One of the primary forms of validation for a disruptive technology is its intersection with and utility in other industries.

Good news for the ARK 3D Printing ETF (CBOE: PRNT): 3D printing isn’t just one of the original disruptive technologies. It’s also a master of proving its worth in other industries. That trend has been on display in aerospace and defense and healthcare, just to name a pair, but there other inroads for 3D printing technology are growing increasingly relevant.

Take the case of fiber-reinforced polymers.

“This is quickly becoming one of the most exciting and impactful areas of 3D printing; over the next decade the market will grow to $2 billion, the installed base and applications will expand, and technology will continue to mature,” according to IDTechEx’s “3D Printing Composites 2021-2031: Technology and Market Analysis” report.

The 3D Printing Opportunity Set

Also known as fiber-reinforced composites, these type of polymers have myriad industrial applications, highlighting ample opportunity for PRNT components to make progress in new areas.

For example, fiber-reinforced polymers have applications in aerospace and defensive sectors, automotive production, consumer goods, construction, the power generation field, the manufacturing of protective equipment, and maritime infrastructure, among others.

“FRPs are valuable as metal substitutes in the bodies of luxury automobiles and in truck and trailer body sidings. With higher fracture points than steel, these strong, stiff and light materials also improve fuel consumption while increasing the speed,” according to AZO Cleantech.

Moreover, 3D printing companies may offer polymers to consumers with the often elusive combination of a better product at a favorable price point.

“3D printing of polymer materials can have mechanical limitations that benefit from fiber reinforcement (or other functionalities), and composite manufacturing is known to be costly, and challenging this can benefit from the moldless, rapid prototyping, and automated approach that additive manufacturing enables,” adds IDTechEx.

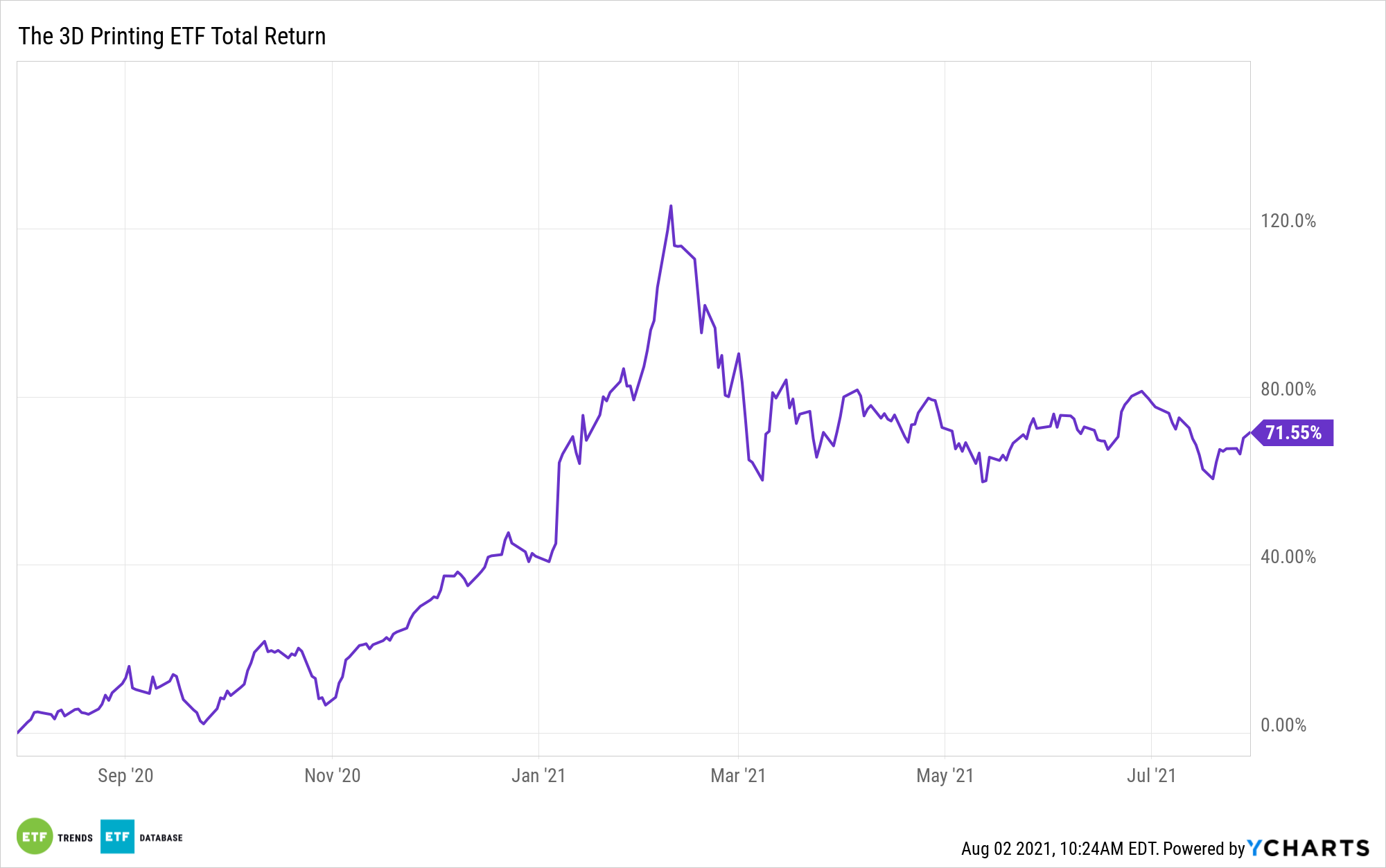

The $556 million PRNT, which is one of ARK’s two passive ETFs, turned five years old last month and follows the Total 3D-Printing Index. That index holds 56 stocks with a median market value of $7 billion. PRNT charges 0.66% per year, or $66 on a $10,000 investment.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.