In its latest report released last December, the Bureau of Economic Analysis (BEA) estimates that the digital economy now represents 10% of the total U.S. GDP, or $2.6 trillion. The digital economy is also growing at an average annual growth rate of 7.1%. That translates into 8.9 million jobs and $1.3 trillion in total compensation.

Using BEA’s definition, the digital economy is comprised of four major types of goods and services:

- Infrastructure that supports the digital economy;

- E-commerce;

- Fee-based digital services;

- Federal non-defense services annual budget related to supporting the digital economy.

Digital Infrastructure

Digital infrastructure includes the diverse set of companies that create the hardware and software that provide the infrastructure underpinnings of the internet. On the hardware side this includes things like computers, servers, networks, datacenters, and the semiconductor chips and processors that power them. On the software infrastructure side, there is the cloud, virtualization, and the software required to deliver digital goods, products, and services.

Internet ETFs

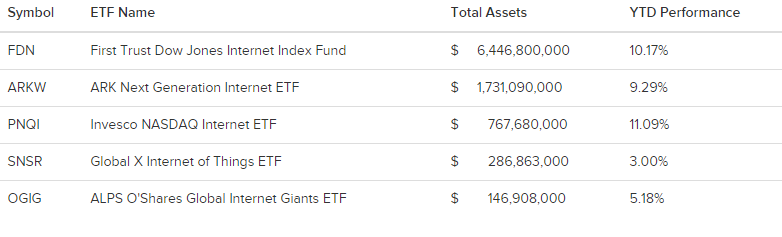

One of the oldest and largest ETFs to offer exposure to the internet is the First Trust Dow Jones Internet Index Fund (FDN) which launched back in June of 2006 and now holds almost $6.5 billion in assets. Its top names are companies like Amazon, Meta, Alphabet, Salesforce, and Netflix.

The internet today, represents a broad opportunity set that is ubiquitous, touching almost every aspect of our daily lives. Internet ETFs offer broad exposure to the digital economy theme. Below are some of the largest ETFs in this category.

Source: VettaFi ETF Database, 3/28/24

Internet Infrastructure ETFs

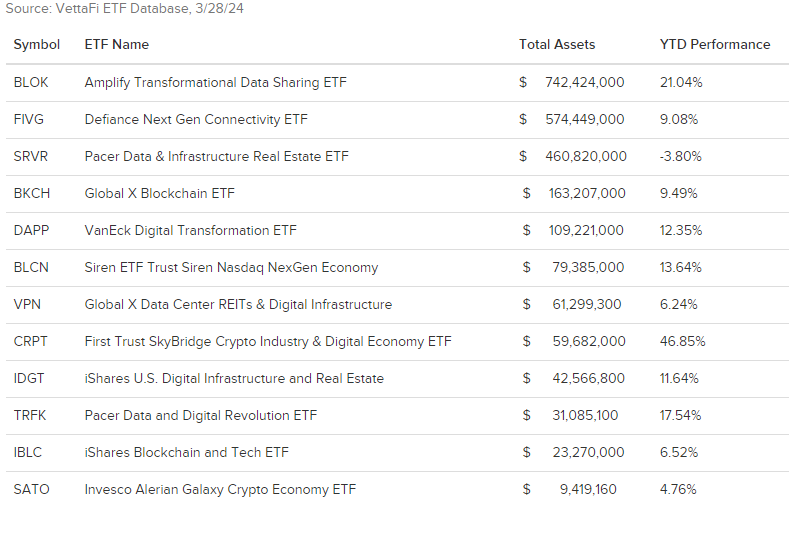

There are a number of newer ETFs offering more targeted exposure to internet infrastructure themes. Given that digital assets heavily rely on digital infrastructure, many of these ETFs hold data center companies. That puts them on the periphery of cryptocurrency mining and blockchain.

One such example is the First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT), based on a VettaFi Index, which is up an impressive 46.85% YTD. The largest ETF in the blockchain category is the active managed Amplify Transformational Data Sharing ETF (BLOK).

Five-G connectivity is another internet infrastructure category along with data center REITs and cell towers. As none of this aligns perfectly from a thematic perspective, I have created a custom table below with these different digital infrastructure exposures. Perhaps reflective of this evolution, on April 1, the Global X Data Center REITs & Digital Infrastructure ETF (VPN) changed its name and ticker to the Global X Data Center & Digital Infrastructure ETF (DTCR).

