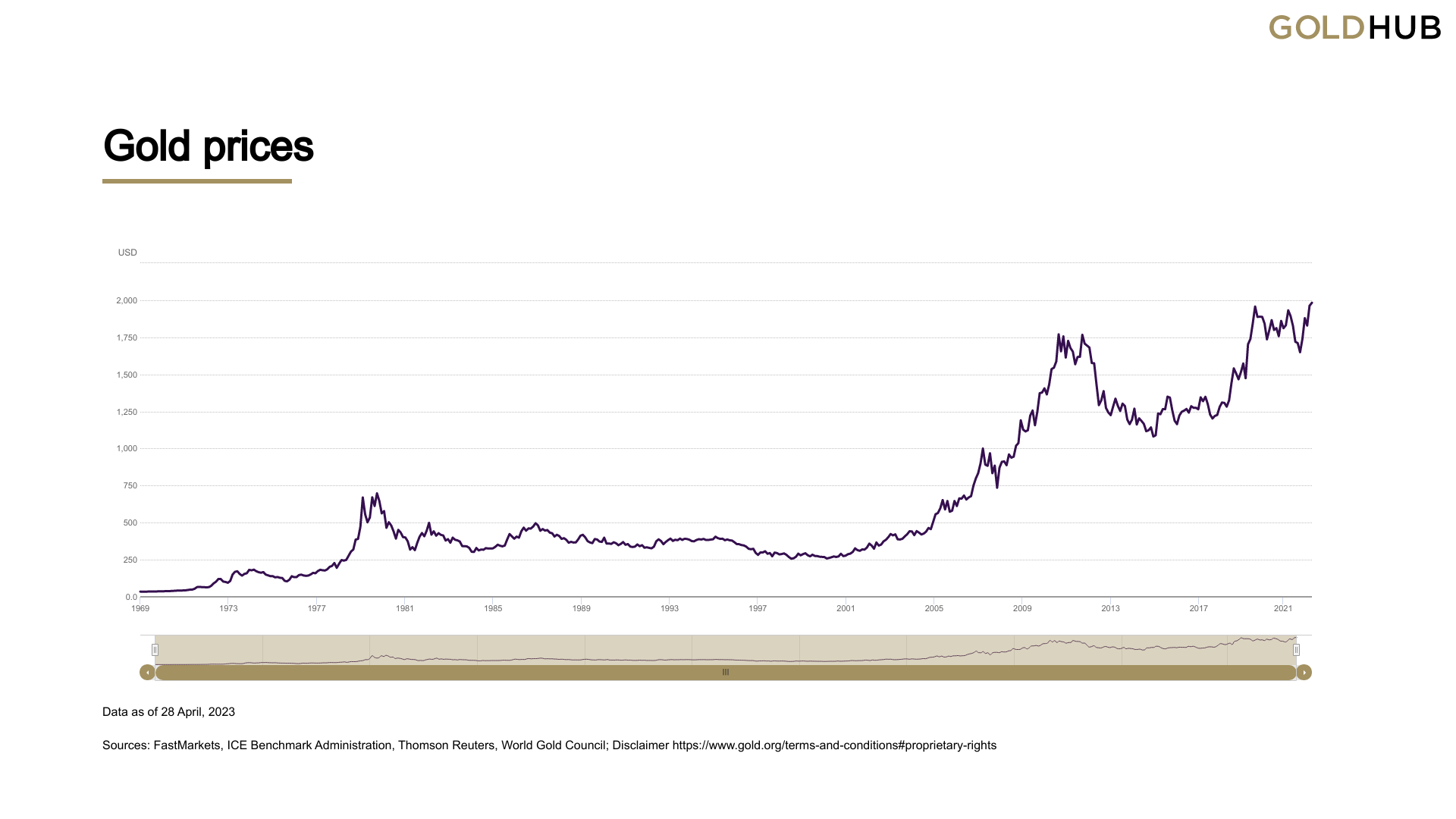

We can see that over a multi-decade period, gold has just continued to climb. That’s not to say it doesn’t have its ups and downs, but the spot price of gold per ounce has done pretty well for as long as it’s been tracked by the good folks over at the World Gold Council. If we can assume that our complicated world will continue to be beset by the kind of economic shocks and uncertainty that have historically privileged gold, we can be encouraged about the future of gold miners.

Over time the price of gold has continued to climb. Image source: Gold Hub

That’s a pretty solid foundation for the likes of the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN). GDMN combines equity and commodity exposures to gold in a single strategy for a lower fee than those alts ETFs like to charge, asking 45 basis points from advisors and investors. GDMN has also returned more than 50% over the last six months in a big moment for the world of gold miners.

