Investors seeking total return, portfolio diversification, and tax efficiency are showing interest in Master Limited Partnerships (MLP) ETFs.

MLP ETFs can harness the various benefits of MLPs through the straightforward ETF platform. The funds can provide good exposure to midstream energy infrastructure companies, along with yield potential.

The Alerian MLP ETF (AMLP) can provide investors with access to key midstream energy players through investing in MLPs. The fund tracks the Alerian MLP Infrastructure Index (AMZI), which includes MLPs that primarily earn cash flow from midstream operations such as pipeline transportation of oil and natural gas.

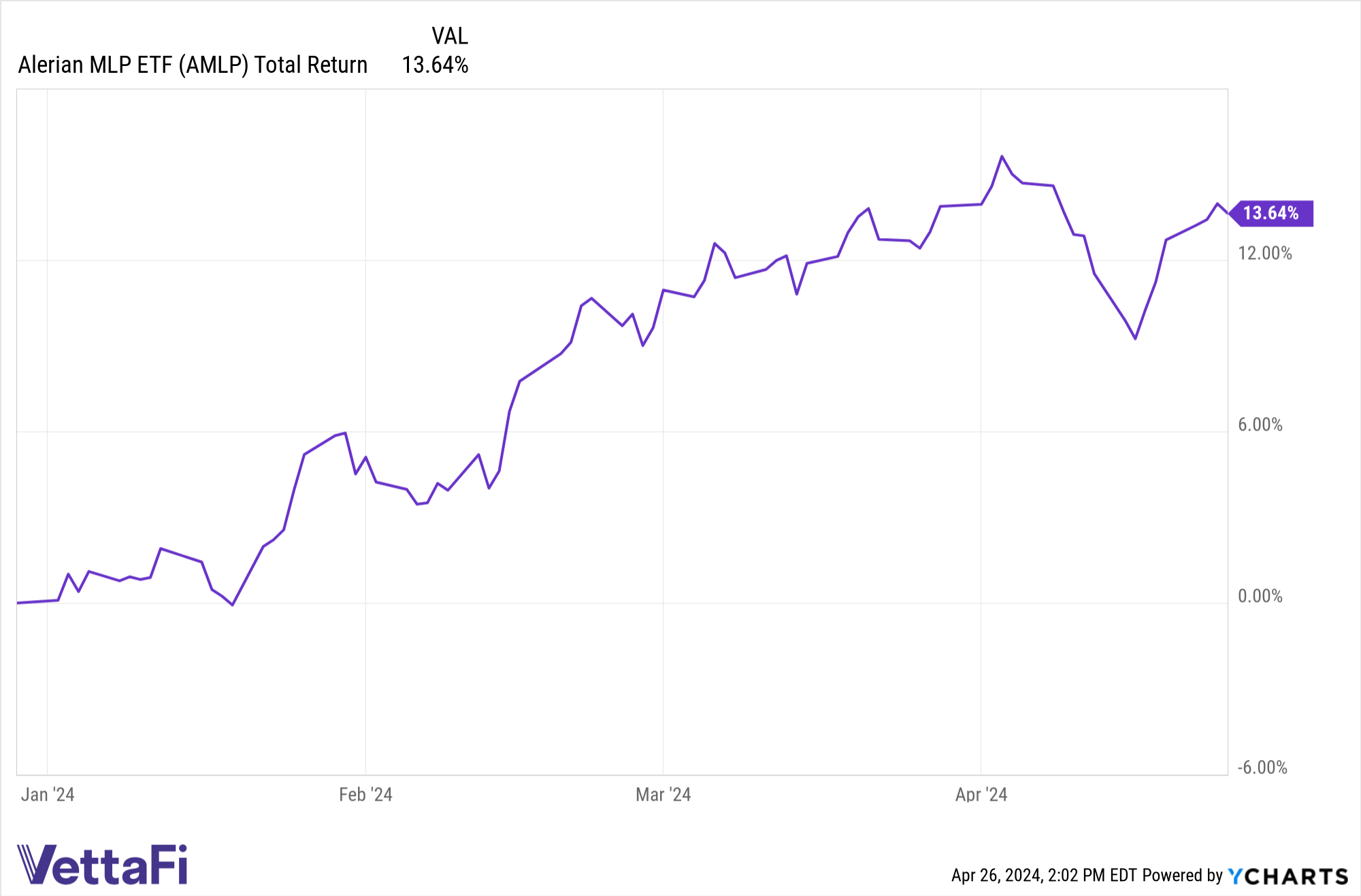

Fund flows highlight the investor interest. AMLP saw around $86 million in net inflows so far in April. Year-to-date, AMLP has seen around $335 million in net inflows. The fund currently has over $8.5 billion in assets under management, as of April 25th, 2024.

Quality Yields

MLP ETFs offer the benefits of MLP exposure and potential tax-advantaged income while avoiding the Schedule K-1 tax form that comes with investing directly in MLPs. AMLP is currently witnessing a trailing twelve-month yield of 7.28% as of April 25th, 2024, per FactSet. Importantly, nearly 65% of the underlying index by weighting as of March 28th holds an investment-grade credit rating.

See More: An Investor’s Guide to the Tax Advantages of MLP ETFs

Going forward, MLPs are expected to maintain generous yields for investors. With midstream investing remaining in demand, investors can harness AMLP’s history of strong dividend yields.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.

For more news, information, and analysis, visit the Energy Infrastructure Channel.