The economic, inflation, and rate narrative remains complex and difficult to predict. Investors seeking to optimize the tax efficiency of their portfolios and make the most of their income may wish to consider Master Limited Partnership (MLP) ETFs. MLP ETFs maintain some of the unique tax advantages of their underlying holdings.

MLPs draw interest for their yields and carry great appeal to investors for their pass-through structure. This means they do not pay taxes at the individual company level — that burden passes along to unitholders.

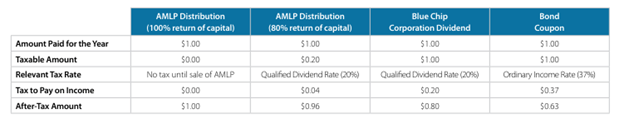

Beyond avoiding double taxation, the benefit comes in how distributions (dividends) are taxed. MLPs qualify for a wide range of tax deductions. This typically results in greater cash passed along to investors than the company’s taxable income assigned to the investor. The distributions in excess of the income area return of capital, which receive their own tax treatment.

See also: “A Primer on the Tax Implications of MLPs”

Taxation on the return of capital distributions is deferred until the underlying security is sold. When selling MLP units, investors often pay ordinary income taxes on the amount deferred and capital gains on any appreciation of the MLP itself.

Those who invest directly in MLPs receive K-1s during tax season. It makes filing more complex, particularly with the addition of potential state income taxes. Owning individual MLPs in tax-advantaged accounts can also result in unrelated taxable income (UBTI).

MLP ETFs Capture Tax Advantages, Add Simplicity

Investing in MLPs via an ETF simplifies much of the tax process while still capturing the benefits. MLP ETFs will not generate UBTI in tax-advantaged accounts, and the ETF issuer processes the K-1s to provide a 1099 to the investor.

MLP ETFs capture the tax benefits of MLPs, such as the return of capital tax deferment. Distributions from funds like the Alerian MLP ETF (AMLP) fall under the return of capital or qualified dividends. This means all distributions paid out are tax deferred or taxed as long-term capital gains, with more favorable rates than ordinary income. Since its inception, 80% of AMLP’s distributions have been tax deferred.

Image source: ALPS Advisors

AMLP does not create UBTI for investors and qualifies for inclusion in 401Ks and IRAs. The fund invests in MLPs and is structured as a C-Corporation with taxation at the fund level. AMLP slots best into taxable accounts because of its tax-deferred income benefits.

Tax Deferred Benefits Alongside Noteworthy Yields

The Alerian Energy Infrastructure ETF (ENFR) is another fund that provides exposure to MLPs. The fund also issues a 1099, qualifies for 401Ks and IRAs, and doesn’t create UBTI. ENFR differs in that it is RIC-compliant, with just 25% of the fund devoted to MLP exposure. The remaining 75% invests in energy infrastructure companies in the U.S. and Canada. ENFR makes a good addition to a tax-deferred account.

Both funds provide the added benefit of diversification across the midstream/MLP space. This eliminates single-company risk while offering attractive yields for investors.

AMLP generated an indicated yield of 7.48% and a trailing 12-month yield of 7.33% as of 04/10/24. Indicated yield annualizes the most recent dividend and divides by the current share price, making it a forward-looking measurement. Meanwhile, ENFR generated an indicated yield of 5.42% and trailing 12-month yield of 5.11% over the same period.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and ENFR, for which it receives an index licensing fee. However, AMLP and ENFR are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and ENFR.

For more news, information, and analysis, visit the Energy Infrastructure Channel.