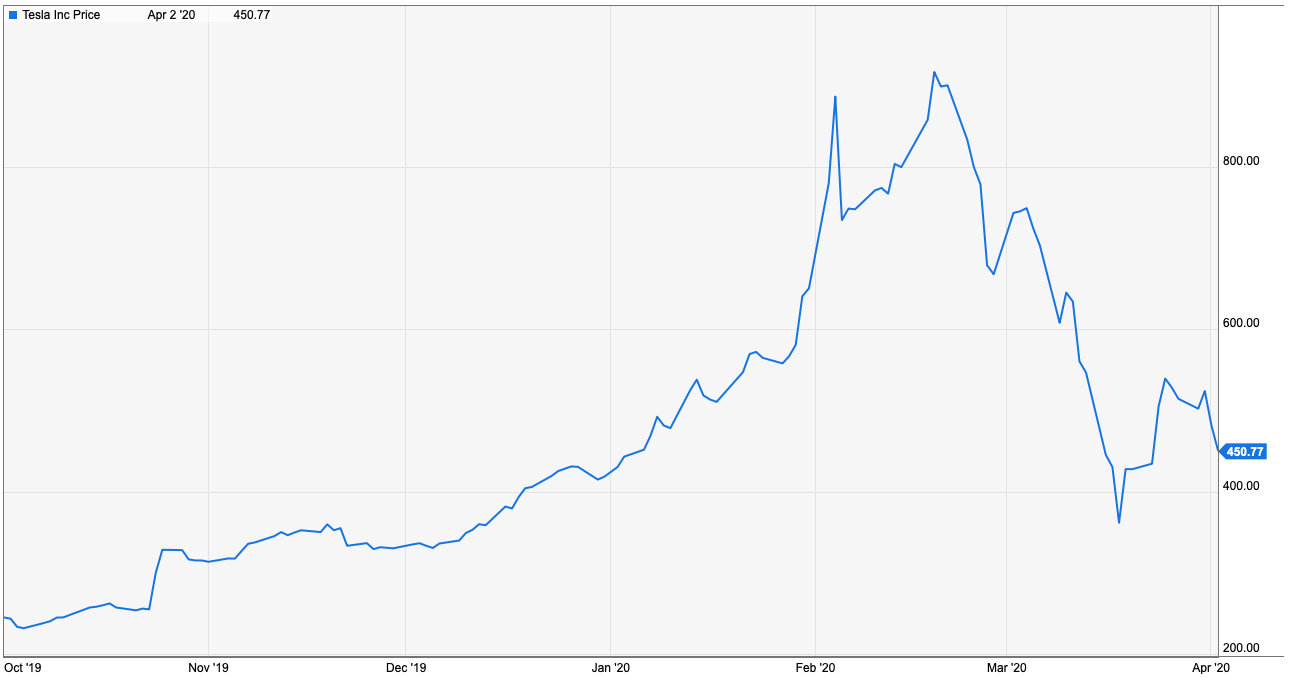

Over the last month, Tesla has been trampled on, to say the least. The electric car manufacturer’s stock has gone from a peak of over $915 per share in February to under $365 as stocks plummeted in the fastest bear market fall in history.

While the stock is currently sitting around $450 after having lost as much as 60% of its value, founder of hedge fund Kynikos Associates and well-known short-seller Jim Chanos said on Thursday that this is not enough for him to become a buyer, and he is still betting against Tesla, even after the electric automaker’s stock plummet.

A lack of deliveries and the ability to maintain sales with clients stifled by quarantines across the globe due to the coronavirus pandemic, which has now infected more than 1 million cases globally with over 51,000 deaths, is definitely affecting Telsa’s bottom line according to experts.

“We believe Tesla, like every other auto manufacturer, is seeing demand softness globally over the last month as consumers remain in a virtual lockdown with health and food/essentials now the priority over a Model 3 purchase,” Wedbush analyst Dan Ives wrote in a recent note to clients.

Chanos feels that despite the global weakness affecting the auto sector, even if there is a recovery, Tesla will lose money this year.

“We are still basically maximum short Tesla. It’s still one of my favorite positions,” Chanos told CNBC’s “Halftime Report.” “Nothing’s changed in my viewpoint here … It will lose money this year,” explaining that the run-up to over $915 per share “was one of the craziest periods I’ve ever seen in my 40 years on Wall Street.”

Meanwhile, Tesla CEO Elon Musk said Tuesday the company would deliver FDA-approved ventilators to hospitals within the company’s delivery area.

“We have extra FDA-approved ventilators. Will ship to hospitals worldwide within Tesla delivery regions. The device & shipping cost are free. The only requirement is that the vents are needed immediately for patients, not stored in a warehouse,” Musk tweeted, requesting that inquiries be directed to himself and Tesla.

Investors who are bargain hunting and feel Tesla is still of value can look at ETFs like ARK Industrial Innovation ETF (NYSEArca: ARKQ), VanEck Vectors Low Carbon Energy ETF (NYSEArca: SMOG), and First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN) which all have healthy allocations of the stock.

For more market trends, visit ETF Trends.