Source: VettaFi ETF Database, 3/28/24

Digital Disruption of Retail

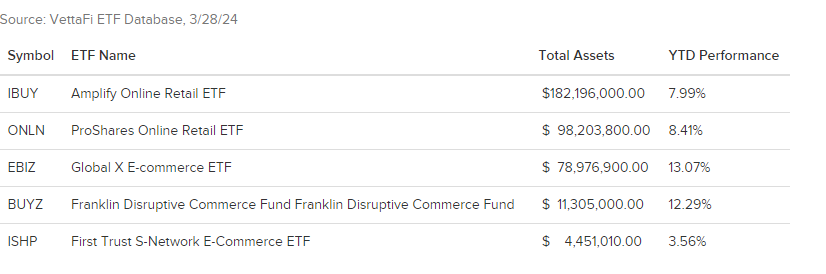

There is no better example of disruption than the digital disruption that shifted the focus on retail from brick-and-mortar stores (bricks) to online shopping (clicks). E-commerce has become somewhat ubiquitous in its own right. The category was further transformed by the pandemic. This led to growing new categories such as online grocery and pharmacy, buy online, pickup in-store (BOPIS), curbside delivery, and an accelerating category in digital payment, “buy now, pay later” (BNPL).

The largest and first ETF in this category is the Amplify Online Retail ETF (IBUY). It recently added omnichannel exposure in recognition of the fact that most traditional retailers utilize e-commerce in their business models to various extents. Many of these ETFs also hold companies is digitally transformed market segments like logistics and online travel that are tangential to e-commerce.

Source: VettaFi ETF Database, 3/28/24

The Cloud

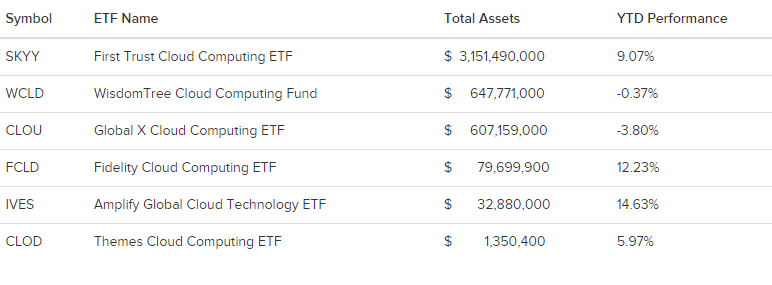

There are many digital service providers that utilize cloud computing. These offerings encompass SaaS (Software as a Service), IaaS (Infrastructure as a Service), and PaaS (Platform as a Service). There are several ETF providing exposure to this category including the $3.5 billion First Trust Cloud Computing ETF (SKYY), the WisdomTree Cloud Computing Fund (WCLD), and the Global X Cloud Computing ETF (CLOU).

Source: VettaFi ETF Database, 3/28/24

Digital Services

Finally, there are a whole host of digital services including digital payments, fintech, media streaming, gaming, gambling, social media, and the metaverse. There are too many choices to include all of the ETFs. That gives exposure to these categories in tabular form, but we can dig into two of them.

Streaming Services

Media streaming, similar to e-commerce, is another perfect example of the power of digital distribution. It has transformed the music industry. Music streaming now generates 84% of recorded music revenue in the U.S. according to RIAA. The MUSQ Global Music Industry ETF (MUSQ) is a pure play on the growth of music streaming.

Streaming has also had a huge impact on the film industry, providing more programming and access than ever before. But it now poses a challenge to movie theaters, which now have to offer a better viewing experience with formats like 3D/4D and IMAX and comfortable seating to lure audiences. As movies have come to our living rooms, the living room has come to the theater.

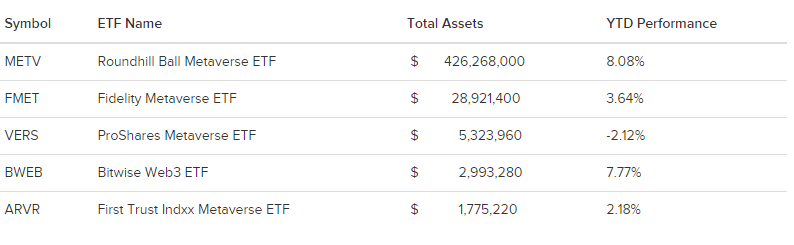

Metaverse Web 3.0

The next leg of the digital revolution will be informed and enhanced by artificial intelligence and technology to make the end-user experience even better. Some folks are referring to this next stage of the digital economy as the metaverse or Web 3.0 involving direct immersion into the digital world. And yes, there are several ways to get this exposure in ETFs as well.

Source: VettaFi ETF Database, 3/28/24

Although the digital economy continues to grow and evolve, and the methods and tools we use to access it continue to change, one thing is for sure: the digital economy is here to stay.

For more news, information, and analysis, visit the Disruptive Technology Channel.