Few other offerings out there combine equities-related growth with a value-store commodity like gold. Sure, you could go with crypto, but we have yet to treat Bitcoin with the same respect gold receives, and I imagine we’re a ways away from that.

Can Gold Prices Go Up From Here?

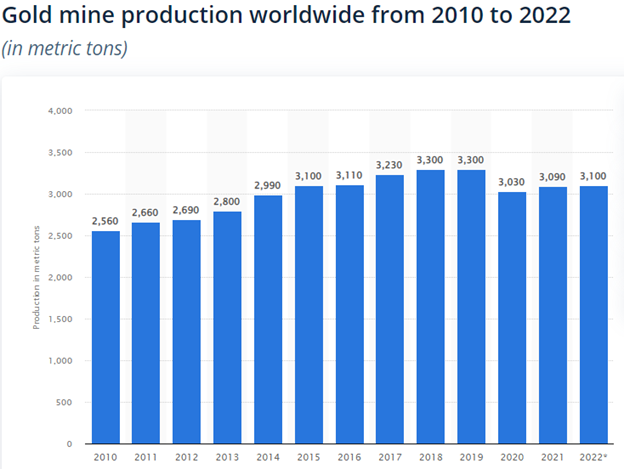

Gordon: If you’re looking to gold miners for income potential, you should be aware that gold miners’ costs — measured by the all-in-sustaining costs (AISC) — hit an all-time high last year, gaining 18% year-over-year to hit $1,276 an ounce according to the World Gold Council. That retreated slightly in the fourth quarter but remains significant alongside global supply that continues to recover from pandemic setbacks. 2022’s estimated production has recovered to 2015 levels and continues to trend upwards.

2022’s estimated production has recovered to 2015 levels and continues to trend upwards.

Image source: Statista

It could be setting up for a supply and demand imbalance in the near term as supply continues to increase while demand falls off. It’s also worth noting that the VanEck Gold Miners ETF (GDX) has underperformed GLD in the 1-year, 3-year, and 10-year ranges, which might I remind you has in turn underperformed equities.

Gold has been established as the store of value, particularly during periods of economic stress and soaring inflation. It might be a portfolio diversifier but when you look back, it’s not a profitable safe haven or hedge — historically the peak price of an ounce of gold has actually declined when adjusting for inflation.

Looking back at the two major peaks pre-pandemic, the most recent happened in 2011 when a run-up in gold prices drove the gold price to a peak of $1,917 an ounce in September. Prices rose on fears of global inflation and worries of instability and weak economic recovery in the wake of the Financial Crisis and recession. Adjusting to calculate for inflation, that ounce of gold would be worth roughly $2,550 today. Gold is currently priced at around $1,990 an ounce.

The second significant spike in gold’s price pre-pandemic occurred in September 1980, a year when inflation soared to over 14% and the Fed Funds rate was a shocking 17%. Gold climbed to $697 an ounce, when adjusting that price for inflation over time, one ounce of gold at the peak of its price in 1980 is equivalent to $2,700 today.

What’s more, investing in gold ETFs doesn’t offer any income opportunities. These are non-producing assets, meaning you can’t generate yield from holding gold, one of its two main use cases for investors. Investing in gold ETFs means that money can’t be allocated to opportunities in other asset classes such as equities, which have outperformed gold over time and offer dividends and buyback opportunities, or even in cash and cash alternatives like the NEOS Enhanced Income Cash Alternative ETF (CSHI) that invests in 90-day Treasuries with a noteworthy distribution yield of 6.15% as of April 30, 2023.

In the words of Warren Buffet, perhaps the most well-known gold skeptic in investing: “A decent productive asset is going to kill any non-productive asset over time” and I’m inclined to agree. Investing in gold just doesn’t make sense to me. It’s not an effective inflation hedge and you leave so much opportunity on the table over time by investing in a non-producing asset with concentrated demand that generally only rises in times of extreme fear.

Nick, it’s been really great. I’ll leave you to dive into your pool of golden coins, I’m off to take advantage of better opportunities for diversification and safe havens in these troubled times.

Peters-Golden: Likewise, Karrie! Thank you for indulging in my old prospector-esque passion for the stuff. A lot of people may say all that glitters is not gold, but as for me, I’ll be in the Sierra Madres with Humphrey Bogart.

For more news, information, and analysis, visit the Modern Alpha Channel.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.